EUR/USD struggling below 1.1700, PMI’s Next

Key Highlights

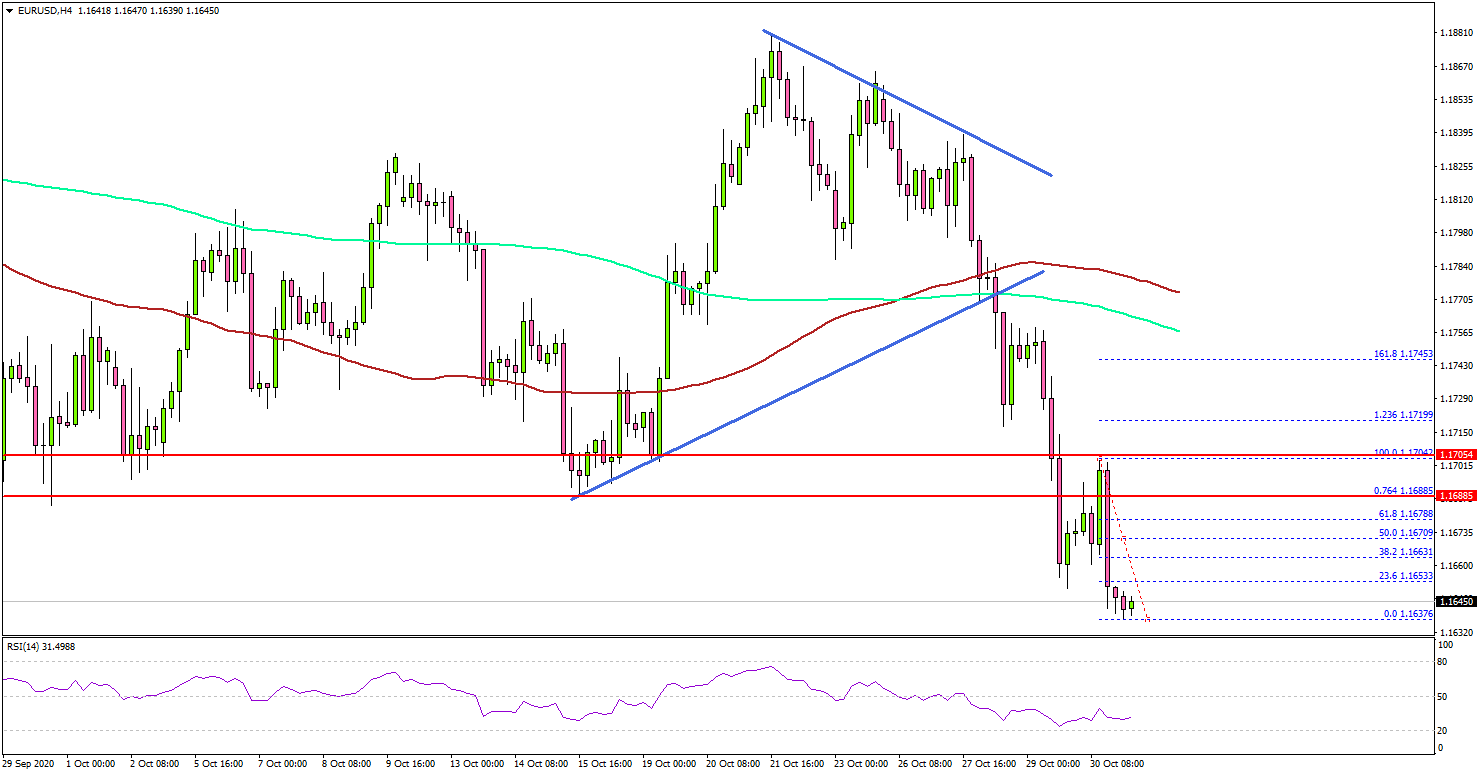

- EUR/USD started a major decline below the 1.1750 and 1.1700 support levels.

- It broke a crucial contracting triangle with support near 1.1785 on the 4-hours chart.

Looking at the 4-hours chart, the pair followed a bearish pattern from well above 1.1850. It broke a crucial contracting triangle with support near 1.1785 to start the current decline.

The pair settled well below the 1.1750 support level, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours). The decline was such that the pair even broke the 1.1700 support level.

It tested the 1.1640 level. If there is an upside correction, the 1.1680 and 1.1700 levels are likely to prevent gains. The next major resistance is near the 1.1750 level or the 100 simple moving average (red, 4-hours).

Conversely, the pair could continue to move down below 1.1640 and 1.1625. The next major support is near the 1.1600 level.

Author

Aayush Jindal

TitanFX

I have spent over six years as a financial markets contributor and observer, and possess strong technical analytical skills. I am a software engineer by profession, loves blogging and observing financial markets.