EUR/USD Price Forecast: Transitory resistance emerges at 1.1600

- EUR/USD faced some tepid downside pressure following Friday’s bounce.

- The US Dollar regained some balance, leaving behind the recent sell-off.

- Market participants now look at trade developments as drivers of the sentiment.

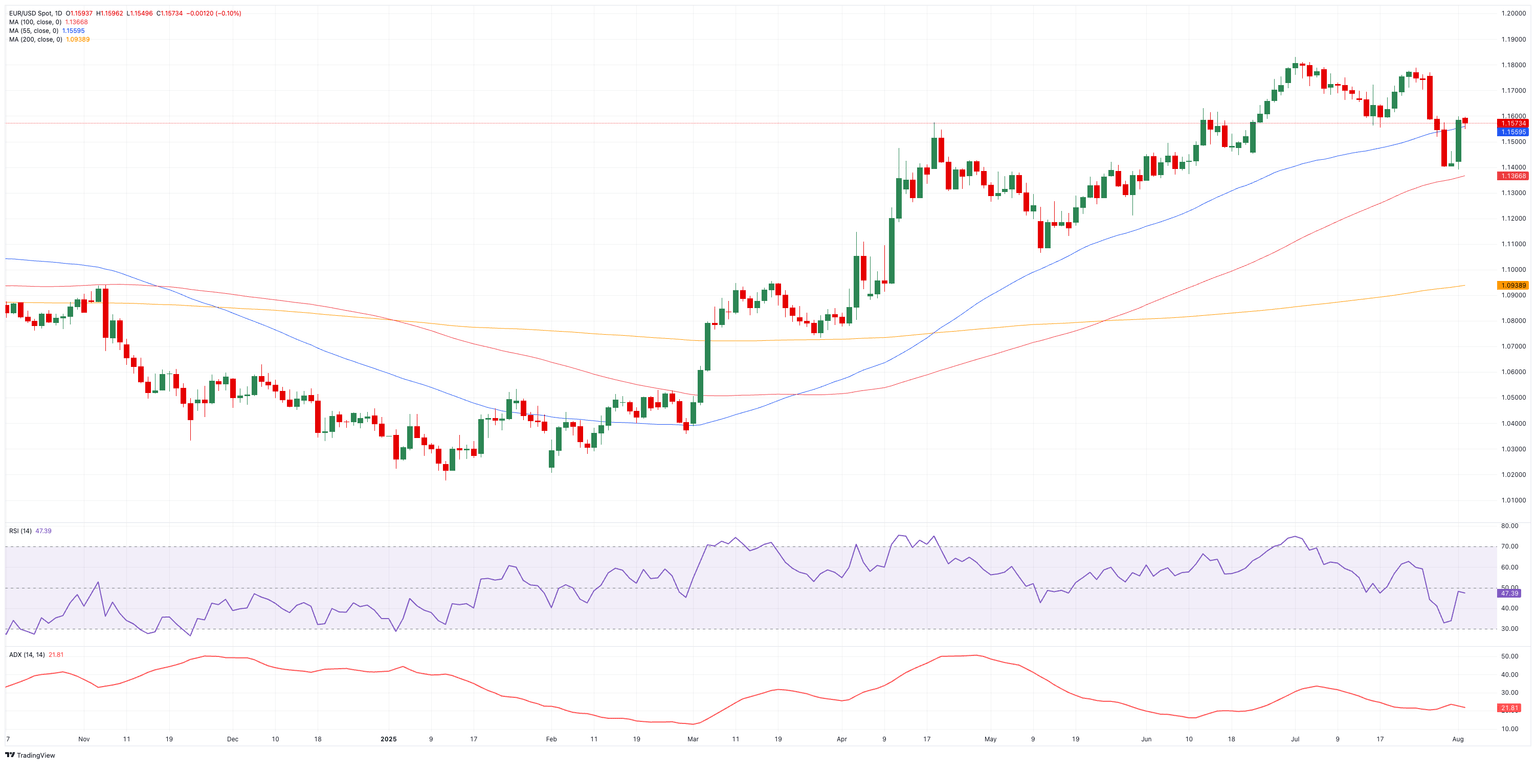

The Euro (EUR) declined modestly at the beginning of the week amid a lacklustre bounce in the US Dollar (USD). Indeed, EUR/USD’s rebound faltered just ahead of the 1.1600 barrier on Monday, reigniting some selling interest and slipping back to the mid-1.1500s, an area coincident with its temporary 55-day SMA.

Trade remains centre stage

In Washington, the new US–EU trade framework gave the Greenback fresh momentum in past days. Under the deal, most EU exports to the United States now face a 15% tariff—up from the 10% imposed in April but well below the 30% President Trump first threatened. The deal spared key industries like aerospace, semiconductors, chemicals, and certain agri-goods, while maintaining a 50% tax on steel and aluminium. In return, the EU has pledged to buy $750 billion of US energy, boost defence procurement from American firms and pour more than $600 billion into direct investment stateside.

However, not everyone in Europe is welcoming the accord. German Chancellor Friedrich Merz warned that higher US tariffs would further strain already fragile industrial output, and French President Emmanuel Macron labelled the agreement “a dark day” for the Continent—highlighting growing unease over the deal’s long-term costs.

Poor jobs report weighs on the Dollar, favours rate cuts

The latest economic data seem to have eroded the prior optimism around the US Dollar after Friday’s Nonfarm Payrolls figures showed the economy added 74K jobs in July amid a severe correction lower in the June data.

That said, investors rapidly forgot the previous auspicious prints from the ADP and the flash GDP numbers, which outpaced expectations in the second quarter, underlining at the same time the narrative of US resilience. Additional reports last week confirmed a slight uptick in the PCE inflation gauge for June.

Central banks hold steady

Central banks maintained a holding pattern in recent meetings. At the Federal Reserve (Fed), Jerome Powell’s hawkish tone clashed with dissenting votes from Governors Christopher Waller and Michelle Bowman, underscoring the uncertainty over when, not if, rate relief might arrive.

Across the Atlantic, European Central Bank (ECB) President Christine Lagarde struck a cautiously upbeat note, describing eurozone growth as “solid, if not a little better.” Markets have since pushed back rate-cut expectations from autumn to spring 2026.

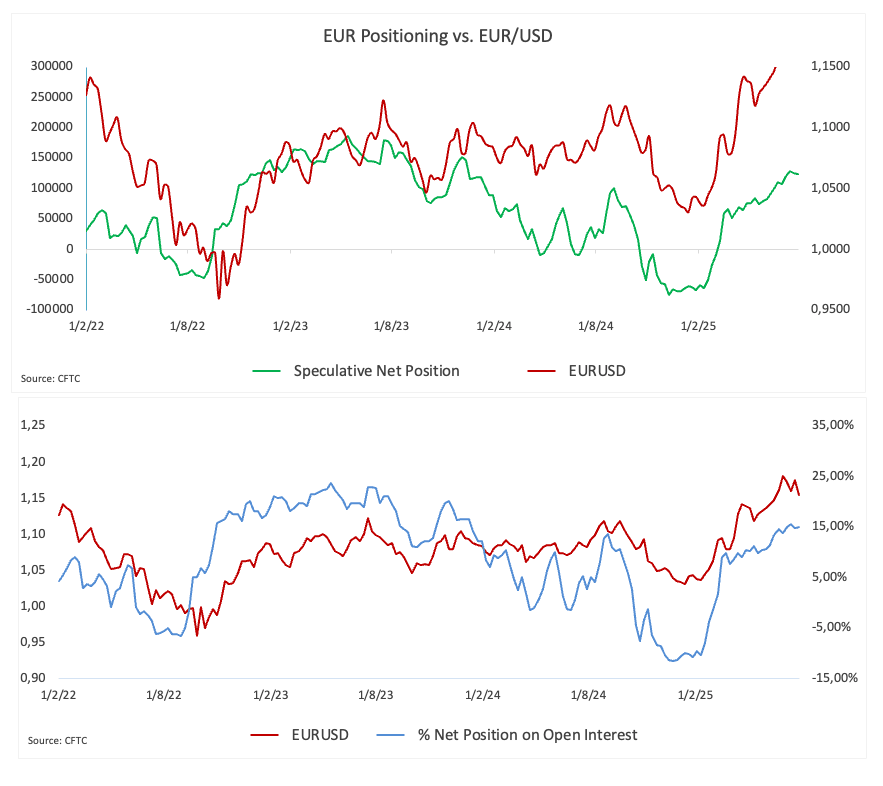

Bullish bets shrank further

Speculative positioning in the Euro (EUR) remained unchanged. CFTC data through July 29 saw net long bets drop to about 123.3K contracts—the lowest in three weeks—while net shorts held by institutional traders eased to roughly 175.8K contracts. Open interest declined after five consecutive weekly gains, this time to around 828.6K contracts.

Technical view

If bulls successfully regain control, EUR/USD may retest the weekly high of 1.1788 (July 24), the 2025 ceiling of 1.1830 (July 1), the September 2021 peak of 1.1909 (September 3), and ultimately the psychological 1.2000 barrier.

On the other hand, support begins at the August base of 1.1391 (August 1), then the intermediate 100-day SMA at 1.1369, and the weekly base of 1.1210 (May 29).

Momentum indicators are sending mixed signals: the Relative Strength Index (RSI) has eased below 48, hinting at still continued downside risk, even as the Average Directional Index (ADX) near 22 suggests the current trend needs to gain conviction.

Looking ahead

Unless the Fed delivers a distinctly dovish surprise or trade tensions ease significantly, EUR/USD will likely remain at the mercy of dollar dynamics—settling into a tentative grind rather than a clear directional break.

US-China Trade War FAQs

Generally speaking, a trade war is an economic conflict between two or more countries due to extreme protectionism on one end. It implies the creation of trade barriers, such as tariffs, which result in counter-barriers, escalating import costs, and hence the cost of living.

An economic conflict between the United States (US) and China began early in 2018, when President Donald Trump set trade barriers on China, claiming unfair commercial practices and intellectual property theft from the Asian giant. China took retaliatory action, imposing tariffs on multiple US goods, such as automobiles and soybeans. Tensions escalated until the two countries signed the US-China Phase One trade deal in January 2020. The agreement required structural reforms and other changes to China’s economic and trade regime and pretended to restore stability and trust between the two nations. However, the Coronavirus pandemic took the focus out of the conflict. Yet, it is worth mentioning that President Joe Biden, who took office after Trump, kept tariffs in place and even added some additional levies.

The return of Donald Trump to the White House as the 47th US President has sparked a fresh wave of tensions between the two countries. During the 2024 election campaign, Trump pledged to impose 60% tariffs on China once he returned to office, which he did on January 20, 2025. With Trump back, the US-China trade war is meant to resume where it was left, with tit-for-tat policies affecting the global economic landscape amid disruptions in global supply chains, resulting in a reduction in spending, particularly investment, and directly feeding into the Consumer Price Index inflation.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.