EUR/USD Price Forecast: Buyers return amid US recession fears

EUR/USD Current price: 1.1070

- United States trade war and retaliatory announcements put markets in risk-off mode.

- The Federal Open Market Committee will release the Minutes of the March meeting.

- EUR/USD flirts with the 1.1100 figure aims to extend gains beyond it.

The EUR/USD pair trades near 1.1100, gaining upward momentum amid renewed US Dollar (USD) weakness. United States (US) President Donald Trump's reciprocal tariffs, accounting for as much as 104% on China, but also extended to over 180 countries, came into effect today.

Beijing responded by announcing counter levies of 84% on US goods, effective April 10. As a result, concerns about a potential US recession and fresh inflationary pressures returned, with the associated fears weighing on stock markets. Most Asian indexes and all European ones stand in the red, leading to losses among Wall Street’s futures.

Meanwhile, the Federal Open Market Committee (FOMC) will release the Minutes of the Federal Reserve (Fed) March meeting. Market players anticipate a more dovish direction, given the risks related to Trump’s tariffs. The more dovish the Fed, the weaker the USD will be.

EUR/USD short-term technical outlook

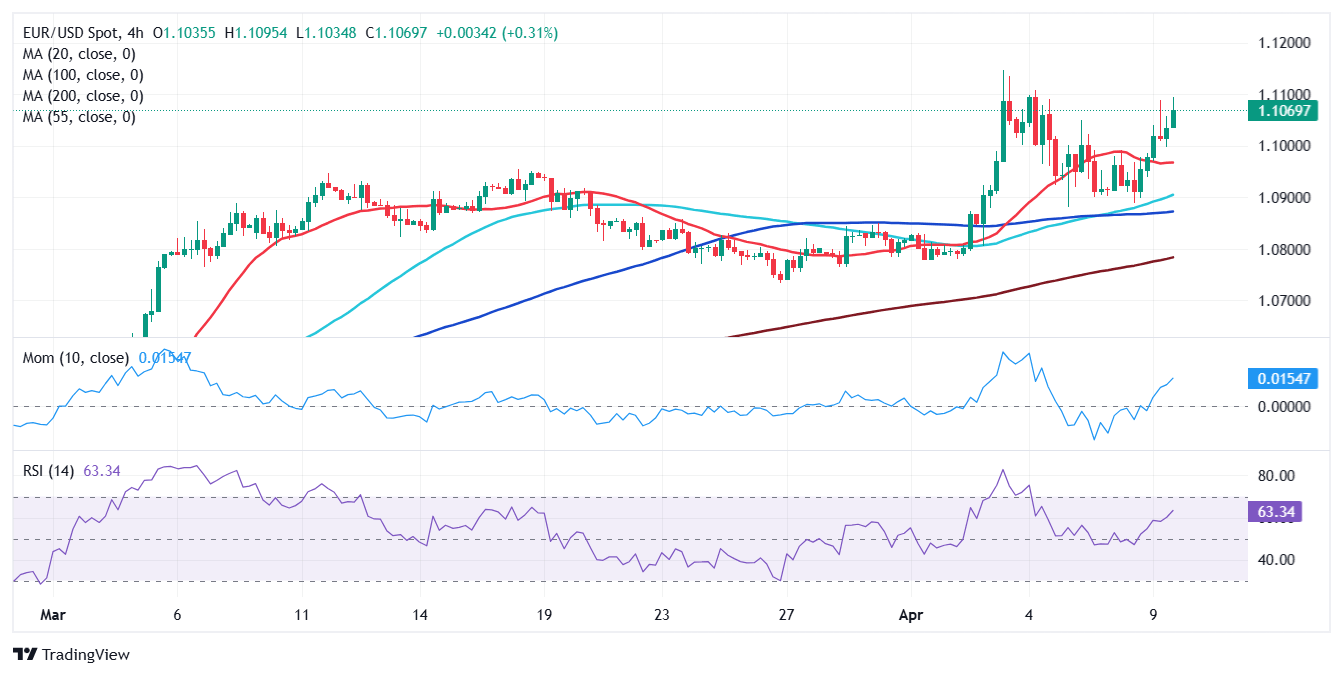

The EUR/USD pair is sharply up, and technical readings in the daily chart support additional gains ahead. Technical indicators have accelerated north well above their midlines, reflecting increased buying interest. At the same time, the pair develops above all its moving averages, with the 20 Simple Moving Average (SMA) extending its advance above the 100 and 200 SMAs, while far below the current level.

In the near term, and according to the 4-hour chart, the risk skews to the upside. EUR/USD develops above all its moving averages, which, anyway, stand pat. The 20 SMA hovers around 1.0970, providing support. Technical indicators, in the meantime, ticked modestly higher within positive levels, but remain below their intraday peaks. A firmer advance could be expected on a break above 1.1100, the immediate resistance level.

Support levels: 1.1045 1.1005 1.0970

Resistance levels: 1.1100 1.1150 1.1190

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.