EUR/USD Weekly Forecast: All eyes on the Fed´s upcoming decision

- The European Central Bank pulled the trigger but failed to boost the EUR.

- The US Federal Reserve and GDP figures will take centre stage next week.

- EUR/USD is undergoing a bullish correction but still faces strong selling interest.

The EUR/USD pair is ending the week in the 1.0220 price zone, extending the recovery from the multi-year low of 0.9951, hit in mid-July. The pair got to bounce on Friday, although the advance had little to do with the shared currency, but more with the outstanding Wall Street’s weekly performance and falling US government bond yields taking their toll on the greenback. US stocks were backed by better-than-anticipated earnings reports alongside hopes the Federal Reserve will refrain from tightening monetary policy at a faster-than-anticipated pace.

The world gyrated around the EU

The pair peaked at 1.0277, but the European Central Bank killed the bulls. The central bank hiked rates for the first time in over a decade, by 50 bps, amid an “updated assessment of inflation.” The Deposit Rate was lifted to 0% from -0.5%, while the Interest Rate was raised to 0.5% from 0%.

The ECB also announced the Transmission Protection Instrument (TPI), the new anti-fragmentation tool, considering it necessary to support the effective transmission of monetary policy across the Union. The TPI is a new bond purchase scheme aimed at helping more indebted eurozone countries and avoiding financial fragmentation within the EU.

President Christine Lagarde later offered a speech in which she noted that, according to data, there is no risk of a recession for this year and the next. However, she added that “the impact of high inflation on purchasing power, continuous supply constraints, and higher uncertainty are having a dampening effect on the economy. Taken together, these factors are significantly clouding the outlook for the second half of 2022 and beyond."

Following the ECB announcement, the chances of future hikes decreased. Market players are now betting on a modest 25 bps hike in September. Lagarde’s caution towards normalization hit the EUR/USD pair, as the central bank is doing too little, too late.

On a positive note, the Russian giant Gazprom resumed gas flows to the EU through the Nord Stream 1 pipeline, although natural gas supply disruptions are still an issue in the Union. So far, Moscow deliveries stand at around the 40% capacity of the pipeline, enough to prevent an energy crisis in Europe while maintaining the pressure on the Union.

Another drag for the EUR was political turmoil in Italy. After the governing coalition collapsed, Prime Minister Mario Draghi effectively resigned. Italian President Sergio Mattarella has dissolved the Italian parliament, opening the door for a snap election on September 25.

One down, one to go

The US Federal Reserve will announce its monetary policy decision next Wednesday, July 27. The Fed has adopted the most aggressive quantitative tightening, followed close by the Bank of Canada, and lifted rates by 150 bps since the year started, 25 in March, 50 in May and 75 in June, the latter surpassing the market’s expectations.

Still, the US economy faces the risk of recession while inflation continues to soar. The latest available data showed that the Consumer Price Index surged by 9.1% YoY in June, well above the 8.6% expected and the previous 8.1%. The Fed has anticipated another 75 bps hike for July, although market players would not be too surprised if the hike is by 100 bps, despite Fed officials having tapered such expectations. Higher rates may be a tool to tame inflation, but they restrain economic growth. The Fed is trapped between a rock and a hard place, as it needs to control inflation without slowing further the already lame economic progress.

Worrisome growth signs

The macroeconomic calendar was relatively quiet in the last few days, but shocking figures came out on Friday. S&P Global published its July flash PMIs, which showed that EU business output contracted for the first time since February 2021. The Composite Index fell to 49.4 from 52 in June, with the steepest decline recorded in Germany, where the Composite PMI slid to 48, its lowest since mid-2020. Most European indexes fell off expansion territory, reflecting further economic slowdown at the beginning of the third quarter.

In the US, the S&P Global Services PMI plummeted to 47, while the manufacturing index, on the other hand, remained in expansionary territory and printed at 52.3. Nevertheless, business activity contracted for the first time in two years, with the Composite PMI sinking to 47.5 from 52.3 in June. Poor US data pushed government bonds up, to the detriment of yields which slid to fresh 2-week lows on Friday.

Beyond the Fed monetary policy decision, the upcoming week will bring some interest figures. The US will publish the preliminary estimate of the second quarter Gross Domestic Product. The Economy is expected to have grown at an annualised pace of 0.9% in the quarter, recovering from a 1.6% dip in the previous three months. Germany and the EU will also publish the preliminary Q2 GDP estimates, foreseen at 1.7% and 3.4%, respectively.

The US will add June Durable Good Orders to the list of relevant events, while the EU and Germany will publish the preliminary estimates of their July inflation figures.

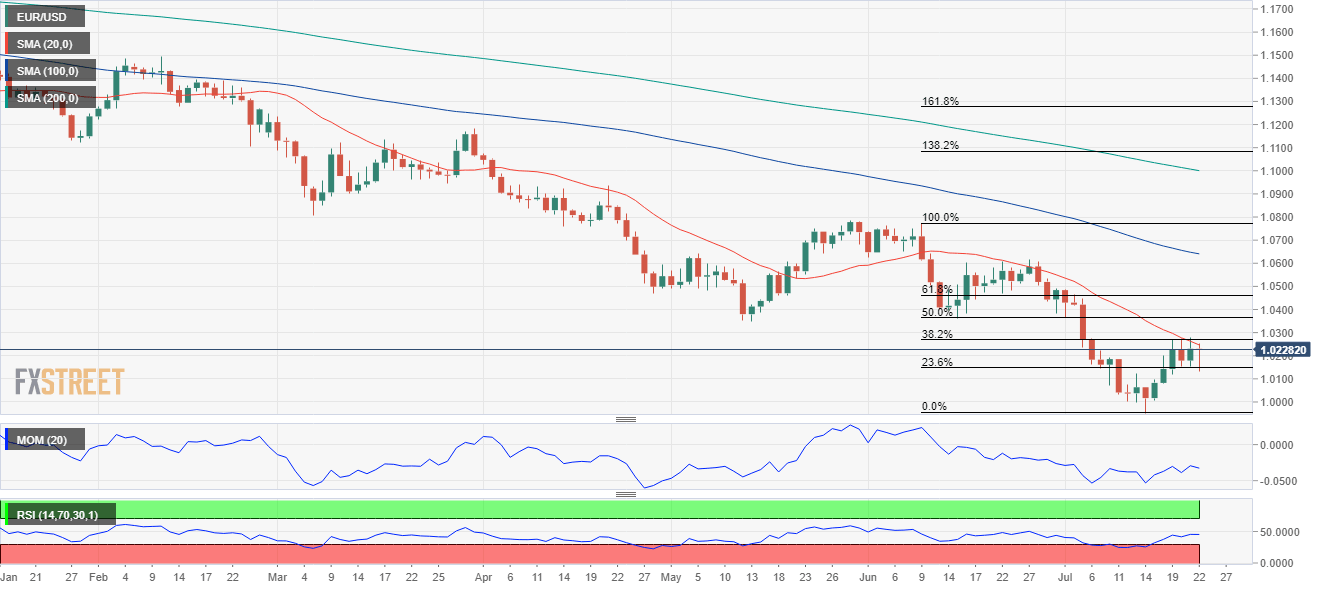

EUR/USD technical outlook

The EUR/USD pair trades near its weekly high, also a relevant resistance level as it converges with the 50% retracement of its latest daily decline measured between 1.0614 and 0.9951 at 1.0280. The pair retreated several times from the level, somehow hinting at a substantial follow-through on a break above it. The next Fibonacci resistance and a potential bullish target come then at 1.0360.

The weekly chart reflects the undergoing bullish correction. Technical indicators have left oversold territory and aim higher within negative levels. At the same time, the 20 SMA maintains its firmly bearish slope, converging with the higher end of the aforementioned range. An interim bottom is not yet confirmed, as the pair would need to clear its May monthly high at 1.0786 to recover its long-term bullish stance.

Technical readings in the daily chart limit the bullish potential, despite the recent comeback. Bears are rejecting advances around a bearish 20 SMA, while technical indicators have lost their directional strength and stabilised below their midlines. Finally, the longer moving averages keep heading firmly lower, far above the shorter one.

The pair could resume its slide on a break below 1.0105, the 23.6% retracement of the mentioned daily slide, opening the door for a retest of the 2022 low at 0.9951.

EUR/USD sentiment poll

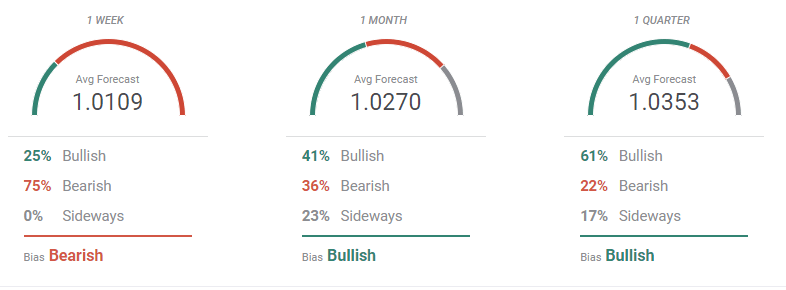

According to the FXStreet Forecast Poll, EUR/USD is close to confirming an interim bottom. Most polled experts see the pair below the current level in the upcoming week, but bulls take over in the monthly and quarterly views. The pair is seen averaging 1.0100 in the near term but recovering towards 1.0300 in the wider views.

However, the Overview chart still shows that bears are in control. The moving averages keep heading lower in the three time frames under study. Moving averages lag the latest price behaviour, but what does not confirm a potential reversal. What seems more relevant, is that potential targets around or below parity have decreased compared to the previous weeks.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.