EUR/USD Weekly Forecast: Bulls cheer tepid US employment data, more gains in the docket

- A disappointing US Nonfarm Payrolls report fueled speculation of delayed tapering.

- The European Central Bank will have a monetary policy meeting on September 9.

- EUR/USD is bullish and could extend its advance to the 1.2000 price zone.

The American dollar was offered throughout the week on the back of dovish comments from US Federal Reserve Chair Jerome Powell and tepid local employment-related data, all of which points to a delay in tapering.

To taper or not to taper

Hawkish comments from different Fed officials and mounting inflationary pressures have led to speculation the US central bank will start reducing its ultra-loose monetary policy by year-end. However, chief Powell cooled down such hopes at the Jackson Hole symposium, expressing concerns about the potential effects of the spread of the coronavirus Delta variant in the economic recovery.

He noted that tapering may still happen this year, conditioned on progress in the economy towards the Fed’s goals. About inflation, he said “At these levels, it is, of course, a cause for concern,” but added, “that concern is tempered by a number of factors that suggest that these elevated readings are likely to prove temporary.”

On employment, Powell said that the sector is recovering but has a further way to go. Over the last few days, his words were confirmed by macroeconomic figures, pouring cold water on the market’s hopes.

The ADP survey anticipated poor employment figures, as the private sector added 374K new jobs, well below the 613K expected. In addition, the ISM Manufacturing employment sub-component contracted to 49 from 52.9. Finally, the Nonfarm Payrolls report was a huge disappointment, as the country added just 235K new jobs, missing the 750K expected. The Unemployment Rate contracted to 5.2% as expected, while the Labor Force Participation Rate remained unchanged at 61.7%.

ECB on hold for now

The European Central Bank is meeting on September 9, and market participants expect it to maintain its monetary policy on hold. European policymakers have been prudent over announcing a change to their current policy and are mainly focused on pandemic developments.

Beyond central banks, data released these days was most discouraging. The EU Economic Sentiment Indicator contracted to 117.5 in August, while US CB Consumer Confidence shrank to 113.8 in the same month.

Also, Markit published the final readings of its August PMIs, most of which suffered downward revisions from preliminary estimates, anyway indicating expansion.

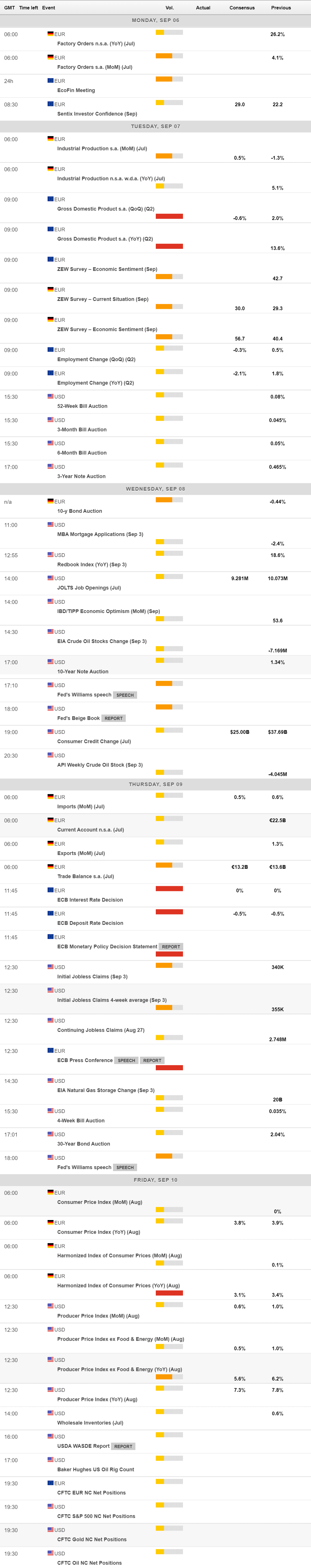

The macroeconomic calendar will be a busy one next week in the EU. Apart from the ECB meeting next Thursday, Germany will publish July Factory Orders, Industrial Production and Trade Balance. The country will also release the September ZEW survey, with the economic sentiment seen improving to 56.7. In addition, the country will also publish the final reading on August inflation.

The Union will publish a revision of its Gross Domestic Product for the second quarter, while the US has a quiet week in terms of macroeconomic figures.

EUR/USD technical outlook

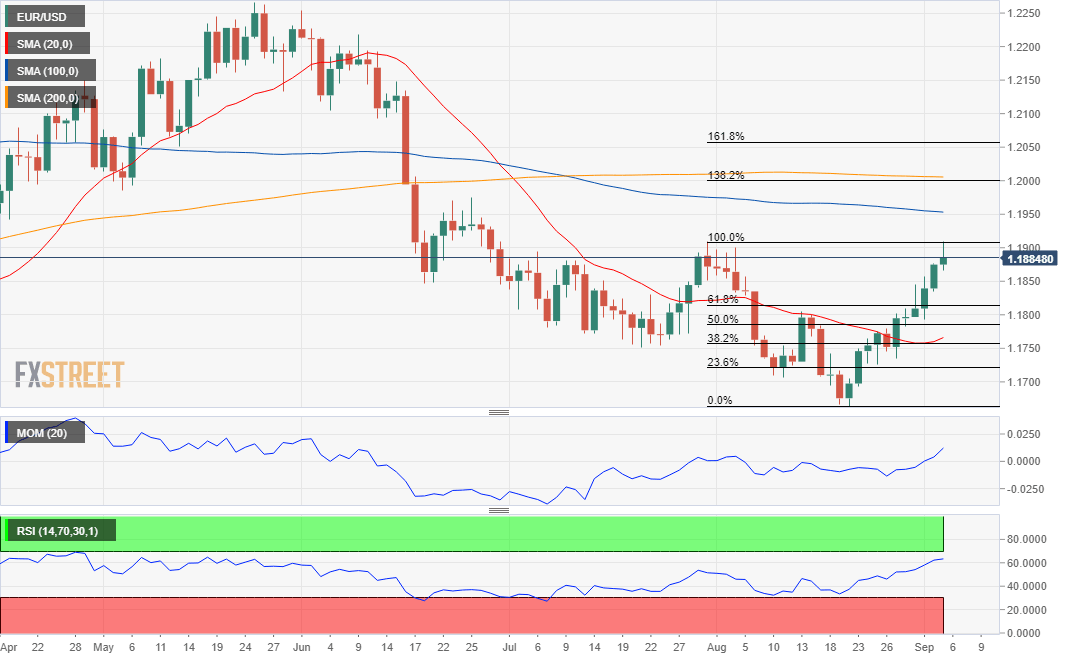

The EUR/USD pair holds on to weekly gains after topping out at 1.1908, also the high from July 30. Up for a second consecutive week, the weekly chart shows that the pair remains below a mildly bearish 20 SMA, while the 100 and 200 SMA converge around 1.1570, with the shorter maintaining a modest bullish slope. Technical indicators have continued to recover within negative levels, falling short from suggesting a long-term bullish extension.

The pair is bullish, according to the daily chart, up for a sixth consecutive day. The pair has moved well above its 20 SMA, which slowly turns higher. However, the pair is still below the longer ones, with the 100 SMA currently at around 1.1950, providing dynamic resistance. Meanwhile, technical indicators head firmly higher within positive levels.

Beyond 1.1950, the next resistance level is the 1.2000 psychological threshold en route to the 1.2060/70 price zone. The main support at this point is 1.1820, with bulls holding the grip if the pair remains above the level. Below it, the slide could continue toward the 1.1750 price zone.

EUR/USD sentiment poll

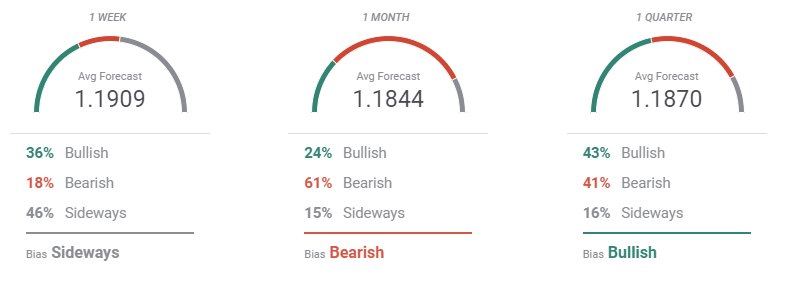

The FXStreet Forecast Poll shows that investors are mostly neutral in the near term, as 46% of the polled experts aim for targets around the current price zone. Those hoping for lower levels are a majority in the monthly perspective, with the pair seen on average at around 1.1844. Bulls retake the lead in the quarterly view, jumping to 43%.

However, the Overview chart presents a different picture. The moving averages have turned sharply bullish in the three time-frame under study, although, in the monthly view, most targets accumulate below the current level. The same chart shows that in the quarterly perspective, there is a wide spread of possible targets, between 1.15 and 1.24, somehow reflecting the ongoing uncertainty related to the US Federal Reserve monetary policy.

Related Forecasts:

USD/CAD Weekly Forecast: Third week of falls? BOC and Canadian jobs hold the keys

GBP/USD Weekly Forecast: Torn between mixed forces, data to determine next moves

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.