Euro-zone PMIs preview: Three reasons why EUR/USD may fall without waiting for Draghi

- High PMI expectations may result in a miss due to weak data.

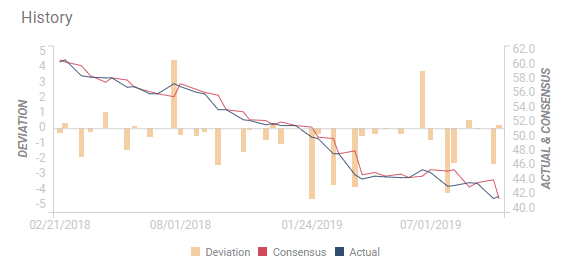

- The critical German Manufacturing PMI has disappointed in two-thirds of releases this year.

- EUR/USD may fall on profit-taking related to the recent gains and ahead of the ECB.

Is the euro-zone escaping a recession? That is what expectations for Markit's forward-looking figures are implying. The Purchasing Managers' Indexes are all expected to rise from the lows seen in September.

Before poking holes at these expectations, here are reasons that they may be based on.

These estimates may stem from recent optimism about Brexit. After the EU and the UK seemed to be on a collision course, a breakthrough on October 10 provided hope and may have influenced participants in the survey. The euro-zone economies may suffer if Britain leaves without a deal.

Another positive is the trade truce between the US and China. The first phase of a trade deal between the world's largest economies was also announced that week. Exports to China have driven German growth, and trade wars have hurt it. An improvement in relations – and the delay in US tariffs planned for October 15 may have raised economist expectations as well.

Why EUR/USD may fall

Perhaps there are additional positive arguments. Nevertheless, there are good reasons to doubt high expectations materialize – or at least limit cap any hopes for EUR/USD gains.

1) Recession fears

The first reason is a genuine drop in economic activity.e Euro-zone industrial output has dropped by 2.8% yearly in August, German factory orders are down 6.7% yearly, exports are falling, and only the consumer is doing its part with an annual increase of 2.1%. Inflation – which is eyed by the European Central Bank – is also depressed around 1%.

ECB officials have downplayed fears of a recession – but keep talking about it. The incessant talk means it is a real fear. In Germany, denials of a recession have already made way to rejecting the notion of a "deep recession" – Berlin is beginning to prepare the public for a downturn.

All in all, the trend is clear and there is no reason to hope the PMIs will be much different.

2) Previous PMIs mostly disappointing

The PMIs have fallen short of expectations in recent months. Lower estimates that followed weak numbers also proved too optimistic at times. For the most significant figure, German Manufacturing PMI, the outcome disappointed no fewer than 12 times in this year's 18 releases. Both preliminary and final figures provided downside surprises.

Past experience does not always determine future outcomes, but the omens are adverse.

3) Opportunity for post-Brexit profit-taking

EUR/USD has seen a rapid run from the lows of 1.0879 seen early this month and a meaningful correction has yet to take place. A small miss – or even just a confirmation of the slowdown – may be enough to trigger some profit-taking. Markit's figures serve as a reminder that the old continent is going nowhere fast.

Moreover, the PMIs are published just hours before the ECB's decision – Mario Draghi's last one as President. The veteran Italian banker has sent the euro down more than once in the past eight years. Investors may want to position themselves at the lower ground ahead of a potential final drag.

Trading the PMIs with EUR/USD

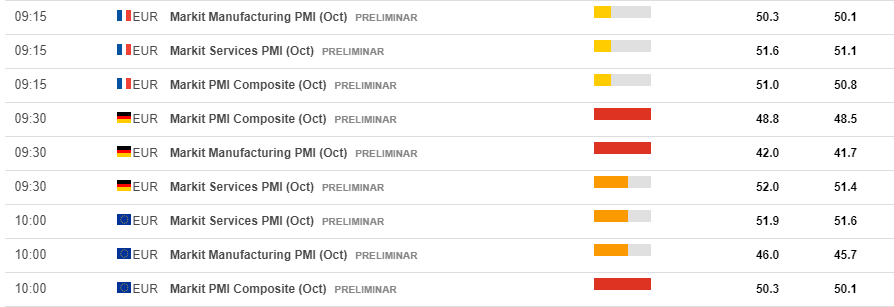

French figures are released first and tend to trigger some action. If the data for both the services and the manufacturing sectors miss, EUR/USD may fall. A beat in both may send it higher. If they offset each other, no significant moves are likely. The data from the continent's second-largest economy serve as a warm-up to the numbers from the largest one. Nevertheless, if one of the French figures falls below 50 – the threshold separating expansion and contraction – the common currency may come under increasing pressure.

German Manufacturing PMI tends to have the most significant influence. If it falls below 41 points, it will overshadow everything else. A beat may provide calm and boost the euro. If it meets expectations, the services PMI – which helps determine the composite one – will likely have more impact than usual. Another step down toward 50 will be worrying.

Last but not least, the focus on the euro-zone data is set to be on the composite PMI, which came out at 50.1 in September – on the edge. A drop below the round number may trigger headlines talking more loudly of a recession. If it meets expectations for an increase or beats them, EUR/USD may find room to recover.

Conclusion

Markit's forward-looking PMI is critical to the outlook for the continent's economies and the euro. There are good reasons to expect a disappointment – or at least an outcome that will push EUR/USD lower.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.