EUR/USD Price Forecast: Weak US Dollar demand maintains the pair afloat

EUR/USD Current price: 1.1707

- United States and Canadian markets are closed on Monday due to Labor Day.

- Market concerns revolve around US President Donald Trump’s tariffs.

- EUR/USD retreats from intraday highs, holds above the 1.1700 mark.

The US Dollar (USD) is weak at the beginning of September, trading with a soft tone against all its major rivals. The EUR/USD pair peaked at 1.1736 during European trading hours, easing modestly yet holding above the 1.1700 threshold. Market action is limited amid a holiday in the United States (US) as the country celebrates Labor Day. Canadian markets will also be closed, anticipating little action until the Asian opening.

Financial markets revolve around US President Donald Trump’s tariffs. On the one hand, Fitch Ratings slashed its GDP growth forecast for 2025 and 2026 to just 2.2%, down from 2.9% in 2024 amid surging tariffs. The private company estimated that effective rates, particularly against China and the European Union, are now between 15% and 20%, much higher than the roughly 2.5% from 2024. Preliminary estimates from Oxford Economics indicate a global GDP loss of around $1 trillion over the next two years.

On the other hand, a US court ruled that most tariffs issued by Trump are illegal on Friday. The ruling affects the so-called “reciprocal" tariffs, but will not take effect until October 14, to give the White House time to ask the US Supreme Court to take up the case.

Meanwhile, Trump shared on Truth Social: “More than 15 Trillion Dollars will be invested in the USA, a RECORD. Much of this investment is because of Tariffs. If a Radical Left Court is allowed to terminate these Tariffs, almost all of this investment, and much more, will be immediately cancelled! In many ways, we would become a Third World Nation, with no hope of GREATNESS again. TIME IS OF THE ESSENCE!!! President DJT”

The macroeconomic calendar has nothing relevant to offer at the beginning of the week. The EU published the July Unemployment Rate, which contracted to 6.2% in July from the 6.3% posted in June. Later in the day, European Central Bank (ECB) President Christine Lagarde is due to offer a speech.

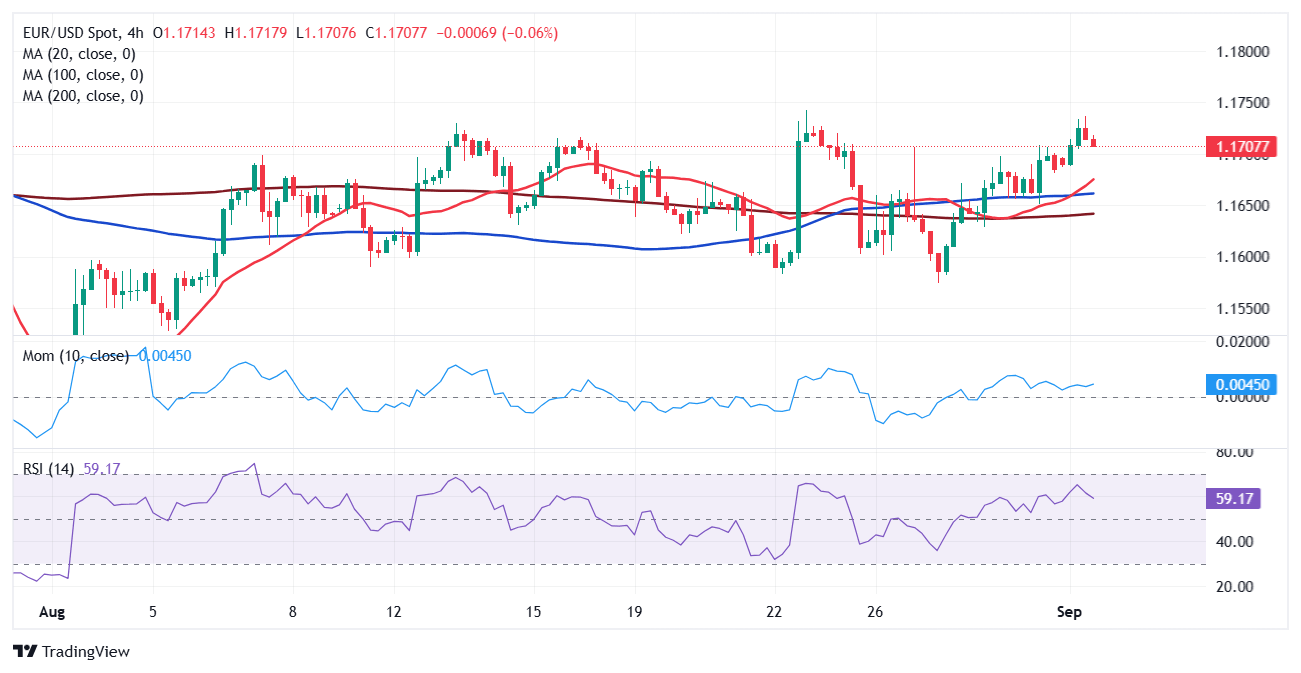

EUR/USD short-term technical outlook

The daily chart for the EUR/USD pair shows it holds on to gains while posting higher highs and higher lows, in line with persistent buying pressure. At the same time, the pair develops above all its moving averages, with a mildly bullish 20 Simple Moving Average (SMA) providing near-term support in the 1.1650 area. In the meantime, the Momentum indicator remains lifeless around its 100 line, while the Relative Strength Index (RSI) indicator aims higher at around 55, also indicating bulls' predominance.

In the near term, and according to the 4-hour chart, the 20 SMA picked up, crossing above a flat 100 SMA while also developing above an also directionless 200 SMA. Technical indicators remain well above their midlines, but are turning south amid the ongoing retracement. The pair could extend its intraday slide once below 1.1695, but would hardly reach the next support at 1.1650.

Support levels: 1.1695 1.1650 1.1610

Resistance levels: 1.1740 1.1785 1.1910

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.