EUR/USD Weekly Forecast: Potential bottom not in sight yet

- The European Central Bank maintained its policy unchanged and a cautious stance.

- Global inflationary pressures were fueled by Chinese lockdowns and Russian attacks on Ukraine.

- EUR/USD is technically bearish without showing signs of downward exhaustion.

The EUR/USD pair fell for a second consecutive week and reached a fresh two-year low of 1.0765, to finally settle a handful of pips above 1.0800. The main bearish catalyst was the European Central Bank, as President Christine Lagarde & co announced they would introduce no changes to their monetary policy.

ECB’s dovish surprise

Market participants were anticipating a shift toward a more hawkish stance, but the ECB left rates on hold and repeated the asset purchase programs would end in Q3. Monthly net purchases will amount to €40 billion in April, €30 billion in May and €20 billion in June.

The accompanying statement was quite dovish, as it noted that Russia's aggression is affecting the economies in Europe and beyond. Higher energy and commodity prices are affecting demand and slowing production, which results in higher inflation. Also, trade disruptions are leading to new shortages of materials and inputs, another factor weighing on prices pressure.

But at the same time, President Christine Lagarde said it was “premature” to discuss quantitative tightening, adding that rate hikes could begin “sometime after” the end of the APP program. Finally, policymakers noted that upcoming decisions will depend on the incoming data, adding that under current conditions of high uncertainty, they would maintain “optionality, gradualism and flexibility in the conduct of monetary policy.”

Across the pond, US Federal Reserve officials continued to anticipate a 50 bps rate hike in May and paving the way for a reduction of the balance sheet. The imbalance between both central banks will likely keep weighing on EUR/USD.

Global jitters exacerbate inflation

Meanwhile, the global chaos adds to the risk-averse sentiment that usually fuels the greenback. On the one hand, is China with coronavirus-related lockdowns adding to supply disruption. On the other hand, Russian attacks on Ukraine send commodity prices to multi-year highs. Both are just adding to price pressures.

Speaking of which, the US reported the March Consumer Price Index, up to 8.5% YoY, a fresh multi-decade high. The core figure rose by less than anticipated, reaching 6.5% in the same period and somehow triggering hopes inflation may be finally topping. Germany confirmed its annual inflation at 7.3% in the same period, another record high.

Other relevant data published these days was the Michigan Consumer Sentiment Index, which improved to 65.7 in April, according to preliminary estimates. The country also published March Retail Sales, up a modest 0.5% MoM. Finally, the German ZEW Survey showed that Economic Sentiment plummeted to -43 in the Eurozone, also down in the country.

The upcoming week will be light in terms of macroeconomic data, with the most relevant figures being the preliminary April S&P Global PMIs. The EU will release the final readings of March inflation figures, while Germany will unveil the Producer Price Index for the same month.

EUR/USD technical outlook

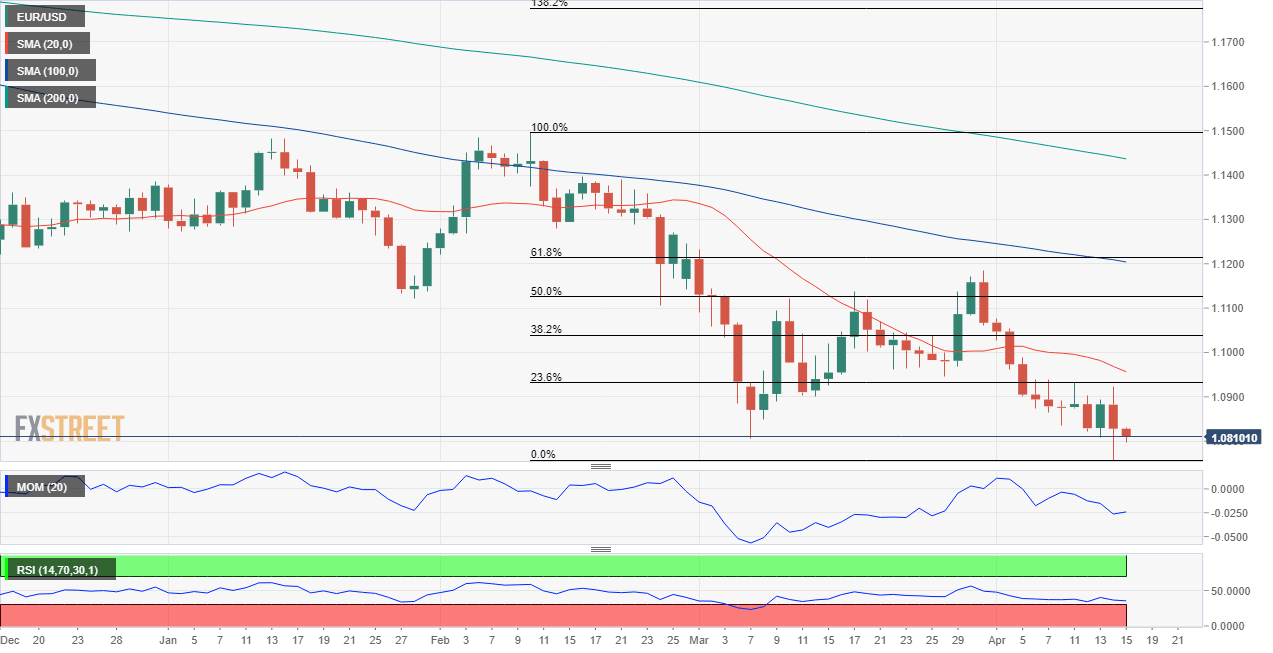

The bearish case for EUR/USD remains firmly in place. The weekly chart shows that technical indicators maintain their downward slopes near oversold readings, without signs of bearish exhaustion. The 20 SMA heads south well below the longer ones, supporting a bearish continuation on a break below the 1.0760 price zone, a strong static support level. In such a case, the pair could retest March 2020 low at 1.0635.

According to technical readings in the daily chart, the pair is also on the bearish path. EUR/USD is developing below all of its moving averages, with the 20 SMA accelerating south below the longer ones. In the same chart, technical indicators resumed their slides within negative levels and are still holding above oversold readings.

In the case of a recovery, the first relevant resistance area comes at 1.0930, where sellers will likely add shorts. The corrective advance could extend up to the 1.1000 figure if somehow the pair manages to break above the aforementioned 1.0930 price zone.

EUR/USD sentiment poll

The FXStreet Forecast Poll shows that market participants are looking for lower lows in EUR/USD. The pair is seen on average at 1.0787 in the weekly perspective, with 67% of the polled experts betting on a decline. The sentiment is bullish in the monthly and quarterly view, as the number of those looking for higher levels are way above those seeing the pair lower. Nevertheless, the pair is hardly seen beyond the 1.1200 level.

The Overview chart offers quite a bearish picture, as all the moving averages under study head firmly lower. The number of those looking for a slide towards 1.0600 or below continues to increase in the monthly and quarterly views, hinting at strong selling interest.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.