Eurozone Inflation Preview: Eyes on monthly HICP amid heightened hawkish ECB bets

- The Eurozone February inflation is foreseen at 0% MoM and at 8.2% annually.

- Higher ECB peak rate bets strengthened after hot French and Spanish inflation data.

- The EUR/USD recovery could gather steam on the hotter-than-expected HICP report.

The optimism surrounding peak inflation seems to be fading, as persistent price pressures in the Euro area’s leading economies are likely to compel the European Central Bank (ECB) to keep up its rate increases this year.

The Eurostat is due to publish the preliminary estimate of the Eurozone Harmonised Index of Consumer Prices (HICP) for February this Thursday at 10:00 GMT.

Hot Eurozone HICP to bolster hawkish ECB bets

The Eurozone annualized Harmonised Index of Consumer Prices is seen softening to 8.2% in February, compared to the 8.6% increase reported in January. Meanwhile, the core HICP is seen steady at 5.3% YoY in the reported period.

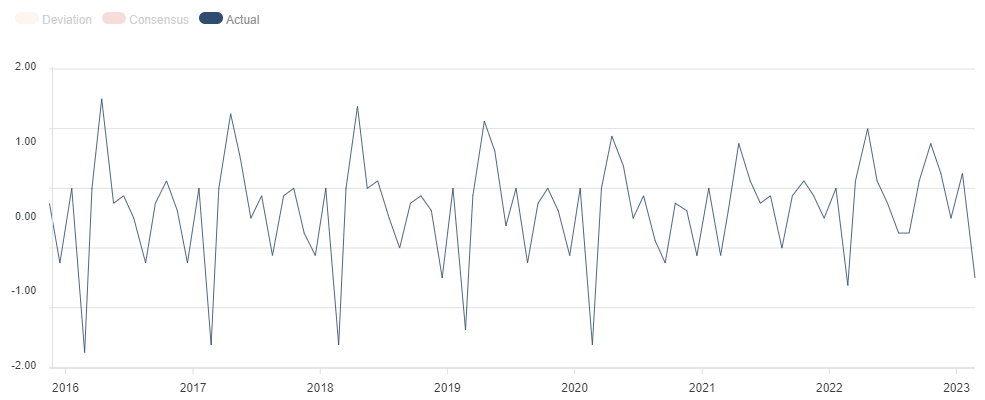

The focus, however, is likely to be on the monthly figures, with the HICP in the old continent seen dropping by 0.3% last month as against the previous decrease of 0.2%. The core HICP is likely to show no growth at 0% in February vs. -0.8% prior.

Eurozone Core HICP MoM

Source: FXStreet

The Eurozone inflation data will follow the French, Spanish and German inflation reports. On Tuesday, French and Spanish inflation data rebounded in February across the time horizon, suggesting that there are clear upside risks for the bloc’s HICP in February.

French Consumer Prices Index (CPI) unexpectedly rose 7.2% in the year to February, hitting the highest level since the Euro was launched in 1999. Spanish Consumer Price Index in February also surprised to the upside, arriving at 6.1%, up from January’s 5.9%.

Faster increases in food and services prices offset the steeper decline in energy prices in these leading economies, implying that the Eurozone inflation is also likely to be more sticky than previously thought. Also, it would leave markets wondering how long it will take for inflation to come down to the ECB’s 2.0% target.

European Central Bank President, Christine Lagarde, and her colleagues continue to press on a 50 basis points (bps) rate hike for the March meeting, noting that the rate hike outlook will likely remain data-dependent thereafter.

Hotter-than-expected inflation readings from France and Spain combined with an upside on core inflation led markets to price a 90% probability of a 4.0% terminal rate, a positive shift considering that a 3.75% terminal rate was fully baked just a week ago.

Trading EUR/USD with Eurozone inflation

EUR/USD is struggling to initiate a meaningful recovery above the 1.0600 threshold despite the hawkish ECB expectations. The focus will be on Germany’s HICP release due on Wednesday ahead of Thursday’s Eurozone inflation data.

On Tuesday, Euro area peripheral yields shot through the roof on the French and Spanish inflation surprise. The yield on Germany’s rate-sensitive two-year bund climbed 3.15%, its highest level since the 2008 financial crisis. Hot German HICP data could also see a fresh leg up in the Euro alongside the yields.

On a potential upside surprise to the Eurozone inflation data, the Euro buyers could continue to pile on, providing the much-needed leg to the EUR/USD recovery from 2023 lows of 1.0532.

Any disappointment in the HICP figures could reinforce sellers, sending EUR/USD back toward the 1.0500 mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.