EUR/USD Price Forecast: Bulls pause but retain control

EUR/USD Current price: 1.1540

- US President Trump criticized Fed Chairman Powell hurting investors’ confidence.

- Wall Street is under strong selling pressure, stocks fall alongside the US Dollar.

- EUR/USD consolidates fresh gains, paused ahead of higher highs.

The EUR/USD pair surged past the 1.1500 mark on Monday, reaching levels that were last seen in November 2021 amid a continued US Dollar (USD) sell-off. The Greenback plummeted following an extended weekend, with thinned market conditions exacerbating the slide. Most Asian and European markets remained closed on Easter Monday.

Speculative interest keeps pricing in the United States (US) President Donald Trump's decisions’ effects on the US economy. Trump shifted the main focus from tariffs to the Federal Reserve (Fed) Chairman Jerome Powell. On a Truth Social post, the President criticised the head of the central bank’s decision to maintain rates on hold and called for lower rates, adding that Powell’s “termination cannot come fast enough.” Trump’s comments further dented investors’ confidence.

US markets opened as usual, although Canadian ones will remain closed on holiday, which means activity won’t return to normal until the upcoming Asian session. In the meantime, the macroeconomic calendar has nothing relevant to offer.

Wall Street is also reflecting concerns, with the Dow Jones Industrial Average down over 300 points in pre-opening trading.

EUR/USD short-term technical outlook

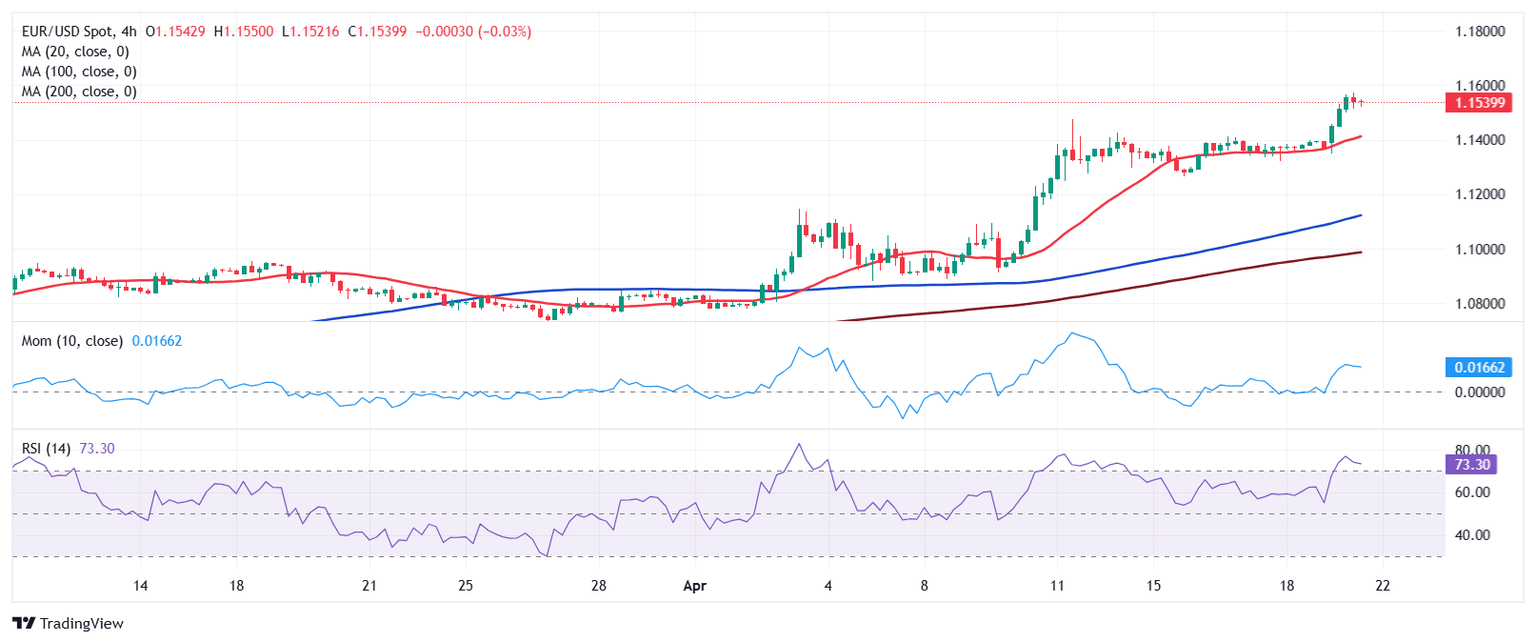

The EUR/USD pair hovers around 1.1540 after peaking at 1.1573, retaining its bullish tone despite being overbought. In the daily chart, technical indicators keep heading firmly north within extreme levels, with no signs of upward exhaustion, supporting the case of additional advances. At the same time, the pair stands far above all its moving averages, with a bullish 20 Simple Moving Average (SMA) currently at around 1.1060.

The near-term picture shows buyers paused, but retain control. In the 4-hour chart, EUR/USD remains far above bullish moving averages, which reflect the dominant trend. Technical indicators, in the meantime, have partially lost their bullish strength, but remain near their recent peaks, far from suggesting an upcoming slide. Corrections will likely attract buyers, with the 1.1500 mark now offering immediate support.

Support levels: 1.1500 1.1470 1.1425

Resistance levels: 1.1575 1.1610 1.1650

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.