Eurozone Inflation Preview: EUR/USD fate hinges on confirmation of peak inflation

- The Eurozone inflation is seen off record highs, at 10.4% YoY in November.

- Core HICP is likely to hold steady at 5.0%; a 50 bps ECB rate hike in December remains on the cards.

- Another record-high inflation rate is needed to drive EUR/USD above 1.0500.

European Central Bank (ECB) President Christine Lagarde told European lawmakers on Monday that Eurozone inflation hasn’t peaked after reaching the highest levels on record in October. Will the Preliminary Eurozone inflation print confirm a peak in inflation?

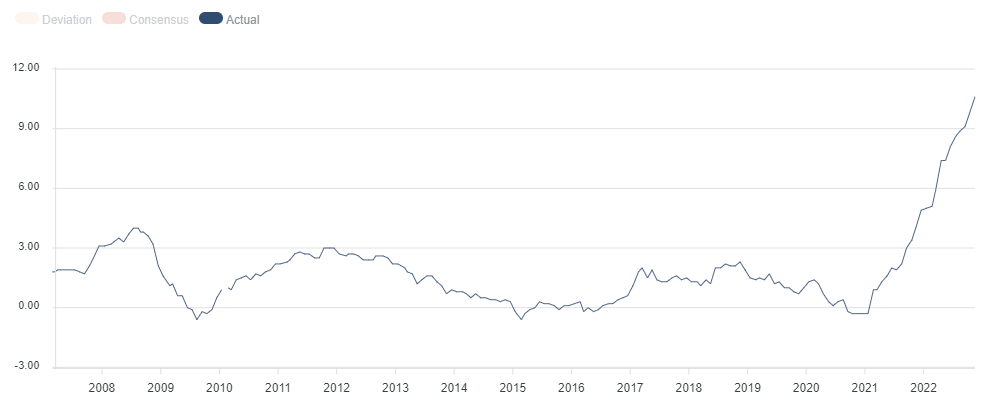

The Eurozone annualized Harmonised Index of Consumer Prices (HICP) unexpectedly accelerated to double digits of 10.6% in October, registering the fastest rate of increase since records began in 1997. The market consensus was for a softer print of 9.8%. Meanwhile, the core HICP climbed to 5.0% YoY in October when compared to the 4.9% expected and 4.8% recorded in September.

Inflation to ease from record highs

The headline annualized HICP is expected to slow to 10.4% in November, with the core figure seen steady at 5.0%. On a monthly basis, the HICP in the old continent is expected to stay unchanged at 1.5% in the reported period while the core HICP is also seen flat at 0.6%. The data is scheduled for release on Wednesday at 1000 GMT.

The bloc’s HICP figures hold utmost significance, as the data helps investors assess the European Central Bank’s (ECB) monetary policy tightening outlook. Note that the ECB inflation target is 2%.

Source: FXStreet

According to Eurostat, a 41.9% surge in energy prices combined with a 13% rise in food prices led inflation to a record high in October. Although natural gas and electricity prices have eased over the last months, a lag effect on household bills suggests that energy price inflation will abate only gradually.

Meanwhile, economists predict inflation softening in Europe’s four largest economies, with frontrunner Germany’s annualized Preliminary HICP seen easing to 11.3% in November vs. 11.6% recorded previously. These mixed factors fail to provide any hints of a peak in inflation.

Lagarde’s comments on Monday suggested that she sees a long way to go before reaching peak inflation. “Whether it is food and commodities at large, or whether it is energy, we do not see the components or the direction that would lead me to believe that we have reached peak inflation and that it is going to decline in short order,” she said.

Therefore, the ECB is likely to continue its battle to bring down inflation by raising interest rates. Markets are pricing a 50 basis points (bps) rate hike in December, as the ECB remains wary that price growth is becoming entrenched and the Eurozone economy is almost entering a recession.

Trading EUR/USD with Eurozone inflation

At the time of writing, EUR/USD is looking to extend the recovery above the 1.0400 threshold amid China’s Zero-Covid repercussions and a looming recession in Europe. The focus will be on Germany’s HICP release due on Tuesday ahead of Wednesday’s inflation data from the bloc.

The EUR/USD pair needs a positive surprise in the headline and core HICP figures to reclaim the 1.0500 level. Another record-high inflation rate could revive expectations for a 75 bps rate hike next month.

The Euro could drop back toward 1.0200 on softer-than-expected inflation data, as it could raise hopes for a peak in inflation, thereby weighing on the hawkish ECB policy tightening outlook.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.