Eurozone Inflation Preview: Signs of peak inflation, not yet

- The Eurozone inflation is seen steady at 8.6% YoY in July.

- Core HICP is likely to tick higher to 3.8%, suggesting no signs of peak inflation.

- Upside risks to the bloc’s inflation persist amid soaring gas prices. EUR/USD has room to rise.

There seems no reprieve for the Europeans, with an overwhelming heat wave this summer while they brace for a tough winter amid the worsening gas crisis. Households and industries continue to bear the brunt of runaway inflation in July, thanks to the Russia-Ukraine war-led surging food and energy costs.

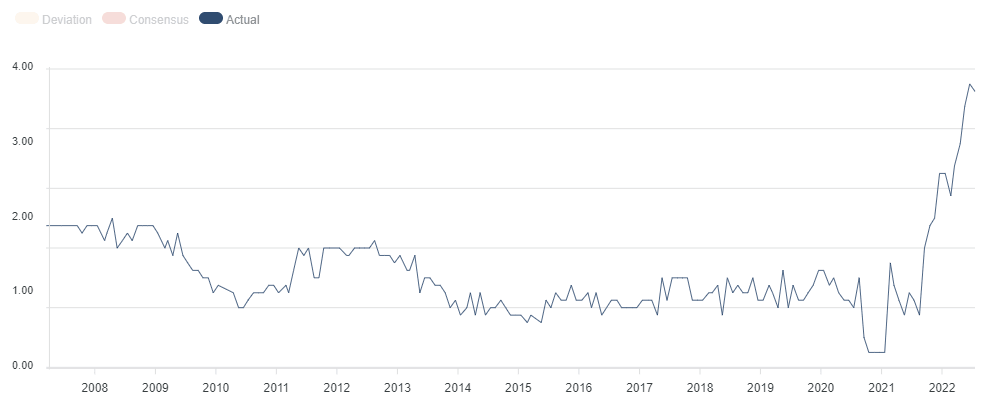

In June, the Eurozone Harmonised Index of Consumer Prices (HICP) surged 8.6% YoY vs. the previous reading of 8.1% and market expectations of 8.4%. Meanwhile, the core HICP eased to 3.7% YoY in June when compared to the 3.9% estimate and 3.8% booked in May.

Core HICP holds the key

Although the headline annualized HICP is expected to remain stagnant at 8.6% in July, a minor uptick in the core figure to 3.8% YoY is likely to grab the European Central Bank’s (ECB) attention. The data is slated for release on Friday at 0900 GMT.

Source: FXStreet

That said, the headline Eurozone inflation could surprise to the upside as gas prices have soared roughly 30% so far this month. On Wednesday, European natural gas prices jumped more than 10% after Gazprom PJSC said Nord Stream 1 pipeline will pump 33 million cubic meters a day, or just 20% of its capacity, as another turbine is halted for maintenance.

Soaring energy costs due to the Russia-Ukraine crisis are out of the purview of the ECB to control but it can curb its impact on the overall price pressures by raising rates further. The central bank raised its policy rates for the first time in 11 years by 50 bps to 0% in a show of commitment to fighting inflation.

At the July post-policy meeting press conference, ECB President Christine Lagarde said, “price pressure is spreading across more and more sectors.” “We expect inflation to remain undesirably high for some time,” she said, enlisting driving factors such as food, and energy costs, and rising wages.

Therefore, signs of inflation peaking seem like a distant dream for the ECB policymakers, leaving the central bank room for additional rate rises. The latest economic forecast released by the European Commission offered a pessimistic outlook on inflation, with prices in the eurozone seen higher at an average of 7.6% in 2022.

Trading EUR/USD with Eurozone inflation

EUR/USD is rejoicing the less hawkish Fed-inspired rally around the 1.0200 region. The German Preliminary HICP data will be released on Thursday, a day before the bloc’s inflation report. The euro could take a positive lead from a potential acceleration in the German inflation for July.

The main currency pair has more room to recover should the headline, as well as, core HICP figures surprise to the upside. Expectations of a 50 bps ECB rate hike in September could jack up on above forecasts inflation readings, boosting the euro.

The inflation data, in line with the expectations, will also briefly support the shared currency, as acceleration in core HICP will water down hopes of peak inflation.

The EUR/USD pair could resume its downtrend towards parity if the data fall short of expectations, implying softening price pressures, which could temper aggressive ECB tightening bets.

The prevalent risk trend and the preliminary GDP data for the bloc will also have a significant impact on the euro market. The eurozone economy is seen expanding by 0.2% QoQ in Q2 while a 3.4% growth is projected on an annualized basis.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.