EUR/USD Price Forecast: Calm before the next storm

EUR/USD Current price: 1.0947

- A better mood sees global stocks trimming part of their recent massive losses.

- The Eurozone is considering tariffs on US imports up to 25% on different goods

- EUR/USD consolidates around 1.0950 as markets finish digesting tariffs’ shock

The EUR/USD pair trades around 1.0950 early in the American session on Tuesday, stabilizing after a few days of intense turmoil. The US Dollar (USD) is under mild selling pressure as the mood improved: global indexes trade in the green, recovering part of the massive losses posted after United States (US) President Donald Trump announced reciprocal tariffs on Wednesday. As time goes by, hopes that some deals could reduce the impact of levies increased.

Nevertheless, the trade war remains the main market topic, with speculative interest paying little attention to macroeconomic data, while maintaining the focus on the potential effects of US protectionism on worldwide economic progress and inflation.

And indeed, the trade war is far from over. Tensions remain high between Washington and Beijing, as the Chinese Commerce Ministry said they would “fight to the end.” At the same time, the Eurozone (EU) plans to hit the US with tariffs of up to 25% on a wide range of goods. The European Commission will propose targeting tobacco, steel, textiles, eggs, dental floss, poultry, and numerous other US exports to the bloc, as reported by Reuters.

Meanwhile, there were no relevant data releases in Europe, nor will the US publish macro figures.

EUR/USD short-term technical outlook

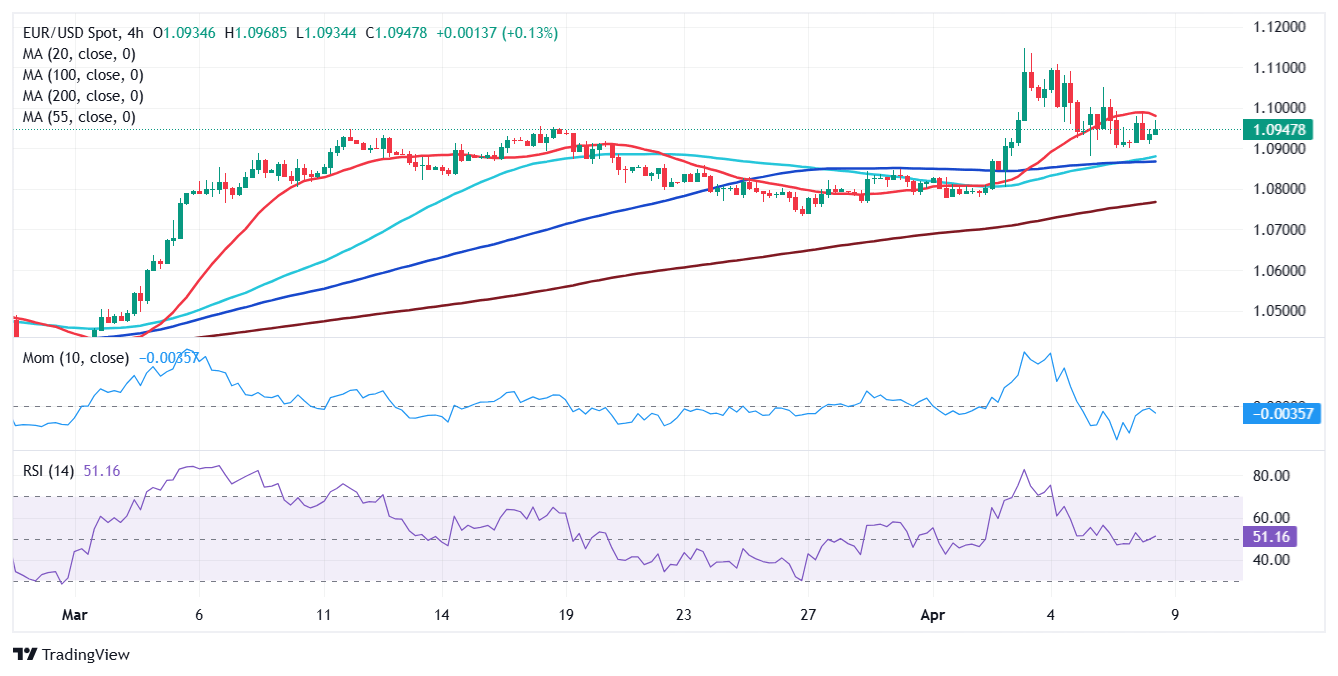

The EUR/USD pair is up for a second consecutive day, although still trading below Friday’s close at 1.0957. The bearish potential has decreased, but the odds for a firmer advance seem limited, according to technical readings in the daily chart. The pair remains above all its moving averages, although the 20 Simple Moving Average (SMA) remains flat at around 1.0860. Technical indicators, in the meantime, ticked higher with limited strength, with the Momentum indicator still stuck at neutral levels.

In the near term, and according to the 4-hour chart, EUR/USD is in a consolidative phase with the risk skewed to the downside. Technical indicators remain within negative levels with uneven directional strength, still suggesting buyers remain sidelined. At the same time, a directionless 20 SMA provides intraday resistance at around 1.0996, while a flat 100 SMA lies in the 1.0860 region.

Support levels: 1.0900 1.0860 1.0820

Resistance levels: 1.0960 1.1000 1.1045

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.