EUR/USD Price Forecast: Initial resistance sits around 1.1380

- EUR/USD added to Monday’s uptick well north of 1.1200 the figure.

- The US Dollar remained on the defensive, extending its leg lower.

- Flash Consumer Confidence in the euro area is seen improving in May.

The euro gained further ground on Tuesday, with EUR/USD rising once again to the area of two-week tops around 1.1280, always on the back of extra weakness hurting the US Dollar (USD).

On the latter, Federal Reserve’s (Fed) concerns over the US economic activity kept the Greenback under pressure and sent the US Dollar Index (DXY) back to the boundaries of the critical 100.00 support. Adding to the Dollar’s poor performance also emerged persistent uncertainty on the trade front.

Trade optimism offers uneven support

EUR/USD has shown signs of stabilisation in recent sessions following a volatile rebound in the dollar. Markets welcomed a tentative trade agreement between the US and China announced on May 10, which included a rollback of tariffs from over 100% to 10% and a 90-day pause on new hikes. However, a 20% tariff on fentanyl-related imports remains, leaving the effective burden close to 30%.

Despite upbeat rhetoric from President Trump and recent deals with the UK, the lack of concrete implementation plans has undermined the Dollar’s rebound, which in turn morphed into fresh legs for the European currency and its risk-related peers.

Fed–ECB divergence still in focus

Monetary policy divergence between the Federal Reserve and the European Central Bank (ECB) continues to influence EUR/USD dynamics.

The Fed has held rates steady and remains cautious on rate cuts, while the ECB lowered its deposit rate by 25 basis points to 2.25% last month and could ease again as early as June.

Markets are still pricing in two rate cuts from the Fed by year-end, driven by subdued April inflation and receding trade-related risks.

Back at the ECB, officials are treading carefully on the rate-cut front. Isabel Schnabel said the bank is still on track to bring inflation back to 2%, but flagged risks like a possible trade war that could drive prices up again, so she’s not in favour of easing policy just yet. Meanwhile, Klaas Knot said it’s too soon to decide on a June cut, pointing to the need for more clarity on how US and EU trade policies are feeding into inflation.

Speculators remain long Euro

Speculative interest in the euro remains robust. CFTC data for the week ending May 13 showed net long EUR positions rising to nearly 84.7K contracts, with total open interest climbing above 750K contracts for the first time since December 2023. Meanwhile, commercial players (hedge funds) remained net short, highlighting persistent prudence.

Technical picture

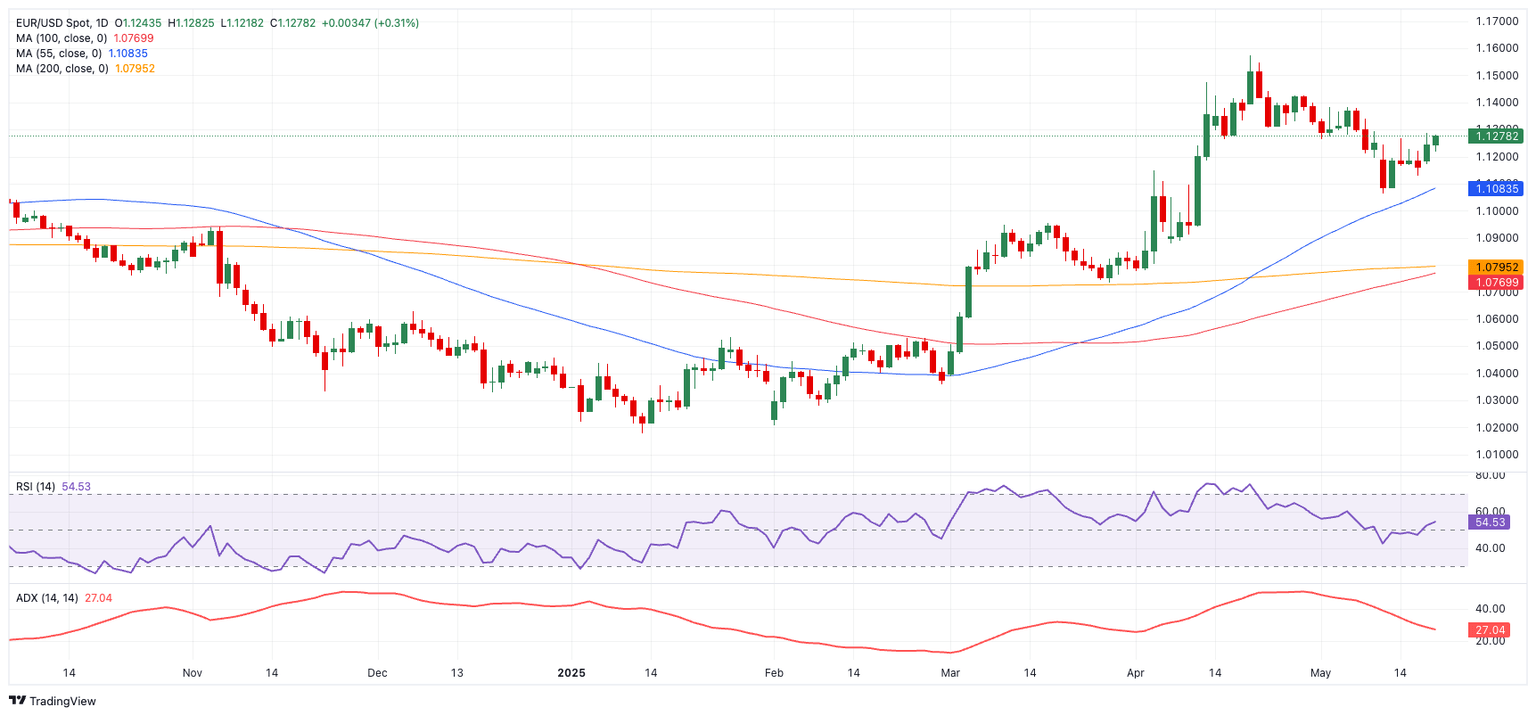

EUR/USD faces meaningful resistance at the 2025 peak of 1.1572 (April 21), ahead of the round level at 1.1600, and the October 2021 high at 1.1692 (October 28).

On the downside, initial support stands at the May 12 low of 1.1064 (May 12), ahead of the psychological 1.1000 threshold, and the always relevant 200-day simple moving average (SMA) at 1.0801.

Momentum signals are mixed. The Relative Strength Index (RSI) has edged above 54, suggesting a rising bullish mood, while the Average Directional Index (ADX) at 27 indicative of a trend that remains in place but is losing strength.

EUR/USD daily chart

Short-term outlook

EUR/USD is likely to remain volatile in the near term, caught between conflicting central bank signals, shifting speculative flows, and ongoing trade uncertainty. While positioning supports further Euro strength, the absence of clarity on policy and geopolitics could keep gains in check.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.