EUR/USD: the breakdown below $ 1.1060 was a key move [Video]

![EUR/USD: the breakdown below $ 1.1060 was a key move [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/EURUSD/european-euro-coin-on-top-of-american-dollar-bill-11292130_XtraLarge.jpg)

EUR/USD

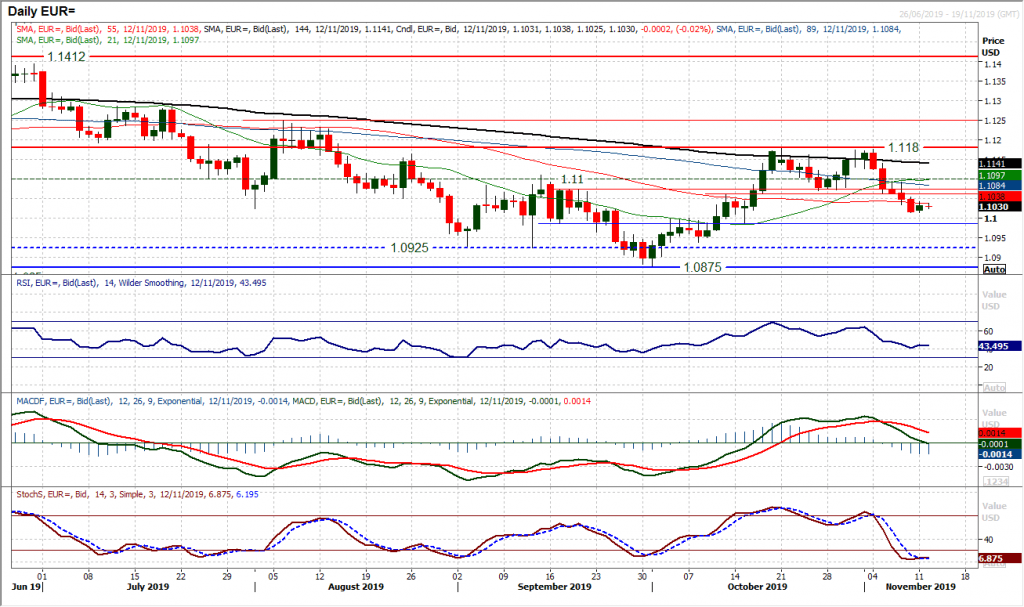

With US bond markets shut yesterday, it is difficult to take too much from yesterday’s mild gain on EUR/USD. However, there has been a solid open higher today and the corrective momentum of last week does appear to have been restricted, at least for now. Despite this though, we see that the breakdown below $1.1060/$1.1075 was a key move last week and signalled a shift in outlook to a point where the corrective forces look to be dominant on a near to medium term basis. Trading under all the moving averages, along with sliding/negative configured momentum suggests that near term rallies are going to struggle now. $1.1060/$1.1075 is now a pivot area as a basis of resistance that needs clearing on a closing basis for the bulls to feel a sense of control again. We expect pressure to resume on the support of Friday’s low at $1.1015 and then $1.0990.

Author

Richard Perry

Independent Analyst