EUR/USD Price Forecast: Bulls keep looking for higher highs

EUR/USD Current price: 1.1698

- US President Donald Trump pledged to replace Fed’s Chair Powell, US Dollar in sell-off mode.

- The United States downwardly revised the Q1 Gross Domestic Product.

- EUR/USD corrects overbought conditions, bullish potential remains intact.

The EUR/USD pair rallied to a fresh multi-year high on Thursday, as the US Dollar (USD) plunged on headlines indicating United States (US) President Donald Trump is considering replacing Federal Reserve (Fed) Chair Jerome Powell sooner rather than later.

Powell’s term ends in May 2026, although Trump said during a press conference at the Hague following a NATO summit that he is already thinking of three or four people who could replace him. “I mean he goes out pretty soon, fortunately, because I think he’s terrible,” Trump stated, adding "I think he is a very stupid person, actually."

Data-wise, the Eurozone had nothing relevant to offer. The US, on the other hand, just released a bunch of relevant figures. The country reported that Durable Goods Orders rose a whopping 16.4% in May, much better than the -6.6% posted in April. The Q1 Gross Domestic Product (GDP) was confirmed at -0.5% in the first quarter of the year, worse than the preliminary estimate of -0.2%.

Also, Initial Jobless Claims rose by 236K in the week ended June 21, beating expectations. Finally, the Goods Trade Balance posted a deficit of $96.6 billion in May, worse than the -$88.5 billion expected. The mixed figures have no real impact on financial markets.

EUR/USD short-term technical outlook

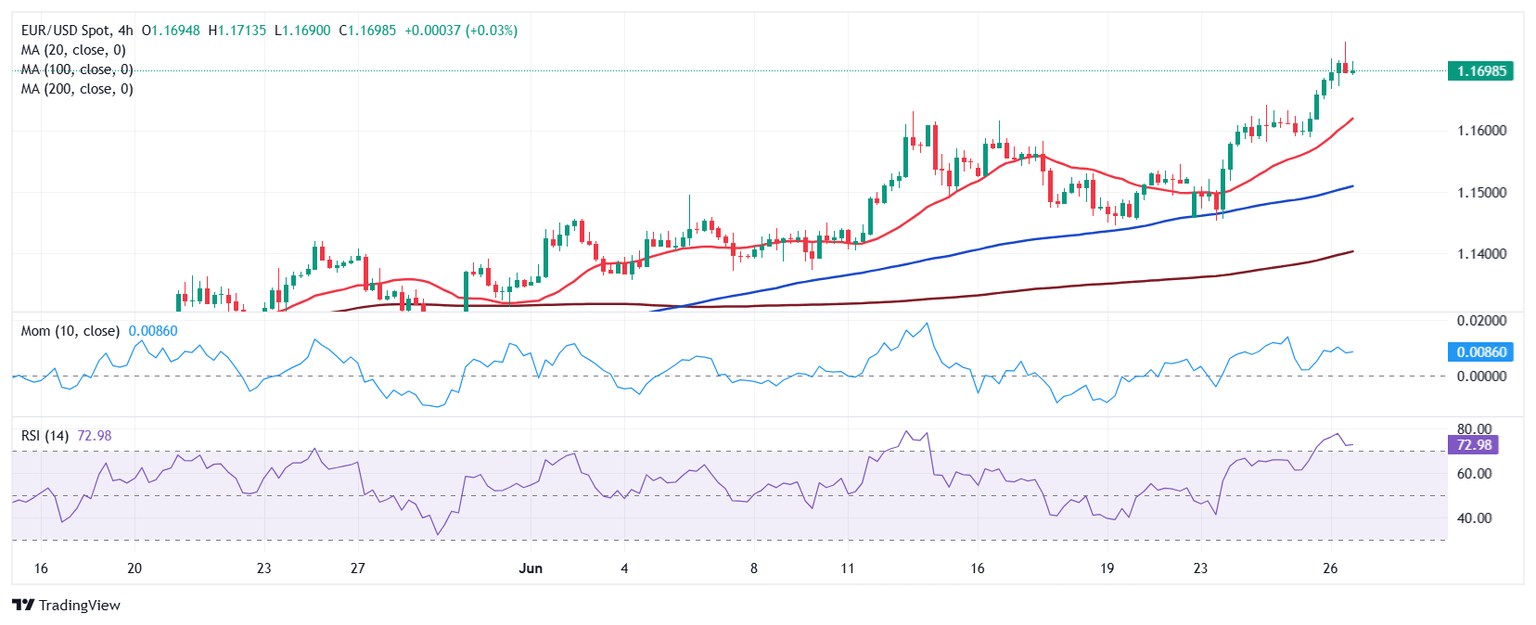

The EUR/USD pair peaked at 1.1741 during European trading hours, its highest since September 2021. It currently hovers around the 1.1700 mark, and the daily chart shows the bullish potential remains intact as the pair advances for the sixth consecutive day. Technical indicators aim firmly north, with the Relative Strength Index (RSI) indicator entering overbought territory without signs of upward exhaustion. At the same time, moving averages remain far below the current level and are heading higher, reflecting buyers' dominance. The 20 Simple Moving Average (SMA) currently stands at around 1.1500.

The 4-hour chart shows the EUR/USD pair has room to extend its advance. It has corrected extreme overbought conditions, but there are no signs of an upcoming slide. Technical indicators have turned flat far above their midlines, hinting at a pause rather than upward exhaustion. Finally, the pair develops well above all its moving averages, which present healthy bullish strength.

Support levels: 1.1660 1.1620 1.1575

Resistance levels: 1.1745 1.1790 1.1840

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.