EUR/USD Price Forecast: Potential consolidation pre-Fed

- EUR/USD resumed its uptrend and came close to yearly peaks past 1.1600.

- The US Dollar faced renewed downside pressure, revisiting the area of recent lows.

- The ECB’s Nagel said inflation in the region is now “on target”.

The Euro (EUR) started the week on a positive foot against the US Dollar (USD), resuming its ongoing multi-week gradual ascent.

That said, EUR/USD rose past 1.1600 the figure once again, although the move lacked follow-through and eventually sent spot back to the 1.1580 zone following a late recovery attempt in the Greenback.

From the money markets, yields on both sides of the Atlantic added to Friday’s bounce and accompanied the uptick in the pair

Geopolitical tensions offset trade discussions

Investors appear to have taken a break from closely monitoring trade developments, especially the headlines surrounding the US-China trade spat, focusing instead on the resurgence of Israel-Iran tensions last Friday and over the weekend.

It is worth mentioning that the most recent round of negotiations between Beijing and Washington, which resumed in London last Monday, yielded a trade agreement between both countries. The deal said that China would provide rare earths and magnets, while the White House announced a new tariff structure that includes a 25% surcharge to remove current barriers, a 20% levy to combat fentanyl trafficking, and a 10% "reciprocal" duty. China would then tax some US imports by 10%.

Fuelling FX flows with policy path split

Central bank policy paths have been guiding currency flows in addition to trade developments.

The Federal Reserve (Fed) is broadly expected to maintain its Fed Funds Target Range (FFTR) unchanged at the end of its two-day meeting on Wednesday. Investors should concentrate on the revised "dots plot" and the comments made by Chair Jerome Powell during his usual post-meeting press conference, in addition to the decision.

So far, investors now see the Fed reducing its rates two or even three times in the second half of the year, a view that was reinforced following disheartening results from key fundamentals and further cooling of inflationary pressure and the labour market.

On the other hand, the European Central Bank (ECB) lowered its Deposit Facility Rate to 2.00% earlier in June, matching the wide consensus. However, President Christine Lagarde adopted a cautiously hawkish stance, ruling out further easing unless trade conditions drastically worsen and upgrading growth forecasts.

Speculative bets lean Euroward

According to CFTC data as of June 10, open interest in EUR rose to nearly 810K contracts, the highest level in several years, and net long positions increased to over 93K contracts, the highest since early September 2024. Commercial hedgers increased their short exposure to about 151.3K contracts, indicating institutional demand for euro downside protection.

Technical Prospects

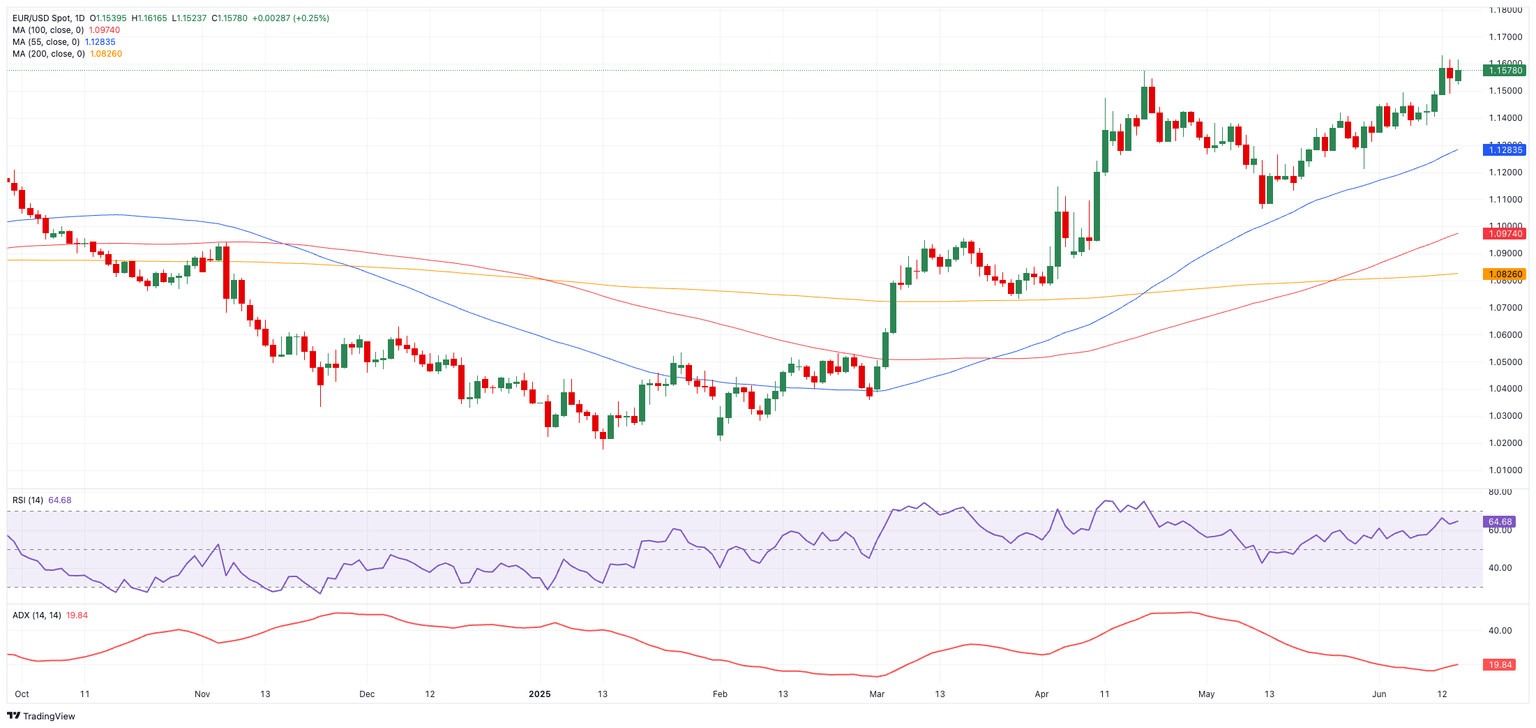

EUR/USD faces immediate resistance at its 2025 peak of 1.1631 (June 12), prior to the October 2021 high of 1.1692, and the round level at 1.1700.

Alternatively, there is interim contention at the 55-day SMA at 1.1291, seconded by the weekly low of 1.1210 (May 29) and the May floor at 1.1064 (May 12).

A mixed picture is painted by momentum indicators: the Relative Strength Index (RSI) around 65 indicates ongoing upward bias, while the Average Directional Index (ADX), beyond 20, indicates increasing trend strength.

EUR/USD daily chart

Next on tap in the bloc

On June 17, the ZEW Institute will issue its Economic Sentiment indicator for Germany and the Euroland. On June 18, the EMU's final Inflation Rate, as well as the Current Account data, will be the focus. The Construction Output in the wide bloc is expected on June 19, as well as the Eurogroup Meetings. Germany will publish its Producer Prices on June 20, and the European Commission (RC) will publish its preliminary Consumer Confidence report ahead of the ECOFIN meeting.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.