EUR/JPY starts a new bearish wave [Video]

-

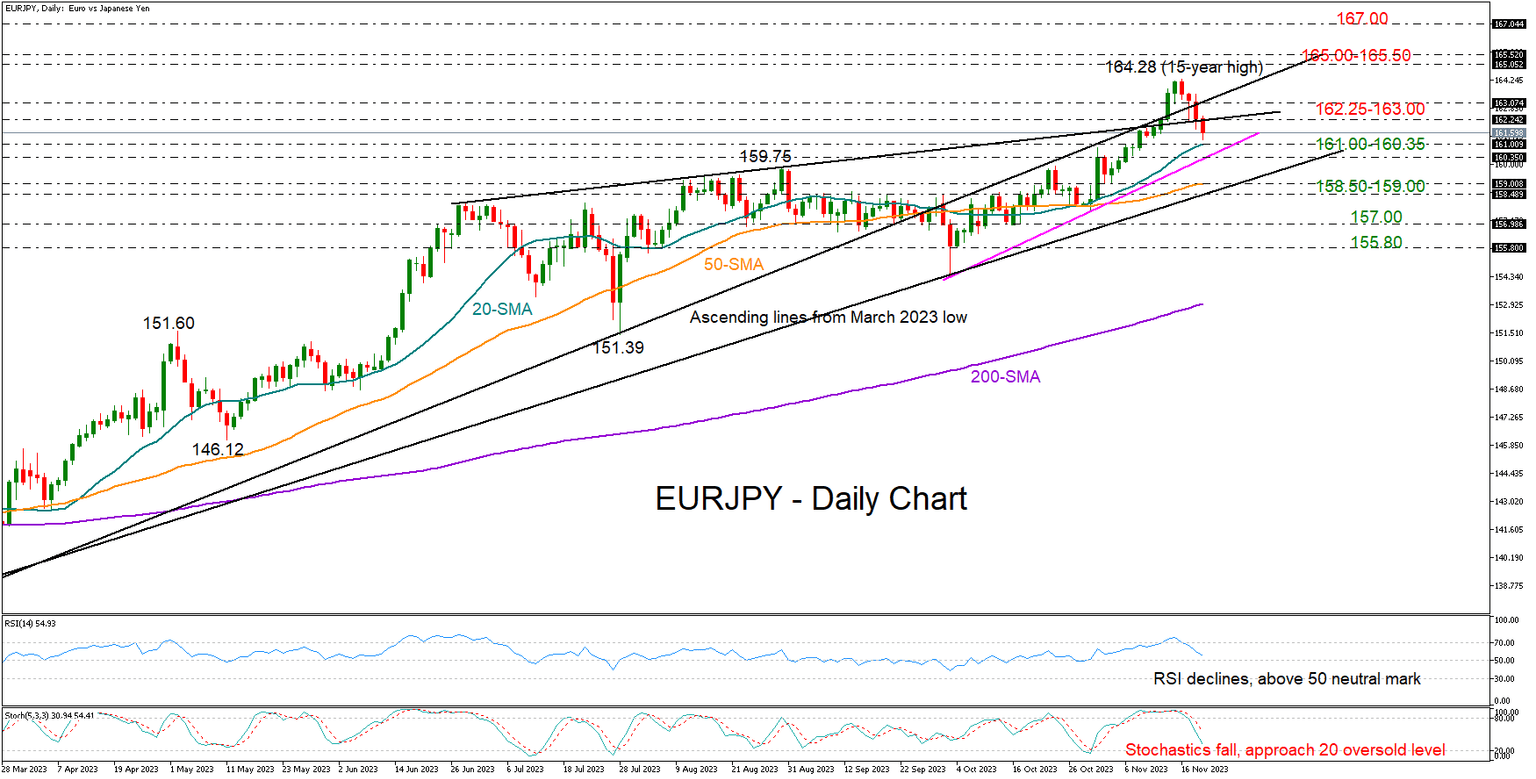

EURJPY turns down after 15-year high, faces weakening bias.

-

Immediate support could develop within 160.35-161.00 region.

![EUR/JPY starts a new bearish wave [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Crosses/EURJPY/forex-euro-and-japanese-currency-pair-with-calculator-4580994_XtraLarge.jpg)

EURJPY traders engaged in some profit taking near last week’s top of 164.28, recording four negative consecutive days to drive the pair as low as 161.38 early on Tuesday.

The negative slope in the momentum indicators is a discouraging signal ahead of Eurozone’s flash business PMI data due on Thursday at 09:00 GMT. But the 20-day simple moving average (SMA) at 161.00 and the tentative ascending support trendline from October at 160.35 are in sight and could still come to the rescue as long as the RSI stands above its 50 neutral mark.

Should the bears breach that floor and reclaim August's high of 159.75, they may next target the 50-day SMA at 159.00. A step below the tentative descending trendline drawn from March 2023 could confirm additional losses to 157.00 and then down to 155.80.

If the price returns above yesterday's base of 162.25 and runs higher than 163.00, the bulls might again attempt to reach the 165.00-165.50 caution area from June 2007-August 2008. A victory there could then form a new higher high around the 167.00 bar, which had been limiting both upside and downside movements during the same period, too.

In brief, EURJPY started a new bearish wave after new 15-year highs, but hopes for a pivot have not evaporated yet as a key support region is in a short distance.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.