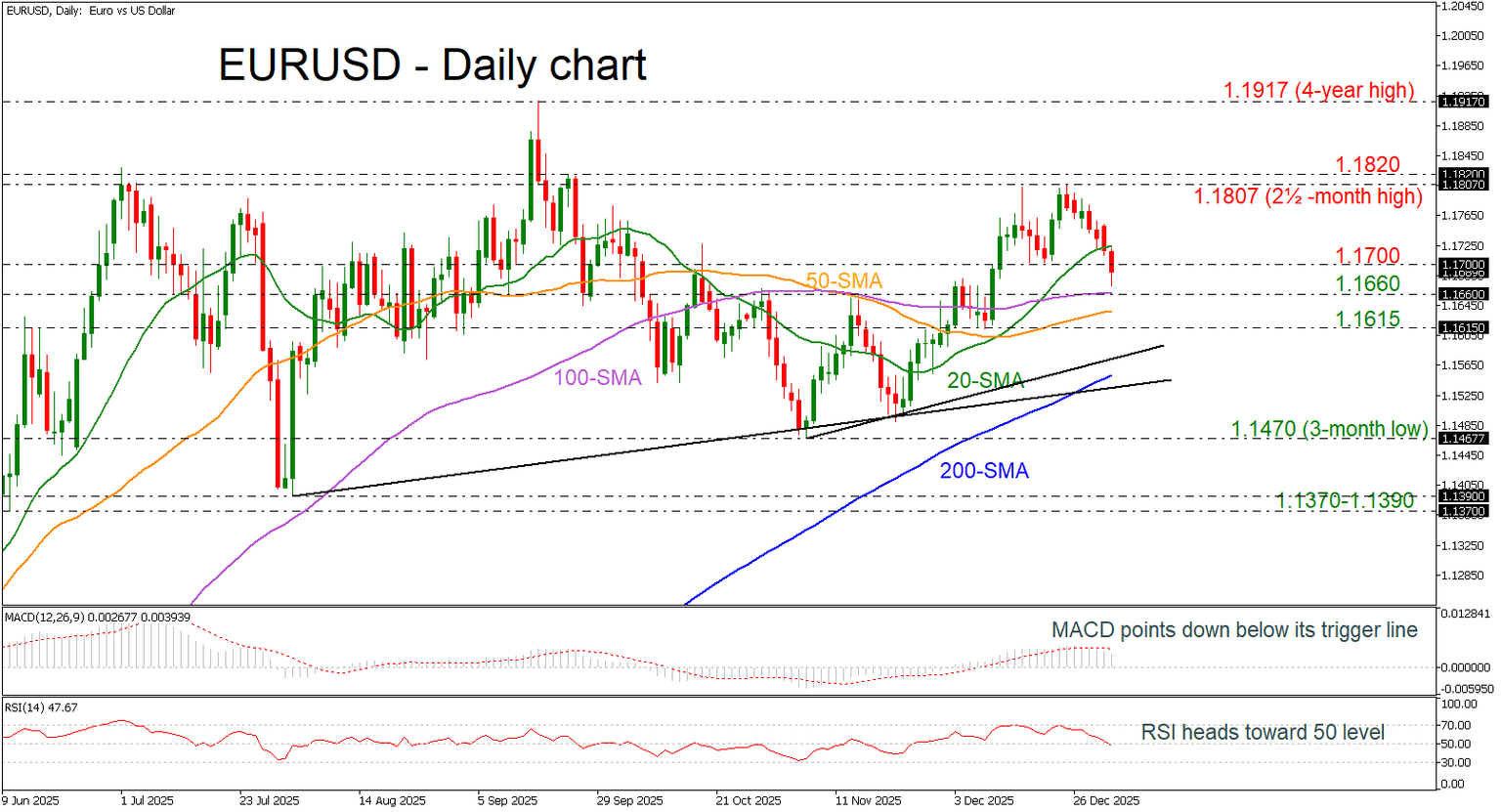

EUR/USD tumbles below 1.1700

- EUR/USD starts 2026 in red.

- MACD and RSI point downwards.

EUR/USD continues to slide below 1.1700 as investors await new catalysts, with attention centered on interest rate expectations in both the Eurozone and the US. The ECB signaled a steady-rate stance for now, citing stable economic performance and inflation near target, while President Christine Lagarde noted that elevated uncertainty limits forward guidance.

Further downside momentum could push the pair toward key support levels, starting with the 100‑day SMA at 1.1660, followed by the 50‑day SMA at 1.16335 and the 1.1615 support zone. A deeper pullback may find additional support near the short‑term upward trend line around 1.1580.

Conversely, a move back above the 1.1700 psychological threshold may open the way toward the recent two‑and‑a‑half‑month high at 1.1807, followed by the 1.1820 resistance area.

Technical indicators reinforce the short‑term bearish bias. The MACD remains below its signal line with a downward slope, while the RSI has slipped below the 50 level.

To sum up, EUR/USD outlook remains tilted to the downside in the near term, with technical indicators signaling weakening momentum. While the pair may encounter support at upcoming moving averages and trend‑line levels, a sustained recovery above 1.1700 would be required to shift sentiment back toward the recent highs.

Author

Melina joined XM in December 2017 as an Investment Analyst in the Research department. She can clearly communicate market action, particularly technical and chart pattern setups.