The euro declined in early trading as traders focused on the rising Covid-19 cases in European countries and measures implemented by Italy and Spain to deal with it. In a statement, the Italian government said that it would introduce the toughest health restrictions since the end of the first wave in May. It unveiled these measures as the number of cases continued to rise. The country recorded a record 21,773 new cases yesterday. In Spain, the government unveiled a nationwide curfew after cases rose by a third during the weekend. The same surge happened in other European countries like Germany and France.

US equities declined in the futures market as hopes of a stimulus deal in the US faded. While talks continued during the weekend, Nancy Pelosi and Steve Mnuchin traded blame for the stalemate. Nancy Pelosi blamed the president for not pushing more Republicans to accept the $2.2 trillion deal. The equities are falling ahead of key earnings this week. Notable companies that will publish their earnings this week are Amazon, Google, and Facebook.

Meanwhile, the market is also reacting to deal-making in the market. Over the weekend, Blackstone agreed to acquire Simply Self Storage in a deal valued at more than $1.2 billion. In another deal, Inspire Brands said it would acquire Dunkin Brands for $9 billion.

The economic calendar will not have many events today. In the morning session, the Japanese statistics office will release the leading index and coincident indicator. The leading index combines several indicators. In Turkey, we will receive the capacity utilisation and manufacturing index. These numbers will come a few days after the central bank left interest rates unchanged. In Europe, we will receive the business expectation and climate numbers from the Ifo Institute. Finally, from the US, we will receive the new home sales numbers.

EUR/USD

The EUR/USD price declined to the current low of 1.1835. On the 30-minute chart, the price is along the 23.6% Fibonacci retracement level. The 15-day and 25-day moving averages have also made a bearish crossover. The RSI has dropped from the overbought level of 70 to the current level of 17. The pair has also formed a head and shoulders pattern. Therefore, for today, the pair may drop to a low of 1.1825, which is the neckline of the H&S pattern.

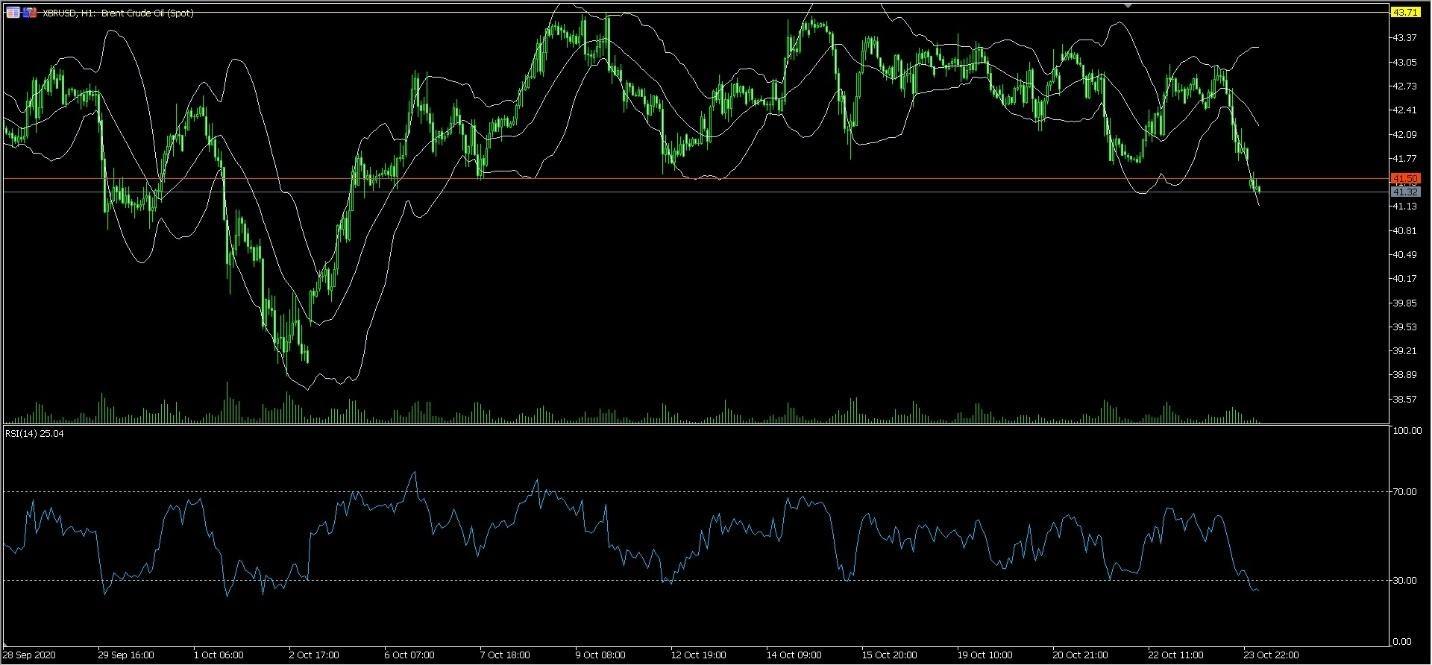

XBR/USD

The price of crude oil gapped lower as the market reacted to the rising number of Covid-19 cases. It reached a low of 41.32, which is the lowest it has been since October 5. On the hourly chart, the price has moved below the important support of 41.50. The price is along the lower line of the Bollinger bands while the RSI has moved to the oversold level of 29. It is also forming a bearish pennant pattern, which is an indication that it will continue falling.

GBP/USD

The GBP/USD pair declined to a low of 1.3025. On the four-hour chart, the price has moved below the middle line of the Donchian channel. Notably, the price started the reversal after it reached the upper level of the previous channel at 1.3165. The RSI also moved from the overbought level to the current low of 47. For today, the pair may continue falling as bears target the support at the lower line of the Donchian channel at 1.2950.

General Risk Warning for FX & CFD Trading. FX & CFDs are leveraged products. Trading in FX & CFDs related to foreign exchange, commodities, financial indices and other underlying variables, carry a high level of risk and can result in the loss of all of your investment. As such, FX & CFDs may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with FX & CFD trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall we have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to FX or CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.