Fed decision in focus – Stocks at all-time highs, US and Canadian data eyed

Fed decision top of mind for traders

The Fed rate decision on Wednesday remains top of mind for market participants, poised to deliver its first 25-bp rate cut this year, bringing the target rate to 4.00% - 4.25%. Cooling job growth and elevated (but somewhat contained) inflation have provided a compelling case for the Fed to pull the trigger tomorrow.

As mentioned in yesterday’s post, a 25-bp cut is fully priced in, shifting attention to the pace of policy loosening going forward. Consequently, the accompanying rate statement, Chairman Jerome Powell's post-meeting press conference, as well as the Fed’s updated SEP – particularly the dot-plot projections – will be closely watched.

The USD index remains on the back foot, down nearly 11.0% YTD, reflecting market expectations of a faster pace of policy easing, as well as improved risk appetite (which tends to weigh on safe-haven appeal). This week’s Fed decision will be pivotal in determining the direction of the USD.

Stocks refresh all-time highs

Equity markets rallied to fresh records yesterday, sending the S&P 500 0.5% higher to 6,615, with the Nasdaq 100 jumping 0.8% to 24,293. It is worth noting that the S&P 500 has historically outperformed after a pause of six months or more, with an average gain of 15% in the year following the resumption of rate cuts.

A breakthrough on TikTok operations has also introduced guarded optimism into trade discussions, with US Treasury Secretary Scott Bessent confirming a framework deal for US ownership of the platform. The agreement has also paved the way for a phone call on Friday between US President Donald Trump and Chinese President Xi Jinping, potentially opening channels for broader trade negotiations.

Day ahead

Following UK employment data that aligned with consensus, today’s macro focus shifts to August US retail sales and Canadian inflation at 12:30 pm GMT.

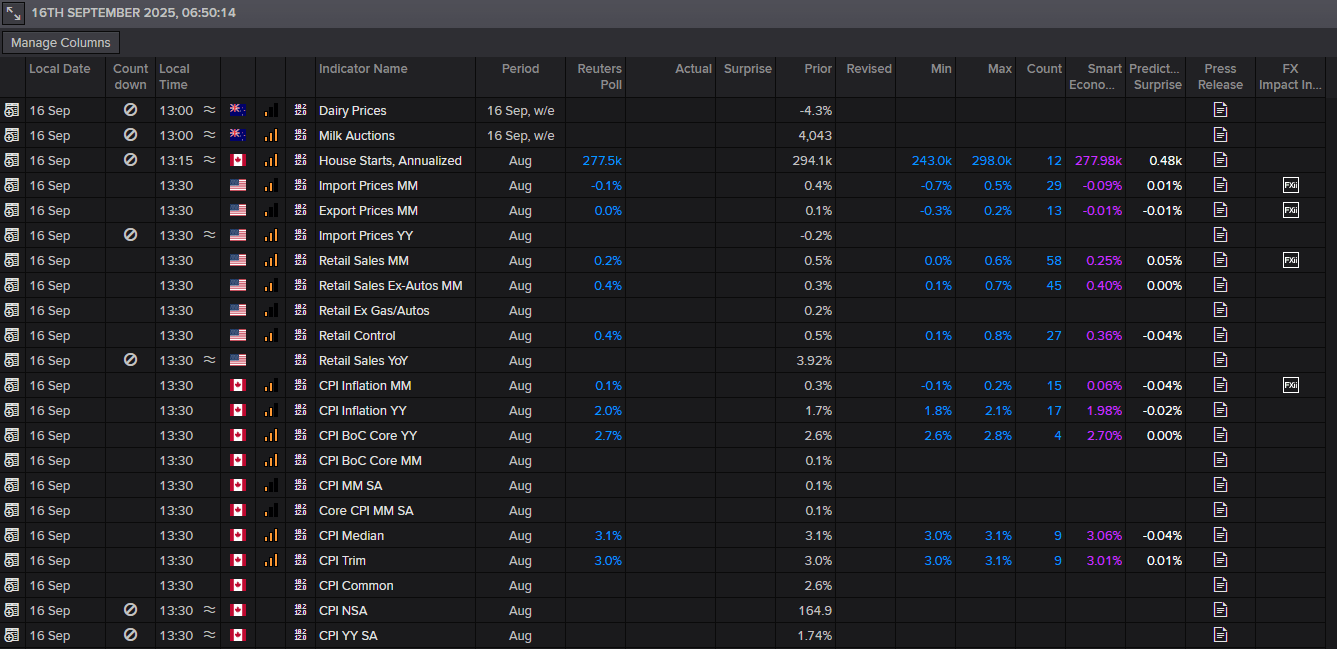

As shown in the LSEG economic calendar below, economists forecast that US retail sales advanced 0.2% MM, marking a modest deceleration from July's 0.5% gain. For those who trade out of event risk, the calendar’s screenshot displays maximum and minimum estimates. The control group metric, which contributes to GDP, is expected to come in at 0.4%, slightly lower than the 0.5% reported previously. A stronger-than-expected reading could prompt a modest bid in the USD, particularly if the data exceed 0.8%.

With the BoC widely expected to reduce policy by 25 bps tomorrow (87% probability), Canadian inflation data could prove market-moving for the CAD. While YY headline inflation is expected to inch higher by 2.0%, from 1.7% in July, the BoC’s core measure continues to hover around the upper target band of 3.0%. Despite this, given that economic activity dipped 1.6% (annualised rate in Q2 25), along with labour market weakness – unemployment rose to a high of 7.1% – this is likely enough to prompt policy easing tomorrow.

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,