EUR/USD Price Forecast: Decent support sits around 1.1400

- EUR/USD regained some composure and rebounded modestly.

- The US Dollar extended its upside momentum to new two-month highs.

- Investors’ attention now shifts to the release of the US Nonfarm Payrolls.

The Euro managed to trigger a humble rebound on Thursday, partially recouping ground lost vs. the US Dollar (USD) in the past few sessions.

That said, EUR/USD briefly tested the 1.1400 neighbourhood, just to regain traction afterwards and attempt a move to the 1.1460 zone, always against the backdrop of the still unabated march north in the Greenback.

US Dollar buoyed by tariffs and growth

The newly unveiled US–EU trade framework gave the US Dollar a fresh jolt. The agreement imposes a 15% tariff on most EU exports to the US—higher than the 10% rate in place since April, but far less severe than the 30% initially threatened. Sensitive sectors such as aerospace, semiconductors, chemicals, and selected agricultural products were spared, while steel and aluminium remain subject to 50% levies.

In return, the EU committed to purchasing $750 billion of US energy, ramping up defence procurement from American firms, and pledging over $600 billion in direct investment in the US economy.

Reinforcing USD optimism, ADP payrolls surprised the upside with a 104K gain, while flash GDP pointed to 3.0% annualised growth in Q2—outpacing forecasts and reinforcing the narrative of US economic resilience. In the meantime, the latest US data showed a firm labour market, while inflation tracked by the PCE ticked higher in June.

But Europe pushes back

Not everyone on the Continent is cheering the latest trade accord: German Chancellor Friedrich Merz warned the tariff hike would weigh on already fragile industrial output, while French President Emmanuel Macron slammed the pact as “a dark day” for Europe—underscoring growing unease about the long-term costs of the deal.

Central banks hold the line

Both the Fed and ECB kept rates steady this week.

At the Fed, the hawkish tone from Chair Jerome Powell collided with dissents from Governors Christopher Waller and Michelle Bowman, all adding to the steady uncertainty over the future path of US rates. In addition, Powell gave little away, signalling no rush to ease amid persistent inflation risks.

Across the Atlantic, ECB President Christine Lagarde struck a more optimistic tone, describing eurozone growth as “solid, if not a little bit better.” Markets have since rolled back expectations for a rate cut this autumn, pushing bets out to spring 2026.

Speculative positions shift

CFTC data through July 22 showed a notable unwind in speculative EUR positions. Speculative net longs were trimmed to around 125.5K contracts—the lowest in two weeks—while institutional net shorts fell to roughly 177.7K. Furthermore, open interest rose for a fifth straight week, nearing 843.5K contracts, pointing to sustained market engagement.

Charts to watch

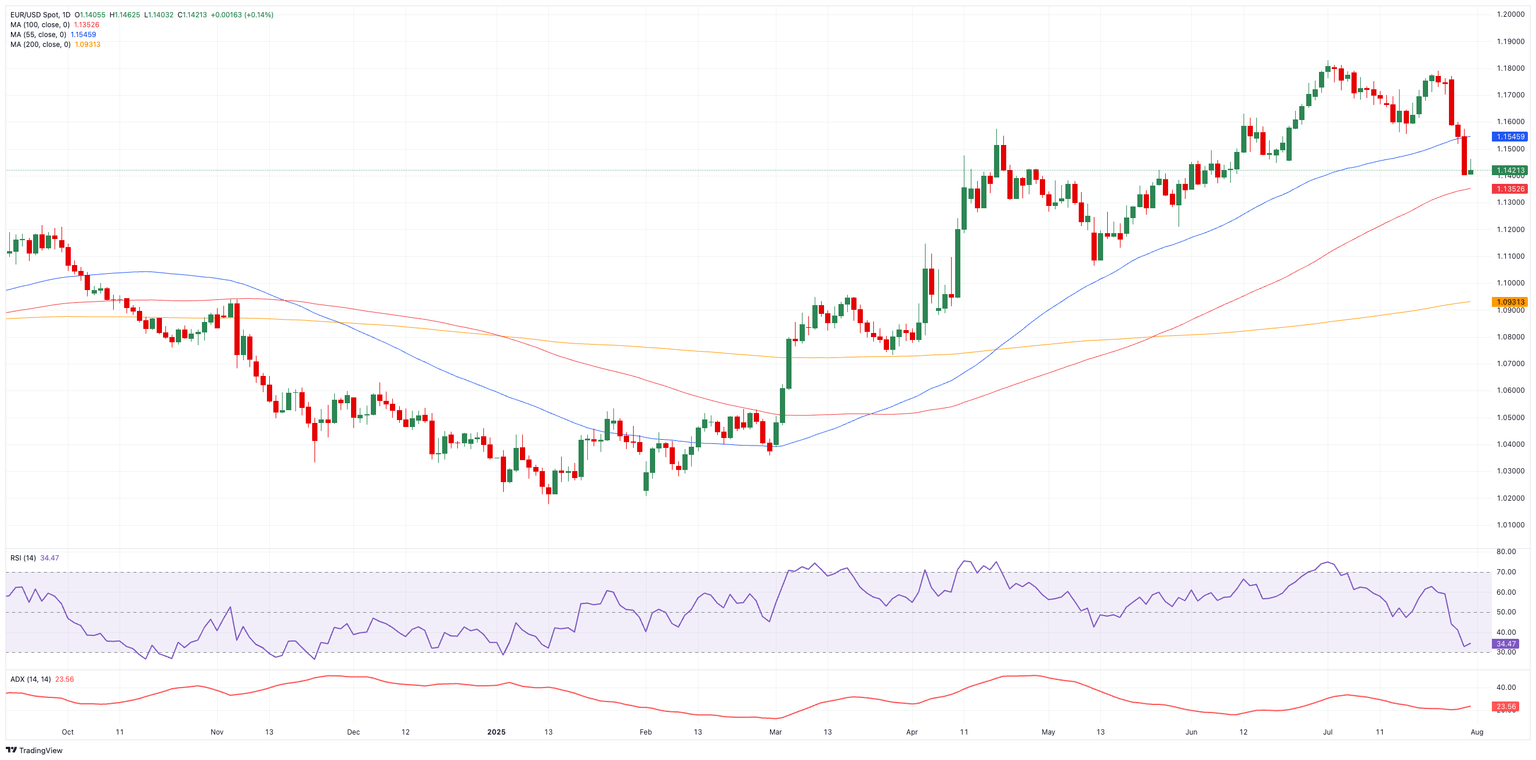

For bulls to regain control, EUR/USD would need to retake the 2025 high of 1.1830 (July 1) and then challenge the September 2021 peak at 1.1909, with the psychological 1.2000 mark looming beyond.

On the other hand, initial support sits at the July low of 1.1401 (July 31), then the provisional 100-day SMA at 1.1355, and the weekly base of 1.1210 (May 29).

The momentum indicators are displaying conflicting signals: the Relative Strength Index (RSI) has risen above 34, indicating potential further decline, while an Average Directional Index (ADX) reading close to 24 indicates the current trend is gaining momentum.

EURUSD daily chart

Outlook: more drift than direction

Unless the Fed signals a clear dovish pivot or trade tensions de-escalate meaningfully, EUR/USD is expected to remain at the mercy of US Dollar dynamic. For now, the path of least resistance continues to favour the Greenback.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.