Euro drops below support after diverging US and European data

The euro declined below a key support level after data revealed that the Eurozone economy contracted in the first quarter. Data by Eurostat showed that the economy contracted by 0.8% from the fourth quarter of 2020. This led to a year-on-year contraction of 1.8%, which was slightly better than the expected decline of 2.0%. In Germany, the biggest economy in the bloc, declined by 1.7% and 3.3% on a QoQ and YoY, respectively. Further data revealed that the bloc’s consumer price index (CPI) rose by 1.6% year-on-year while the unemployment rate improved by 8.1%. These numbers show that the bloc’s economy is lagging behind that of other places like the United States.

The Japanese yen was relatively unchanged as the market reacted to the latest inflation and manufacturing data from the country. According to Markit, the manufacturing PMI increased from 52.7 in March to 53.6 in April. This is important because it is the fourth consecutive month in which manufacturing activity is increasing. Also, the sector employs millions of people in Japan. Further data showed that industrial production increased by 2.2% in March while the unemployment rate declined from 2.9% to 2.6%. The jobs to applications ratio increased to 1.10, signaling that there are more vacancies than workers.

US futures and European indices declined even after some of the biggest companies in the world released strong earnings. In the United States, futures tied to the Dow Jones and S&P 500 declined by more than 0.50% while in Europe, the FTSE 100 and CAC 40 indices declined by more than 0.20%. This week, some of the biggest American and European companies like Chevron, Amazon, Microsoft, and Google released strong earnings. This decline is partly because of fresh worries about the global recovery. It is also likely due to profit-taking.

EUR/USD

The EUR/USD is on track to have its first monthly gain this year. Still, on the hourly chart, the pair managed to move below the lower side of the ascending channel. It also managed to move below the 25-day exponential moving average while the histogram and signal line of the MACD have moved below the neutral line. The Average Directional Index (ADX) has risen to 54. Therefore, the pair may keep falling as bears target the next key support level at 1.2050.

USD/JPY

The USD/JPY is little changed as the market reflects on the mixed data from Japan. It is trading at 108.82, where it has been in the past few days. On the hourly chart, the pair is stuck at the 25-day and 15-day exponential moving averages while the Average True Range (ATR), which is an important measure of volatility, has declined. The MACD is also moving below the neutral line. The pair may break out higher in the coming days.

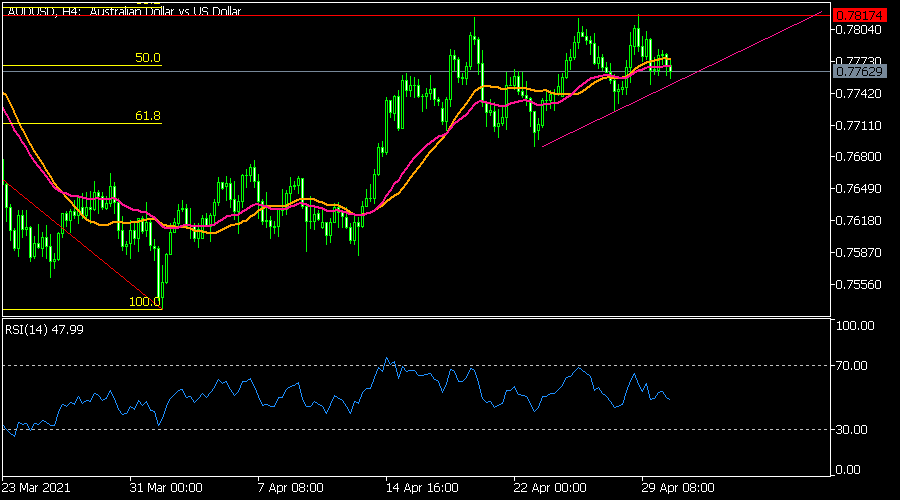

AUD/USD

The AUD/USD pair declined after the relatively mixed Chinese manufacturing data. It is trading at 0.7763, which is slightly below the important resistance at 0.7814. The pair is slightly below the important 25-day and 15-day moving average and the 50% Fibonacci retracement level. It is also forming an ascending triangle pattern, meaning that it will likely have a bullish breakout in the near term.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.