EUR/USD Price Forecast: Further weakness could revisit 1.0990

EUR/USD lost the grip and receded to multi-week lows near 1.1220.

The US Dollar picked up intense upside momentum on trade optimism.

Markets attention now shift to a slew of Fed speakers on Friday.

The Euro (EUR) added its recent decline on Thursday, with EUR/USD slipping back toward the 1.1220 zone as the US Dollar (USD) regained solid momentum following a hawkish tilt from the Federal Reserve (Fed) and rising expectations around US-China trade progress, particularly following President Trump’s announcement of a US-UK trade agreement earlier in the day.

Indeed, the US Dollar Index (DXY) strengthened across the board and largely surpassed the psychological 100.00 barrier as market participants continued to adjust to the latest Fed event, while increasing optimism on the trade front also contributed to the firm rebound in the Greenback.

Cautious optimism on trade

Market sentiment improved modestly on Thursday following confirmation that US and Chinese officials will meet in Switzerland over the weekend for high-level trade discussions.

The tone was further buoyed by the announcement of a US-UK trade agreement and upbeat rhetoric from President Donald Trump, who signalled openness to additional deals. The developments helped restore some investor confidence after months of tariff-related uncertainty.

Central bank divergence widens

Monetary policy paths between the Fed and the European Central Bank (ECB) are diverging. While the Fed maintained its benchmark rate this week, the ECB moved in the opposite direction with a 25 basis point cut last month, bringing its policy rate to 2.25%. A follow-up cut as early as June is now being priced in, raising doubts about the euro’s staying power if US policy remains comparatively tighter.

Speculators still backing the Euro

Despite the ECB’s dovish turn, positioning remains euro-positive. CFTC data as of April 29 showed net long positions on the euro rising to 75.8K contracts—a multi-month high—while open interest surged past 730K, levels last seen in September 2024. However, commercial hedgers remained net short, underlining corporate caution.

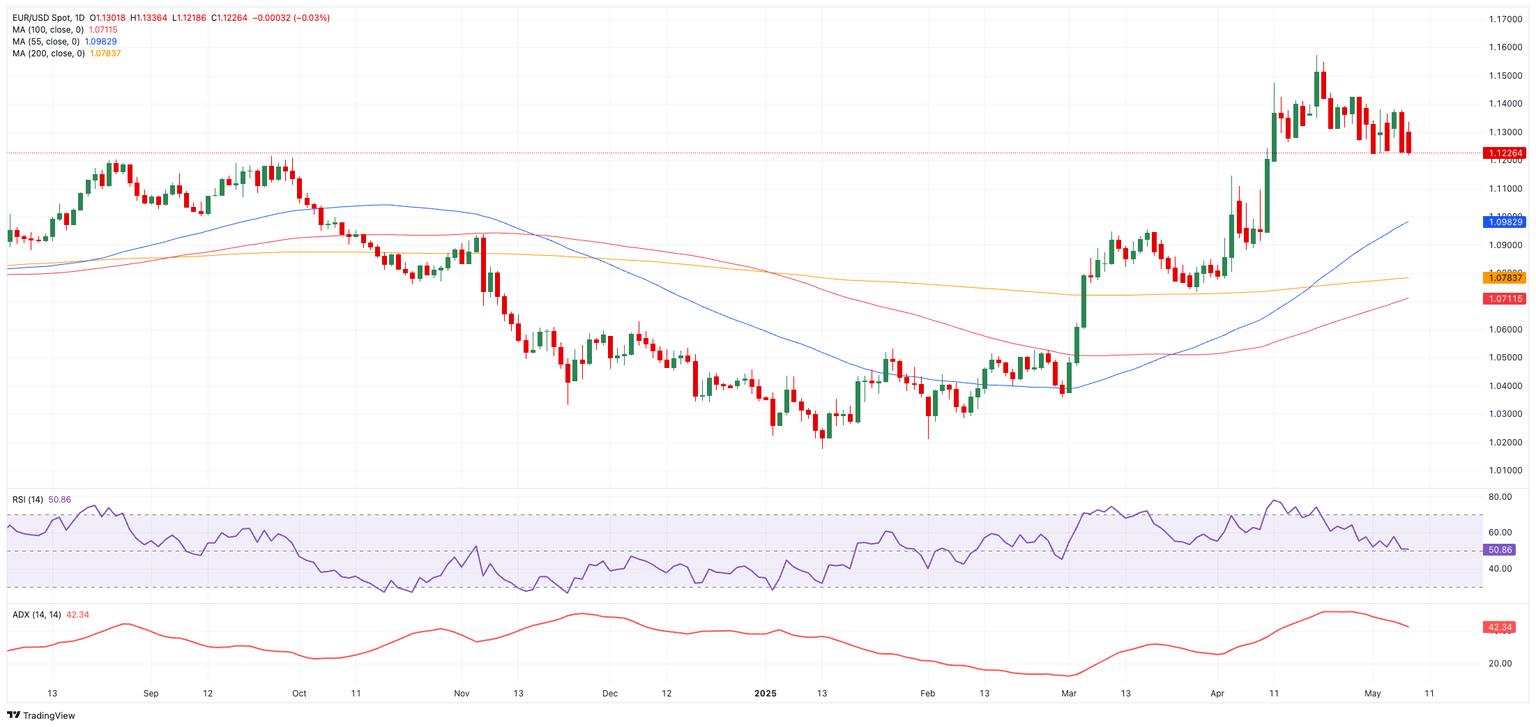

Technical outlook: Strong resistance in play

EUR/USD remains capped below its 2025 high at 1.1572 (April 21), with the psychological 1.1600 level and the October 2021 peak at 1.1692 serving as the next resistance targets.

On the downside, transitory support sits at the 55-day SMA at 1.0990, seconded by the 200-day SMA at 1.0789 and the weekly trough at 1.0732 (March 27).

Momentum indicators seem to suggest some potential correction. The Relative Strength Index (RSI) eases to the 50 threshold, while the Average Directional Index (ADX) at 43 signals strong trend continuation.

EUR/USD daily chart

Outlook: Crosscurrents ahead

The euro remains caught between conflicting forces—dovish ECB policy on one side, supportive political sentiment and speculative positioning on the other. With central bank divergence sharpening and global trade rhetoric re-emerging, EUR/USD is likely to stay headline-sensitive and volatile in the near term.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.