EUR/USD Price Forecast: Sellers pressuring the 1.0900 mark

EUR/USD Current price: 1.0909

- Chinese headlines lead the way throughout the first half of the day.

- Federal Reserve officials’ speeches stand out in the American session.

- EUR/USD’s sellers looking for fresh lows below the 1.0900 threshold.

The US Dollar started the week with a firm footing, maintaining its positive momentum against most major rivals. The EUR/USD pair eased towards the 1.0900 area during European trading hours, pressured ahead of the American opening.

The focus has been on China at the weekly opening, as the country’s Finance Minister Lan Fo’an offered a press conference over the weekend, promising more stimulus but falling short of providing details. Officials announced upcoming aid for the property sector and indebted local governments, while Lan Fo’an said that the central government has room for a deficit increase, but such policies are not yet under discussion. Furthermore, China released the September Trade Balance, which posted a surplus of $81.71 billion, missing expectations and easing from the previous $91.02 billion.

Data-wise, the macroeconomic calendar had nothing to offer on Monday. During United States (US) trading hours, the focus will be on some Federal Reserve (Fed) officials, offering different speeches that may or may not provide clues on where the central bank is heading next.

EUR/USD short-term technical outlook

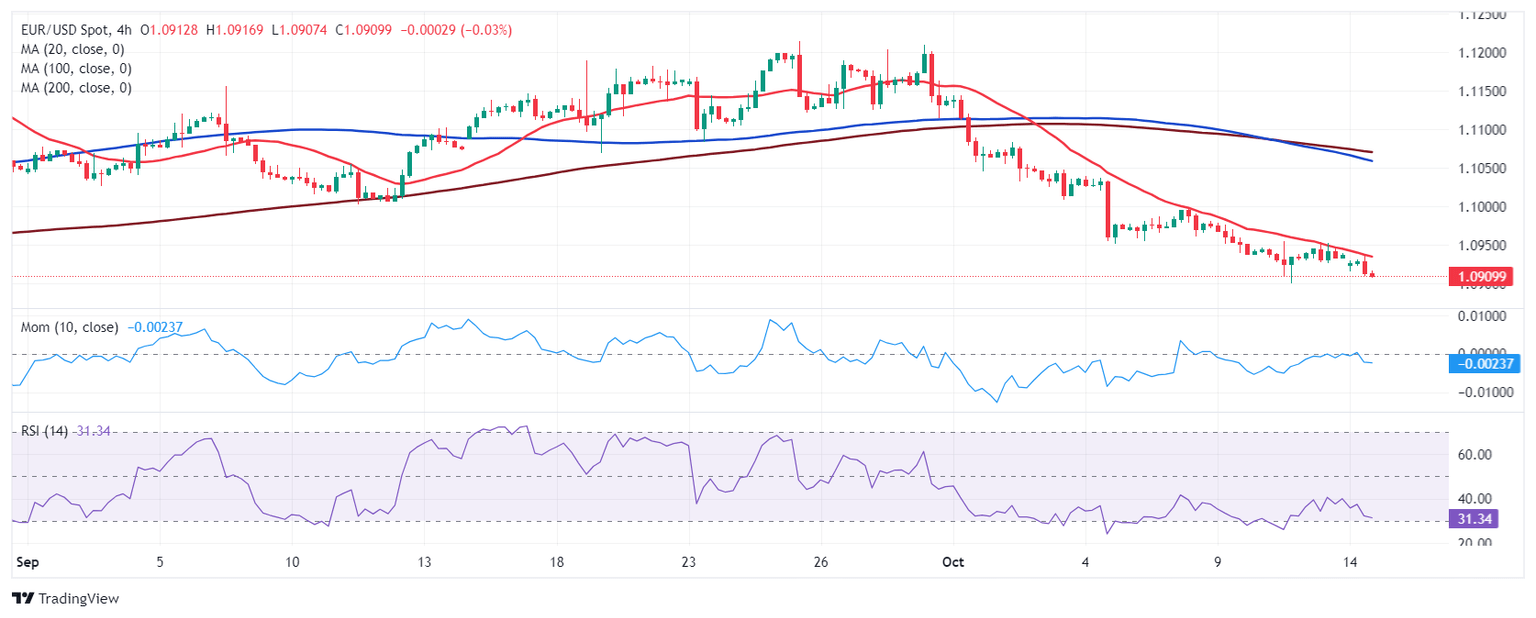

From a technical point of view, the EUR/USD pair is set to keep falling. In the daily chart, the pair has posted a lower low and a lower high while meeting sellers around a flat 100 Simple Moving Average (SMA), currently at around 1.0935. The 20 SMA, in the meantime, accelerated south far above the longer one, reflecting persistent selling interest. Finally, technical indicators resumed their declines within negative levels, approaching oversold readings yet without signs of downward exhaustion.

The bearish case is also strong in the near term. The 4-hour chart shows a bearish 20 SMA leads the way south by providing continued intraday resistance. At the same time, the 100 SMA is crossing below the 200 SMA, over 100 pips above the current level, reaffirming sellers’ dominance. Finally, technical indicators turned south after a period of consolidation within negative levels, supporting a downward continuation on a break below 1.0890, the immediate support level.

Support levels: 1.0890 1.0850 1.0810

Resistance levels: 1.0935 1.0970 1.1010

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.