EUR/USD Price Forecast: Bulls hold the grip, 1.1520 at sight

EUR/USD Current price: 1.1419

- Renewed trade tensions between China and the United States dented the market’s mood.

- The United States ISM Manufacturing PMI is expected to have improved in May.

- EUR/USD holds on to higher ground, upward momentum limited.

The EUR/USD pair trades above the 1.1400 mark on Monday, as the US Dollar (USD) suffered a setback amid renewed trade tensions. United States (US) President Donald Trump announced on Friday that the country will double its current tariff rate on steel and aluminium imports from 25% to 50%, starting on Wednesday.

The news triggered a quick response from China, with the commerce ministry threatening to take measures amid Trump’s decision “seriously violating” the truce agreed last month. “The US government has unilaterally and repeatedly provoked new economic and trade frictions, exacerbating uncertainty and instability in bilateral economic and trade relations,” the minister stated.

Financial markets kick started the week in risk-off mode with global stocks under pressure and the USD falling against most major rivals.

Meanwhile, the Hamburg Commercial Bank (HCOB) released the final estimates of the May Manufacturing Purchasing Managers’ Index (PMI) for the Eurozone (EU). The German index suffered a downward revision, to 48.3 from the previous estimate of 48.8, although the EU Manufacturing PMI was confirmed at 49.4, as previously estimated.

The American session will bring the S&P Global US Manufacturing PMI and the ISM official index. The latter is foreseen in May at 49.5, up from the 48.7 posted in April. Throughout the session, Federal Reserve (Fed) Chairman Jerome Powell and European Central Bank (ECB) President Christine Lagarde will hit the wires and could introduce some monetary policy noise.

EUR/USD short-term technical outlook

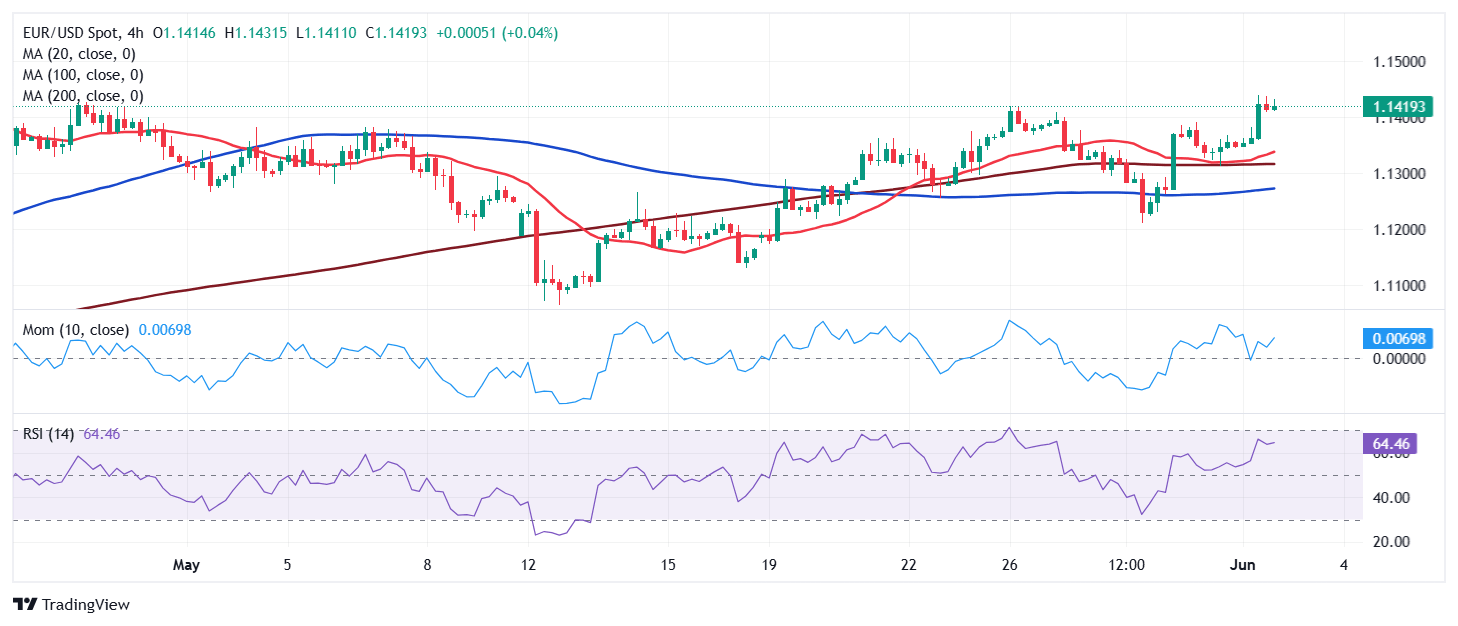

The EUR/USD pair trades near an early peak at 1.1439, and the daily chart shows the risk skews to the upside, although the momentum is limited. The daily chart shows the pair advances beyond a mildly bullish 20 Simple Moving Average (SMA), providing support at around 1.1275. At the same time, the 100 SMA advances beyond the 200 SMA, although roughly 500 pips below the current level, far away to be relevant, but clearly indicating bulls retain control. Finally, technical indicators hold well above their midlines, although without clear directional strength, limiting the odds for a steeper advance today.

In the near term, and according to the 4-hour chart, EUR/USD reached overbought conditions. Technical indicators turned flat at their tops, reflecting the limited price action yet falling short of suggesting an upcoming slide. At the same time, the 20 SMA aims marginally higher above directionless 100 and 200 SMAs, also indicating buyers are in the driver’s seat.

Support levels: 1.1390 1.1350 1.1310

Resistance levels: 1.1440 1.1485 1.1520

US-China Trade War FAQs

Generally speaking, a trade war is an economic conflict between two or more countries due to extreme protectionism on one end. It implies the creation of trade barriers, such as tariffs, which result in counter-barriers, escalating import costs, and hence the cost of living.

An economic conflict between the United States (US) and China began early in 2018, when President Donald Trump set trade barriers on China, claiming unfair commercial practices and intellectual property theft from the Asian giant. China took retaliatory action, imposing tariffs on multiple US goods, such as automobiles and soybeans. Tensions escalated until the two countries signed the US-China Phase One trade deal in January 2020. The agreement required structural reforms and other changes to China’s economic and trade regime and pretended to restore stability and trust between the two nations. However, the Coronavirus pandemic took the focus out of the conflict. Yet, it is worth mentioning that President Joe Biden, who took office after Trump, kept tariffs in place and even added some additional levies.

The return of Donald Trump to the White House as the 47th US President has sparked a fresh wave of tensions between the two countries. During the 2024 election campaign, Trump pledged to impose 60% tariffs on China once he returned to office, which he did on January 20, 2025. With Trump back, the US-China trade war is meant to resume where it was left, with tit-for-tat policies affecting the global economic landscape amid disruptions in global supply chains, resulting in a reduction in spending, particularly investment, and directly feeding into the Consumer Price Index inflation.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.