EUR/USD: Trading in a narrow range as declining US yields

Currencies

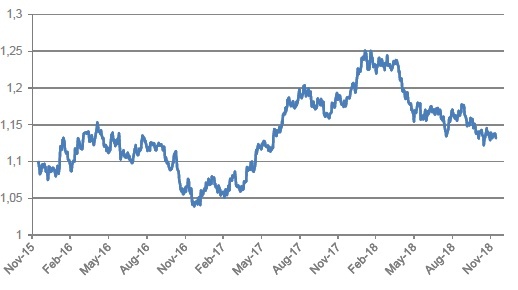

EUR/USD

EUR/USD trading in a narrow range as declining US yields and global uncertainties are keeping the dollar balanced.

EUR/GBP

Sterling under heavy siege as PM May pulled the crucial Brexit vote to avoid a humiliating defeat in Parliament. She seeks more EU concessions to convince MP’s.

USD/JPY trades surprisingly flat in a tight 112-114 range given the volatility uptick in global markets.

EUR/CZK

Weaker than expected Q3 GDP growth (2.4% YoY) and political uncertainty kept the Czech koruna near 2018 lows in November, despite 4 consecutive interest rate hikes.

EUR/HUF

EUR/HUF found higher ground following Orban’s election victory and during the emerging market turmoil but entered relatively calmer water afterwards. Mood swings in the pair are losing momentum.

EM Index

The basket of EM currency’s recovery stalls after a swift uptick in August. Global uncertainty and volatility keeps most EM in the defensive position.

Author

KBC Market Research Desk

KBC Bank