Euro declines due to reported delta spread in Europe

The euro declined against the US dollar as the impact of last week’s Federal Reserve decision continued to reverberate in the market. In its decision, the Fed surprised investors when it sent signals that it will start hiking interest rates in 2023, earlier than the expected 2024. The currency also declined after the Delta coronavirus variant reportedly continued to spread in Europe. It has become dominant in Europe and started to appear in clusters in other European countries like Germany and France. According to the Financial Times, the new strain’s share has continued rising and accounts for 96% of the sequenced infections in Portugal. The currency will react to a statement by Christine Lagarde set for later today.

The price of crude oil rose in early trading as investors reacted to the latest election in Iran. The election resulted in a major victory for hardliners. As such, there are concerns that this outcome will make a deal between the US and the country difficult. As a result, this means that it will take more years for Iranian oil to return to the market. A victory by moderates would have made the likelihood of a deal possible. The price of West Texas Intermediate (WTI) and Brent rose by almost 1% to $74.14 and $71.97, respectively.

The British pound eased slightly against the US dollar after the relatively weak UK house price index. According to Rightmove, the country’s house price index rose by 0.8% in May after rising by 1.8% in the previous month. The data came two days after the UK published weak retail sales numbers. The data showed that the total sales declined in May as people focused on traveling and dining out. Later this week, the currency will react to the latest interest rate decision by the Bank of England (BOE). Elsewhere, the German Central Bank will release its monthly report while the Fed’s James Williams will speak.

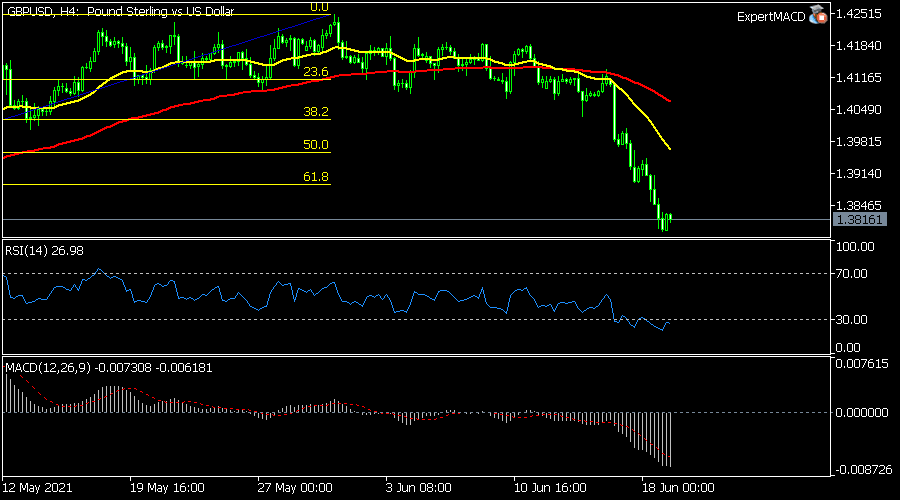

GBP/USD

The GBPUSD pair declined sharply last week after the hawkish Fed decision. The pair fell to 1.3790, which was substantially lower than this year’s high of 1.4250. On the four-hour chart, the pair has moved below the 61.8% Fibonacci retracement and the short and long-term moving averages. The Relative Strength Index (RSI) and the MACD have continued to drop. Therefore, with bears in control, the pair’s path of least resistance is lower.

EUR/USD

The EURUSD pair chart looks quite similar to that of the GBPUSD pair. It has moved below the 61.8% retracement level and the short and longer term moving averages. The pair has also dropped below the Ichimoku cloud while oscillators have continued dropping. All this is happening at a period of high volume. Therefore, the pair will likely keep falling as bears target the next key support at 1.1800.

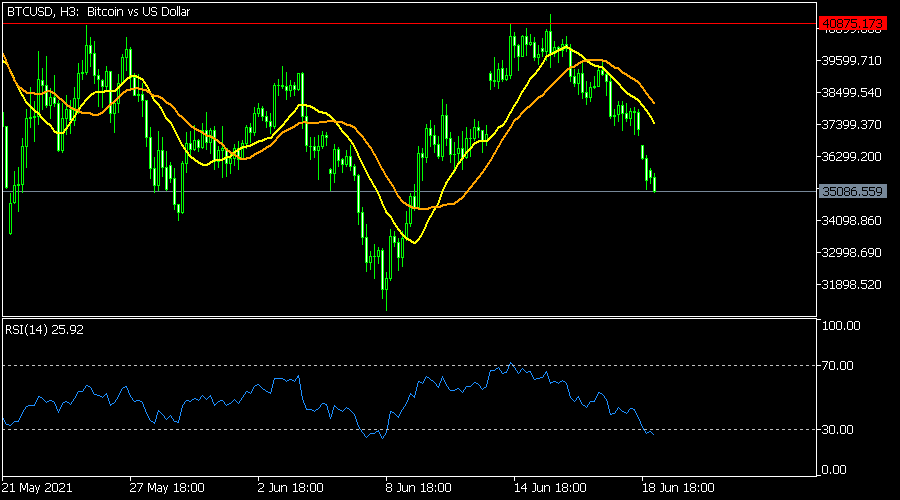

BTC/USD

The BTCUSD pair declined sharply as investors continued to worry about the hawkish Fed. The pair fell to 35,192, which was the lowest level in two weeks. The pair remains below the short and longer-term moving averages. It is also below the strong resistance level at 40,000 while the Relative Strength Index (RSI) and MACD have continued dropping. The pair will likely keep falling, with the next key target being at 34,000.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.