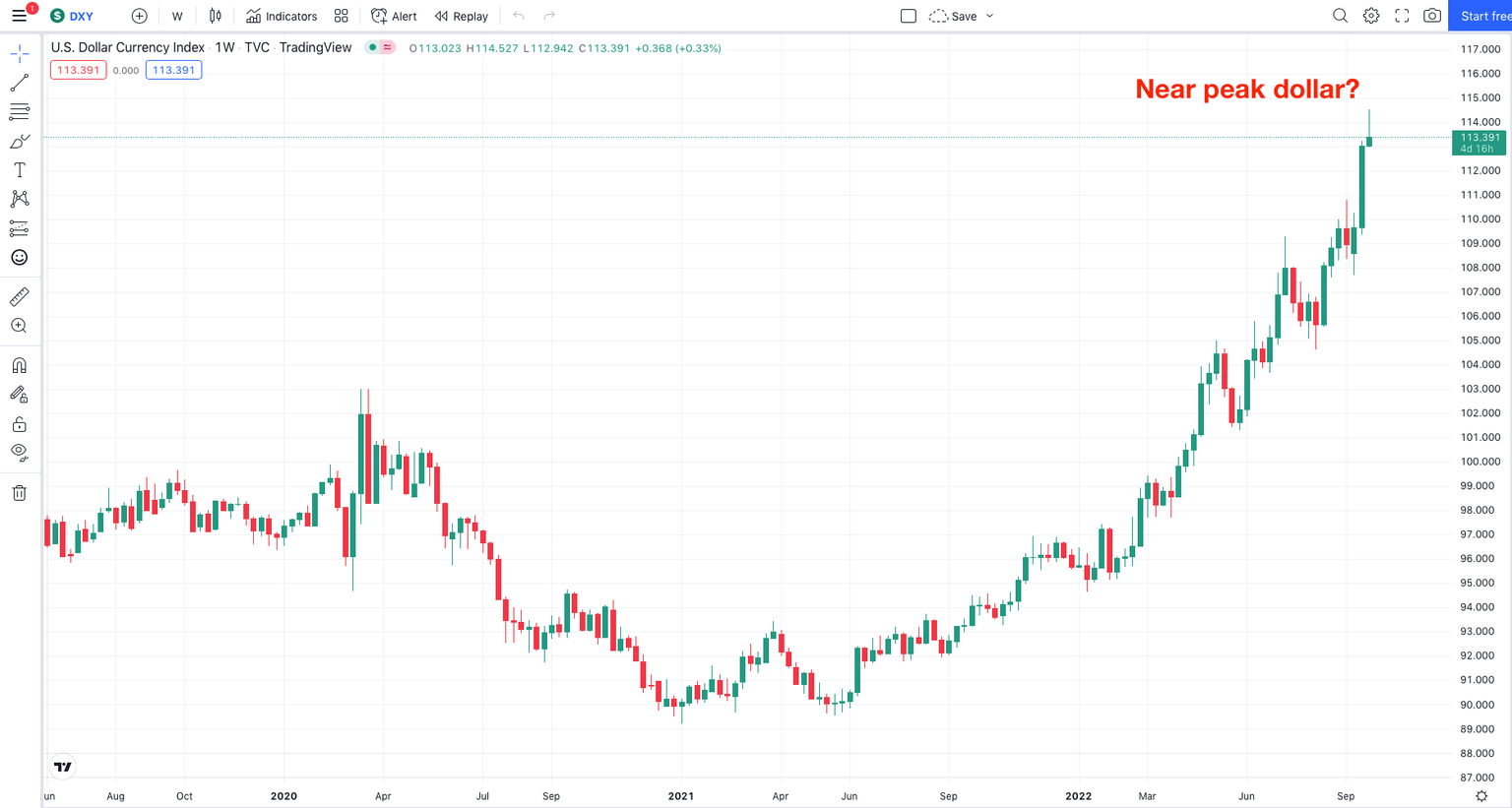

Fed: Peak bullish message for the USD

The Fed hiked by 75 bps to 3.00-3.25% as expected and with the expectation set high coming into the latest FOMC meeting the Fed needed to affirm the terminal rate of 4.5% set by STIR markets to keep the bullish sentiment going around the USD. In the event, Jerome Powell delivered a significant hawkish message expanding the terminal rate to 4.6% for 2023, up from 3.8% prior. Powell affirmed the dot plot in his statement by saying that it is likely that rates will get to levels in the Dot Plot.

This was a hawkish statement and that kept the USD bid. However, where does the USD go from here? On one hand, we can see the Fed keeping the hawkish messaging supporting the USD, but on the other hand, this seems to be the peak for the USD. With the terminal rate expectations of both STIR markets and Fed pricing the same there would need two be a fresh catalyst for more USD strength. So, at this point, it would seem reasonable for the USD to peak. Who is left to buy the USD and with what expectations?

It is possible that risk-off sentiment from Russia/Ukraine risk can keep the USD bid. We could also see firmer inflation from the US that would perhaps see the terminal rate inch up towards 5%. However, this seems a tough order. So, we might be close to peak USD. Timing is always the issue though and incoming data will be key, so be nimble and flexible.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.