EUR/USD rejected by 1.0000 psychological level, bearish bias intact [Video]

![EUR/USD rejected by 1.0000 psychological level, bearish bias intact [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/EURUSD/money-for-the-table-with-figures-gm118451521-10951870_XtraLarge.jpg)

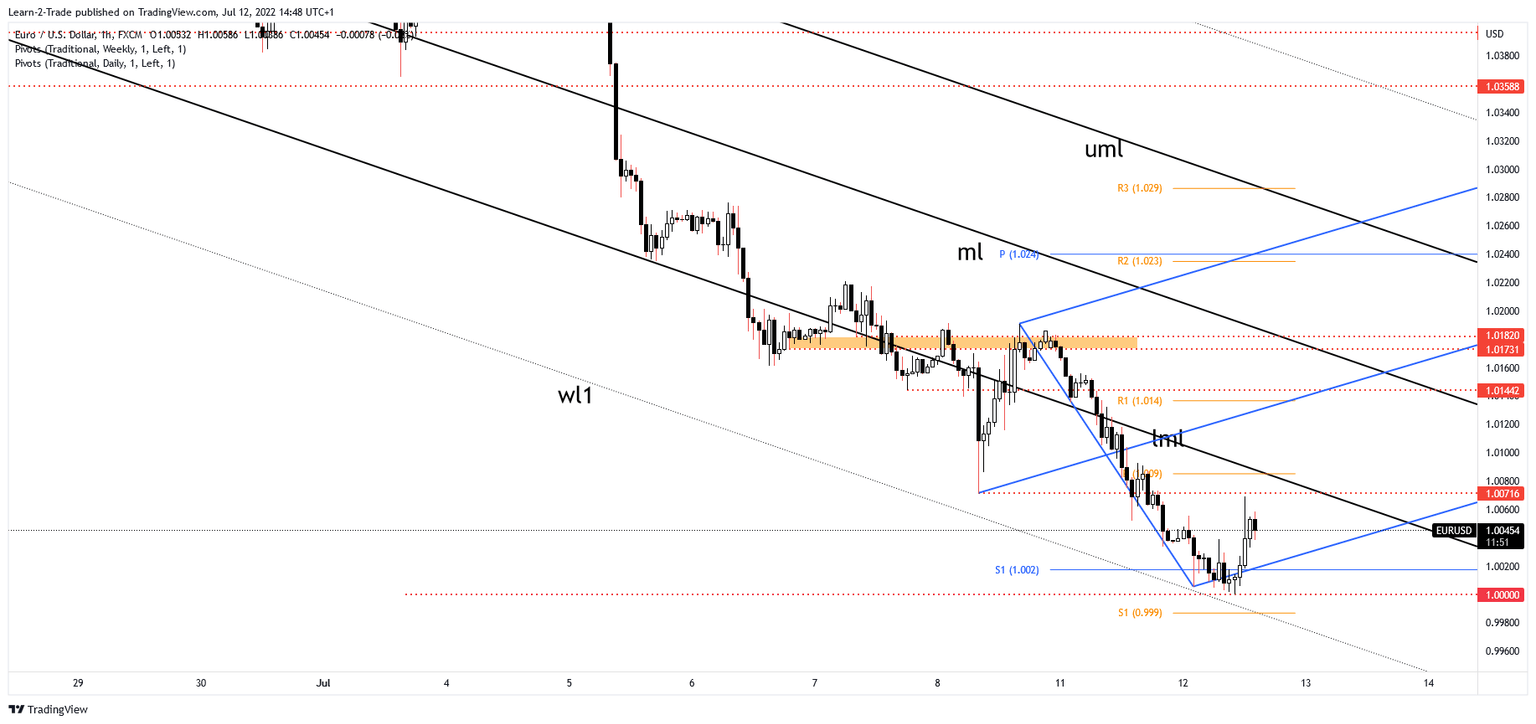

The EUR/USD pair plunged in the short term as the Dollar Index has managed to reach new highs. The price dropped below 1.0000 psychological level reaching 0.99999 today. Now, it is trading higher at 1.0038. After reaching parity, the currency pair rallied. The 1.0000 was seen as a key downside obstacle. Fundamentally, the Euro-zone ZEW Economic Sentiment came in at -51.1 points below -39.0 expected, while the German ZEW Economic Sentiment was reported at -53.8 versus -40.6 points estimated. Tomorrow, the US is to release its inflation figures. The CPI and the Core CPI could bring high volatility and sharp movements.

As you can see on the H1 chart, the EUR/USD pair reached the 1.0000 level where it has found support. Its failure to stay below the weekly S1 (1.0020) downside obstacle signaled that the sellers are exhausted. Now, it seems determined to come back higher at least towards the 1.0071 key upside obstacle. The descending pitchfork’s lower median line (lml) represents a dynamic resistance. As long as it stays under this line, the bias remains bearish and the EUR/USD pair could drop deeper anytime. Technically, the current rebound could bring new selling opportunities from around the near-term resistance levels.

Join Learn 2 Trade VIP Group now!

Join Learn 2 Trade VIP Group now!

Author

Olimpiu Tuns

Learn 2 Trade

Olimpiu is a seasoned Market Analyst / Trader with 11 years of experience in the financial markets having expertise in Forex, Commodities, Index, Cryptocurrencies, and Stocks.