EUR/USD Price Forecast: Decent contention is seen around 1.0950

- EUR/USD finally saw some respite to its strong selling pressure.

- The US Dollar remained mostly sidelined near recent tops on Monday.

- Germany’s Factory Orders contracted more than expected in August.

EUR/USD reversed its multi-day leg lower on Monday, managing to bounce off recent multi-week lows near 1.0950 on an inconclusive start to the week around the US Dollar (USD).

The Greenback, in the meantime, failed to extend its ongoing rally further north of the 102.70 region, despite US yields adding to the ongoing strong rebound and geopolitical concerns in the Middle East escalating further.

In the meantime, it is worth noting that the recent risk-off environment overshadowed investors’ optimism regarding China's recent stimulus measures aimed at boosting its post-pandemic economy.

On the monetary policy front, expectations for further easing by the Federal Reserve (Fed) in the coming months remained in place, although the likelihood of another jumbo rate cut kept shrinking, particularly in response to the stronger-than-expected US jobs report in September.

Recently, Fed Chair Jerome Powell emphasized a data-dependent approach, suggesting that the pace of future rate reductions may slow. However, markets are pricing in the possibility that the Fed will trim its interest rates by 25 bps at its November and December gatherings.

Still around the Fed, Minneapolis Fed President Neel Kashkari highlighted in an event on Monday the resilience of the US economy at the time when he ruled out signs of resurgent inflation.

Across the Atlantic, the European Central Bank (ECB) adopted a more cautious stance at its recent meeting amid inflation and economic pressures. ECB President Christine Lagarde highlighted that while domestic inflation remains elevated, restrictive monetary policies are beginning to ease, which could support economic growth. The ECB projects that inflation will reach its 2% target by 2025.

Last week’s comments from ECB Vice President Luis de Guindos suggested that Eurozone growth may be weaker than previously forecast in the short term. However, he expressed optimism about a recovery driven by rising real incomes and the easing of restrictive policies.

Additionally, French Central Bank Chief François Villeroy de Galhau told an Italian newspaper that weak economic growth could increase the risk of inflation falling below the bank’s 2% goal, indicating that interest rate adjustments might be necessary. He reportedly predicted further changes to the deposit rate in the coming year and mentioned that the ECB plans to return to the "neutral" rate at some point by 2025.

Recent data showed that Eurozone inflation, as measured by the Harmonized Index of Consumer Prices (HICP), dropped below the bank’s target in September, hitting 1.8% over the last twelve months. These figures suggest that the ECB may consider reducing further its interest rate rather than pausing its easing process.

Looking ahead, additional rate cuts by the Fed could reduce the policy gap between the Fed and the ECB, which might lend support to EUR/USD. The market anticipates two more rate cuts from the ECB and around 50 basis points of easing from the Fed before the year ends. However, the comparatively stronger performance of the US economy may limit any significant weakening of the Dollar.

On the euro calendar, Germany’s Factory Orders shrank by 5.8% in August vs. the previous month, adding to persistent concerns surrounding the economic outlook of the largest economy of the bloc.

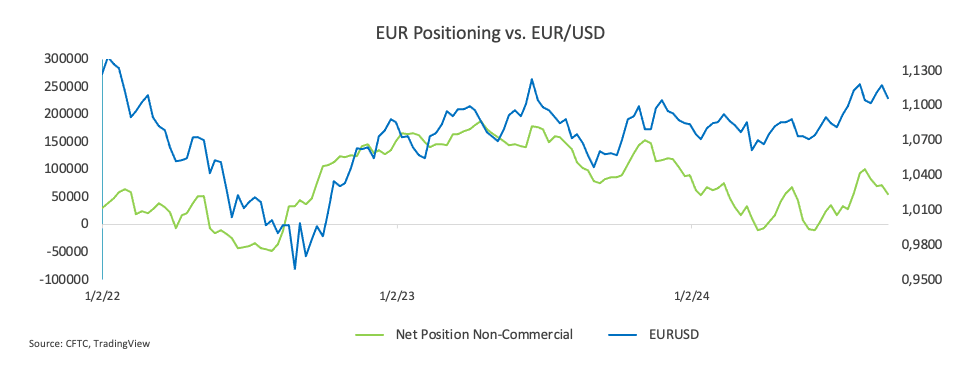

On another front, Non-Commercial traders (speculators) reduced their net long positions in the Euro to their lowest level since late August, while Commercial players lowered their net short positions to a six-week low amid a modest decline in open interest.

EUR/USD daily chart

EUR/USD short-term technical outlook

Further drops may encourage EUR/USD to challenge the October low of 1.0950 (October 4) ahead of the weekly low of 1.0881 (August 8).

On the upside, the initial resistance level is the 2024 top of 1.1214 (September 25), followed by the 2023 peak of 1.1275 (July 18) and the 1.1300 round level.

Meanwhile, the pair's upward trend is projected to continue as long as it remains above the crucial 200-day SMA at 1.0873.

The four-hour chart demonstrates a worsening of the negative trend. The initial resistance level is 1.1082 ahead of the 200-SMA of 1.1099, followed by 1.1143 and 1.1214. On the other hand, the initial support level is 1.0950, followed by 1.0913 and finally 1.0881. The relative strength index (RSI) decreased to about 31.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.