Fed: Powell's legacy should endure

The context surrounding the December 9-10 FOMC meeting (BNP Paribas scenario: -25bp), which marks the final meeting of 2025, serves as a prelude to the challenges that the Federal Reserve will face in 2026. The outlook for the dual mandate calls for differing responses, and uncertainty prevails, fuelled by divisions among FOMC members that stand in contrast to the institution's pro-consensus stance. In the coming year, a significant test awaits US monetary policy and its autonomy, particularly with the succession of Chair Jerome Powell. However, the potential for an abrupt shift in US monetary policy should not be overstated. The Fed's decisions are expected to continue to be driven by economic fundamentals.

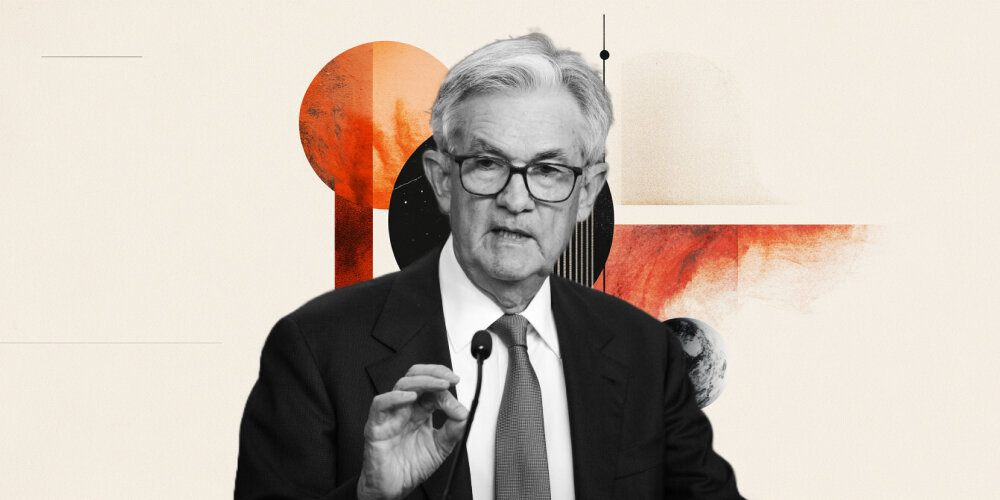

Jerome Powell's legacy: a data-dependent Fed until the end

J. Powell's term as Fed chair will end in May 2026. His leadership, which began in 2018, has been centred on maintaining the central bank's non-partisan nature, adopting a data-driven, economically informed and responsive approach to carrying out its duties, while striving for consensus. The December 9-10 FOMC meeting is expected to adhere to this trajectory, continuing the rebalancing of monetary policy that J. Powell indicated in Jackson Hole, prompted by the increased downside risks to employment that became increasingly evident over the summer. As the outlook on this front has not materially changed since then, a further cut (-25bp) is expected at the forthcoming meeting, in line with those made in September and October 2025, bringing the Fed Funds target to 3.5% - 3.75%.

In 2025, there has been a reallocation of risks around the Fed's dual mandate, which supports the case for monetary easing, while the full impact of trade and immigration policies on employment and inflation have likely not yet materialised. The decline in job growth is stark (non-farm payrolls averaged +59k in the six months to September 2025, compared with +133k a year earlier) and has been compounded by a substantial downward revision to total payroll employment from April 2024 to March 2025 (-911k in the preliminary estimate).

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.