EUR/USD Price Forecast: US Dollar surges on renewed Middle East fears

EUR/USD Current price: 1.1501

- US President Trump said he is not in the mood to negotiate, calls for a “real solution,” in the Middle East Conflict.

- The US Federal Reserve will announce its decision on monetary policy on Wednesday.

- EUR/USD pierces the 1.1500 mark, lower lows in sight in the near term.

The EUR/USD pair pierced the 1.1500 threshold in the mid-American afternoon, as comments from United States (US) President Donald Trump fueled risk aversion, triggering demand for safe-haven assets.

Trump posted on Truth Social that he was not in the mood to negotiate with Iran, adding he wants a “real” solution to the Middle East conflict between Iran and Israel. Even further, Trump claimed the US military has full control of the Iranian airspace, adding that US patience “is wearing thin.” As a result, the US Dollar (USD) surged against most of its major rivals.

Earlier in the day, the Euro (EUR) found near-term support on local data. Germany released the June ZEW, which showed Economic Sentiment improved to 47.5 from the previous 25.2, also better than the 35 expected. Economic Sentiment in the EU rose to 35.3 from the 11.6 posted in May. Finally, the assessment of the current situation index printed at -72, beating the expected -74 and improving from the previous -82.

Across the pond, the United States (US) released disappointing figures. May Retail Sales, which fell by 0.9% in the month, much worse than the previous -0.1% slide or the -0,7% expected. Additionally, Industrial Production in the same period was down by 0.2% against the 0.1% advance anticipated. Finally, Capacity Utilization stood at 77.4%, down from the 77.7% posted in April and missing the 77.7% expected.

Data triggered a short-lived USD downward spike, later overshadowed by resurgent risk aversion. As a result, EUR/USD fell below the 1.1500 mark, holding on to losses ahead of the Asian opening.

The focus will be on the Federal Reserve (Fed) monetary policy decision on Wednesday. The central bank is widely anticipated to keep rates on hold, while repeating uncertainty about tariffs is the main reason behind their decision. Also, officials will present a fresh Summary of Economic Projections (SEP), policymakers’ perspective on economic progress, inflation and employment. The document will likely shape investors’ sentiment, with the USD trading in consequence.

EUR/USD short-term technical outlook

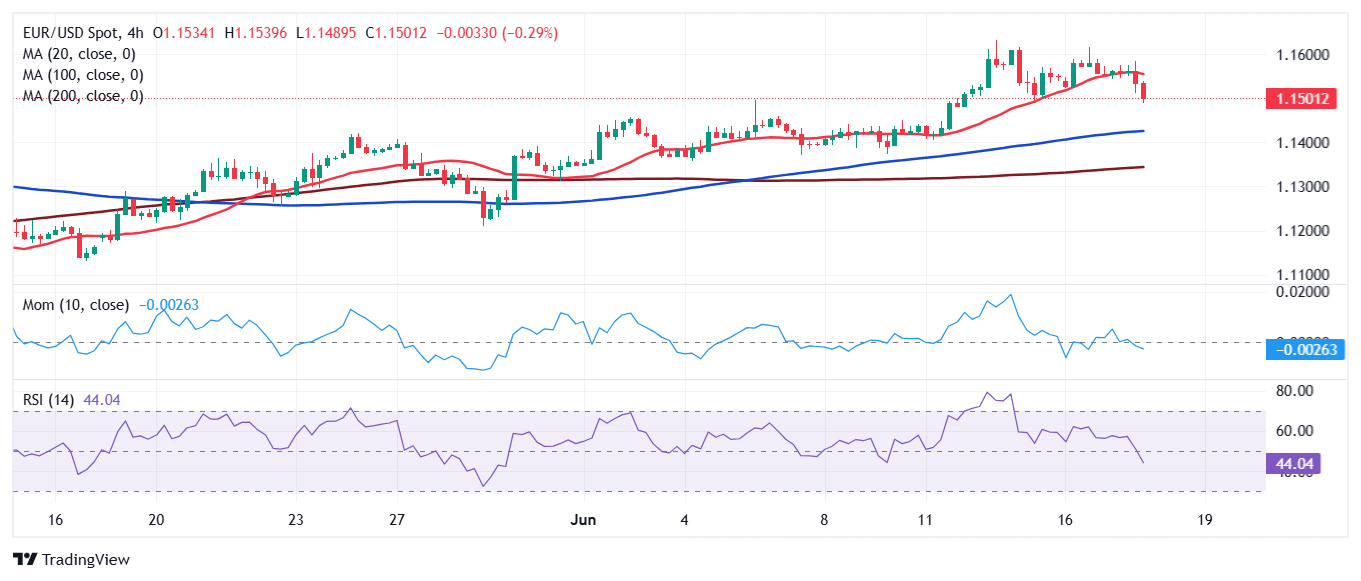

The EUR/USD pair trades roughly 100 pips below its Tuesday peak at 1.1581, and technical readings in the daily chart suggest it may extend its slide, although the bullish trend remains firm in the background. Technical indicators in the mentioned chart turned south, but remain above their midlines, limiting the odds for a steeper decline. At the same time, EUR/USD holds above all its moving averages, with the 20 Simple Moving Average (SMA) losing its upward strength but still heading north at around 1.1410. The 100 and 200 SMAs, in the meantime, remain far below the shorter one.

The near-term picture is bearish. The 4-hour chart shows the EUR/USD pair was unable to recover beyond a now bearish 20 SMA. Finally, the Momentum indicator heads nowhere below its 100 line, while the Relative Strength Index (RSI) indicator gains downward traction at around 43, anticipating lower lows ahead.

Support levels: 1.1485 1.1440 1.1410

Resistance levels: 1.1530 1.1580 1.1620

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.