EUR/USD Weekly Forecasts: EU inflation, US employment and China grant a busy week ahead

- European Harmonized Index of Consumer Prices expected to reach record highs in October.

- Chinese COVID-19 cases keep rising, menacing to interrupt global economic recovery.

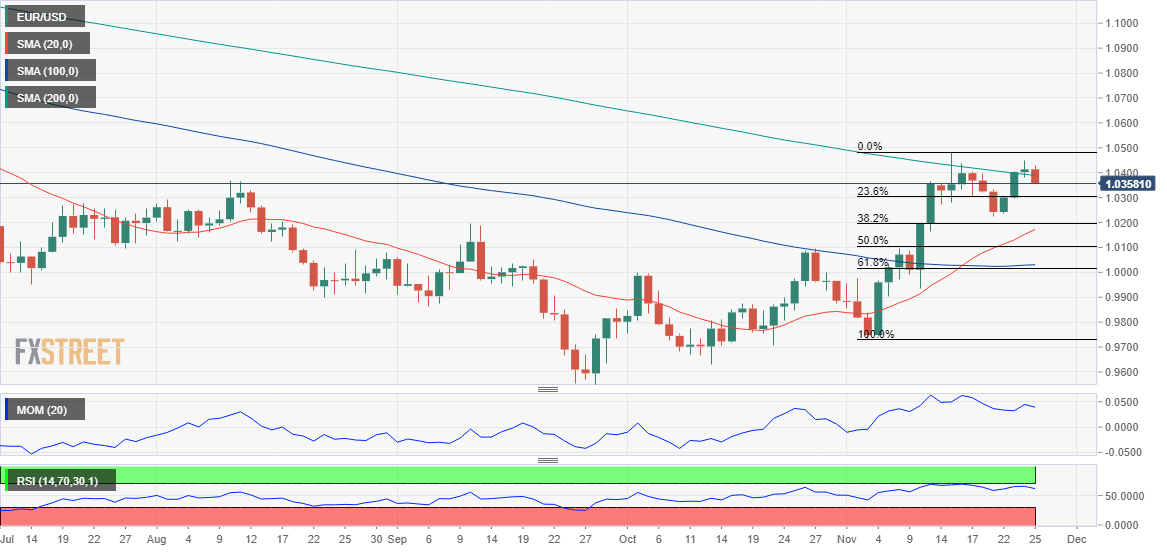

- EUR/USD is technically bullish in the long term, but still needs to clear 1.0480.

The EUR/USD pair resumed its advance this past week, settling below the 1.0400 threshold. The US Dollar appreciated on Monday, extending the positive momentum amid worrisome news coming from China. EUR/USD bottomed at 1.0222, the weekly low, recovering afterwards to the aforementioned figure.

Covid on the rise in China: Supply-chain issues back on the table?

China reported two coronavirus deaths and a spike in contagions, with the situation escalating as the days went by. By Friday, the country reported record COVID-19 contagions for a second consecutive day. Local authorities announced restrictions and lockdowns in different cities, reviving concerns of a global economic setback. According to the latest central bank statements, supply-chain issues ̶ ̶ one of the main reasons behind skyrocketing global inflation ̶̶ are pretty much solved. Fresh lockdowns in the world's second-largest economy may once again interrupt global trade and revive bottlenecks.

Inflation has begun giving signals of easing in the United States but remains at record highs in Europe. The US Consumer Price Index (CPI) rose by 7.7% YoY in October, easing for a fourth consecutive month. In the Euro Area, the Harmonised Index of Consumer Prices (HICP) printed at 10.6% YoY in the same month, barely easing from 10.7% in September. The Ukraine-Russia war has been a huge factor weighing on Europe’s inflation amid the European dependence on Russian energy.

The EUR/USD pair recovered some ground on Tuesday, but a more dramatic advance took place on Wednesday, as United States growth-related data surprised on the downside, while the FOMC Meeting Minutes were much more dovish than anticipated.

Weak PMIs and US Federal Reserve hit US Dollar

S&P Global published its November Purchasing Manager Indexes (PMIs) preliminary estimates. The European indexes showed that activity in the private sector remained in contraction territory, but given that the figures improved from the previous month and beat expectations, market players saw the figures as Euro positive. Furthermore, the official report showed that price pressures cooled amid weaker demand and easing supply constraints. On the contrary, the United States PMIs fell by more than anticipated, with services and manufacturing activity dipping well into contraction territory. The Manufacturing PMI posted a 30-month low of 47.6.

The shock of tepid US data weighed on the US Dollar, while FOMC Meeting Minutes put the final nail in the coffin. The document showed that most Federal Reserve voting members agreed that despite the risk to the inflation outlook remaining skewed to the upside, a slower pace of interest rate hikes would be appropriate soon. Furthermore, they believe the monetary policy is approaching a “sufficiently restrictive” level. The US Dollar entered a sell-off spiral that pushed EUR/USD to a weekly high of 1.0447 early on Thursday. Thinned market conditions ahead of the weekend amid the US Thanksgiving holiday helped the American currency to recover some ground.

What’s next for Europe and the United States?

Generally speaking, financial markets are optimistic. US stock markets stand at their highest in four months, while US Treasury yields have held far below the record peaks posted a couple of months ago. Expectations that inflation has begun easing and that the US Federal Reserve (Fed) will slow the pace of tightening have brought relief about a potential recession in the United States.

Europe, on the other hand, faces the continued pressure of the energy crisis and the lack of a common fiscal policy, an unfinished business ever since the European Union (EU) was formed. Stabilizing prices is a much tougher task for the EU, and in fact, next week, we will get fresh updates on Consumer Price Index readings.

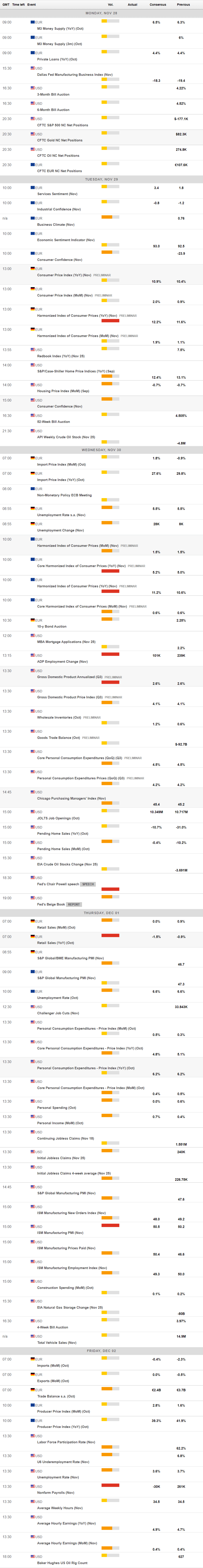

Germany will publish the preliminary estimate of its November Harmonized Index of Consumer Prices, expected to jump to 12.2% YoY from 11.6% in October. The EU will also release the HICP for the same period, seen up by 11.2% YoY vs the previous 10.6%.

Across the pond, the United States will publish the second estimate of the Q3 Gross Domestic Product (GDP), with annualized growth expected to be confirmed at 2.6%. On Thursday, the country will release Federal Reserve’s favourite inflation figures, the core Personal Consumption Expenditures Price Index for October, and the November ISM Manufacturing PMI.

Finally, on Friday, the US will release the Nonfarm Payrolls reports. Expectations are that the country has lost 30,000 job positions in November, while the Unemployment Rate is foreseen at 3.6%, easing from the previous 3.7%.

Beyond macroeconomic data, investors will be keeping an eye on China's coronavirus developments. So far, the situation has been overlooked, but if the Chinese government decides to announce tighter restrictive measures, the market sentiment could suffer a sharp U-turn.

EUR/USD technical outlook

The EUR/USD pair weekly chart shows that it is in a bullish path. The Momentum indicator bounced from around its midline and heads firmly north within positive levels, maintaining its bullish slope and at its highest in two years. The Relative Strength Index (RSI), in the meantime, ticked marginally higher and currently stands at around 55. At the same time, the 20 Simple Moving Average (SMA) remains directionless over 300 pips below the current level, while the longer moving averages maintain their downward slopes far above the current level and with the 100 SMA crossing below the 200 SMA.

The daily chart shows that EUR/USD battles a bearish 200 SMA for a second consecutive week. The moving average has capped advances since June 2021, and a clear break above it should be quite a bullish psychological sign. The 20 SMA in the mentioned time frame heads firmly north, now nearing the 38.2% retracement of the latest daily advance at 1.0193, extending its advance above a flat 100 SMA. The latter converges with the 61.8% Fibonacci retracement in the 1.0030 price zone. Technical indicators retreat from overbought readings, reflecting the intraday decline rather than anticipating another leg south.

The first EUR/USD support level is 1.0305, the 23.6% retracement of the aforementioned rally, followed by the 1.0190 price zone. If the pair breaks below the latter, a retest of parity will be on the table. On the other hand, the November high as 1.0480 provides resistance. A break above the level should open the door for a steeper advance, with market players aiming for a test of the 1.0600 threshold.

EUR/USD sentiment poll

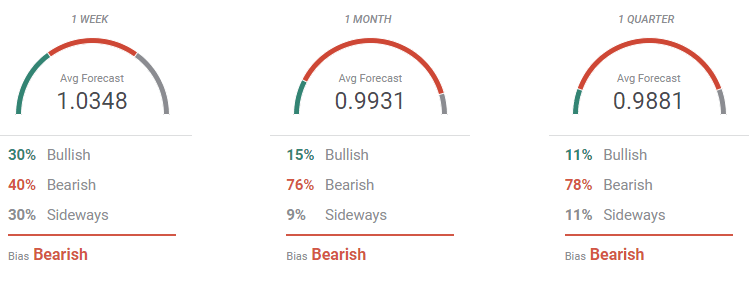

The FXStreet Forecast Poll shows that the EUR/USD pair is bearish, as most banks have failed to update their outlooks. Analysts, on the other hand, had a more accurate view of what may be next for EUR/USD. Nevertheless, the near-term perspective shows that only 40% of the polled experts are looking for lower levels, leaving the average target at 1.0348.

The Overview chart shows that the near-term moving average heads firmly north, in line with higher highs in the upcoming days. The longer-term moving averages have also picked up despite the still-high number of bets aiming for levels below parity. The same chart shows quite clearly how the tie is turning, with higher highs in the 1.0600/800 region now at sight.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.