EUR/USD Price Forecast: Some consolidation seems likely

- EUR/USD regained upside traction and reclaimed the area above 1.1400.

- The US Dollar retreated markedly on the back of trade jitters and soft US data.

- A 25 basis points rate cut by the ECB on Thursday is fully priced in.

The Euro (EUR) regained impulse as the US Dollar (USD) met another wave of selling orders on Wednesday. That said, EUR/USD faded Tuesday’s retracement, breaking above 1.1400 the figure to flirt with recent weekly peaks, maintaining the weekly bullish stance well and soundly.

The other side of the equation saw the US Dollar Index (DXY) staging a deep sell-off, once again breaching below the key support at 99.00, all along a drop to multi-week troughs in US yields across various maturity periods.

Trade tensions flare up again

Fresh trade concerns resurfaced after President Trump announced plans to double tariffs on steel and aluminium imports — from 25% to 50% — reigniting fears of a broader global trade conflict. The move, framed as retaliation for China allegedly backtracking on a minerals deal, kept the sentiment around the dollar depressed.

These new tariffs are set to kick in on Wednesday, coinciding with a push from Washington for renewed proposals in trade talks. Markets were already jittery amid speculation of similar tariff hikes on European goods.

In addition to trade concerns, demoralising figures from the US ADP Employment Change (+37K) and the ISM Services PMI (49.9), both reported for May, contributed to investors' preference for selling the buck.

Policy divergence back in the spotlight

As usual, diverging central bank paths are playing a major role in the FX space.

The Federal Reserve (Fed) left rates unchanged in May despite a cooling inflation backdrop, with meeting Minutes revealing internal divisions over how best to balance the Fed’s twin mandates of employment and price stability. As a result, market participants now expect that the next rate cut may occur in September.

The European Central Bank (ECB), meanwhile, is expected to lower its deposit rate by 25 basis points to 2.00% on Thursday. If that scenario materialises, many investors might anticipate a pause by the central bank for the rest of the year, as officials may want to more precisely gauge the impact of US tariffs on both European and global economies.

Sentiment shifting in EUR favour

Positioning data from the latest CFTC report shows that speculators are becoming more optimistic about the single currency. Indeed, net longs rose to two-week peaks around 79.5K contracts, while commercial traders increased their hedging via net shorts. In addition, open interest climbed to nearly 760.5K contracts, the highest since December 2023.

Technical picture: Bulls still have the edge

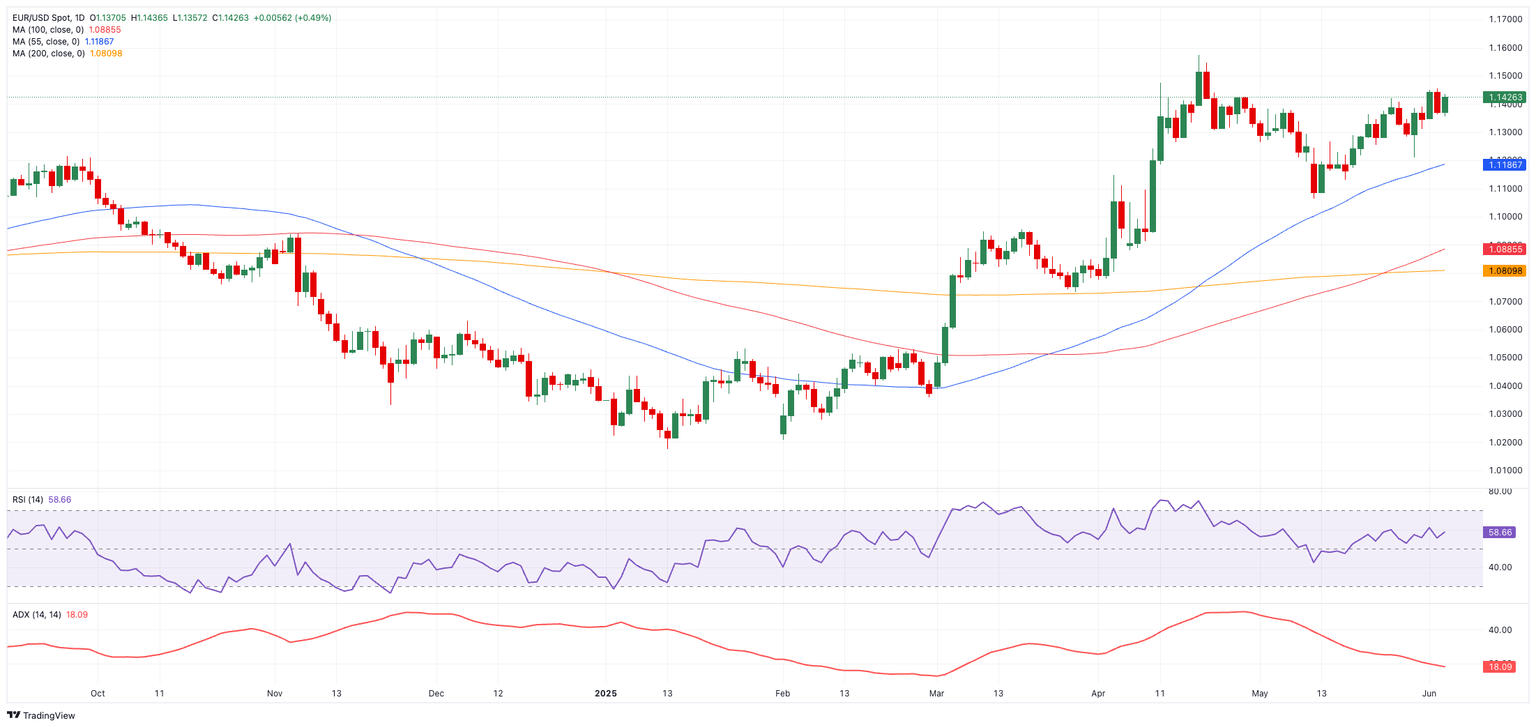

EUR/USD continues to hold comfortably above its 200-day simple moving average (SMA) at 1.0817, suggesting the broader uptrend remains intact.

Key resistance levels lie at the YTD high of 1.1572 (April 21), followed by the 1.1600 round level and the October 2021 peak at 1.1692 (October 28).

Support comes in at the temporary 55-day SMA at 1.1192, with further downside guarded by the May low at 1.1064 (May 12). A break below the key 1.1000 milestone would open the door to a potential test of the 200-day SMA.

Momentum signals remain mixed. The Average Directional Index (ADX) near 18 suggests waning trend strength, but the Relative Strength Index (RSI) near 59 still points to decent bullish momentum.

EUR/USD daily chart

Looking ahead

The docket on June 5 brings German Factory Orders and the HCOB Construction PMI, along with eurozone HCOB Construction PMI and Producer Prices. On 6 June, Germany’s Balance of Trade figures will be released, followed by eurozone Retail Sales, the Unemployment Rate, and the final Q1 GDP Growth Rate.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.