Euro Stoxx 50 - Expecting for More Weakness

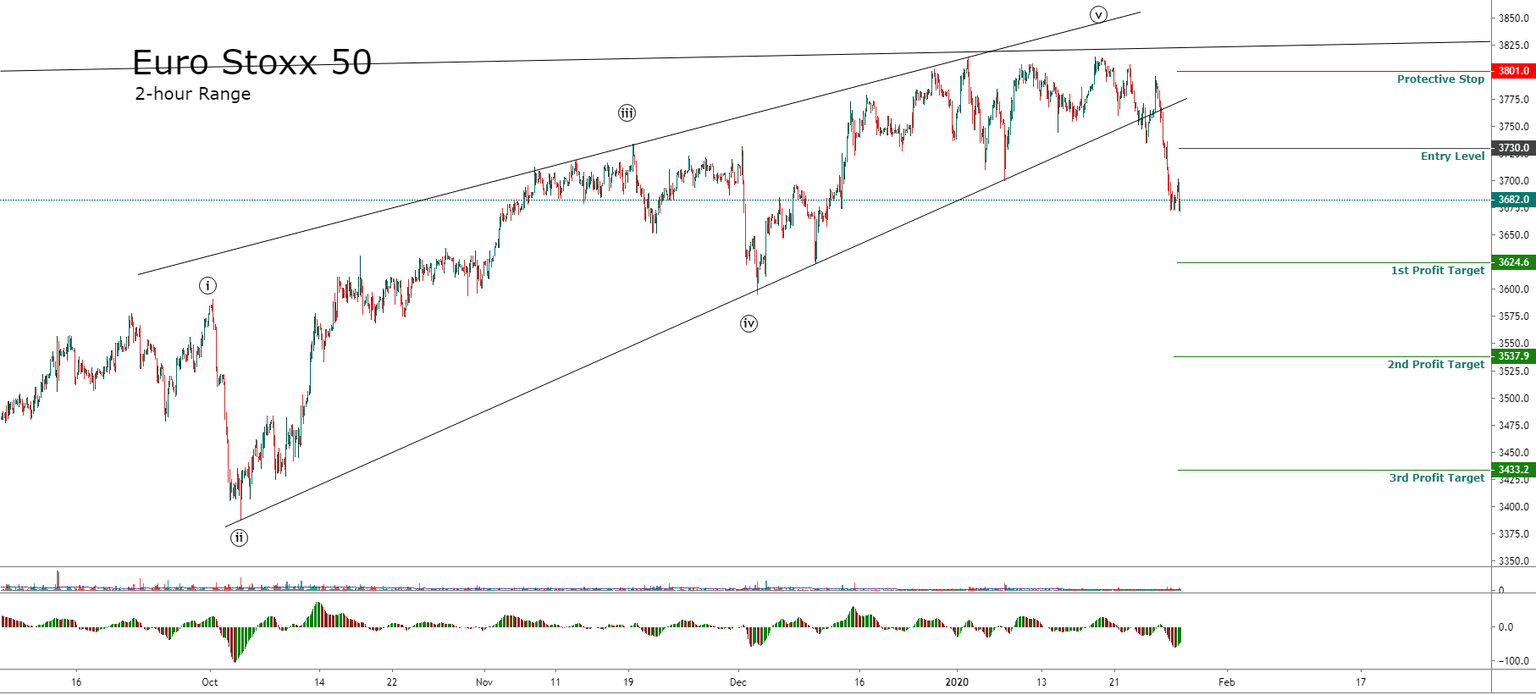

Euro Stoxx 50, in its 2-hour chart, presents an ending diagonal formation that looks to be finished, after the breakdown developed in the past week.

The aggressive decline developed in the past week broke and closed below the previous relevant low at 3,700 pts. This movement gives us some clues that more weakness could develop for the coming sessions in the European stock market.

The current pause seen in the Pan-European index, suggests that the price could make a marginal bounce. This movement could provide the addition of new short positions anticipating the development of a new bearish leg.

A short position will activate if the price rises and, then, the price action closes below 3,730 pts. From a conservative perspective, the second bearish leg could drive the price down to a potential first target of 3,624.6 pts.

The extension of the bearish movement could drag to the Pan-European index until 3,537.9 pts, and even, to 3,433.2 pts as a final bearish target.

The level that invalidates our bearish scenario is settled at 3,801 pts.

Trading Plan Summary

Entry Level: 3,730 pts.

Protective Stop: 3,801 pts.

1st Profit Target: 3,624.6 pts.

2nd Profit Target: 3,537.9 pts.

3rd Profit Target: 3,433.2 pts

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and