EUR/USD Price Forecast: Between Fed ambiguity and ECB patience

- EUR/USD manages to regain some composure, retargeting the 1.1800 barrier.

- The US Dollar faced some renewed selling pressure, eroding part of recent gains.

- Traders will now look to further Fedspeak comments and PMI data.

The Euro (EUR) kicked off the week on a firmer footing, with EUR/USD edging back toward multi-day highs just under the 1.1800 level.

The rebound came as the US Dollar (USD) lost some traction, even with Treasury yields still climbing. The US Dollar Index (DXY) gave up part of last week’s post-Federal Open Market Committee (FOMC) rally, as investors looked ahead to fresh remarks from Fed officials and key business activity surveys on both sides of the Atlantic.

The Fed’s ambiguous message

The Fed trimmed rates by 25 basis points on September 17, citing cooling in the labour market. Inflation, though, remains a sticking point, with the central bank noting that it is still “somewhat elevated”.

The updated dot plot pointed to another 50 basis points of easing before year-end, smaller cuts in 2026 and 2027, and a median 2025 policy rate of 3.6%. Growth projections nudged higher to 1.6%, while unemployment stayed at 4.5% and inflation forecasts were unchanged.

Not everyone was on board. Incoming governor Stephen Miran argued for a deeper 50bp cut.

Chair Jerome Powell, speaking at his press conference, admitted employment growth has slowed, consumer spending has cooled, and inflation is running at 2.7% on the headline PCE and 2.9% on the core measure. He blamed tariffs for pushing up prices but noted services inflation is easing. Powell described risks as “more balanced” and stressed the Fed is moving closer to neutral, downplaying the appetite for sharper rate cuts.

ECB holds steady as inflation nears target

The European Central Bank (ECB) earlier this month kept all three policy rates unchanged, sticking to its meeting-by-meeting, data-driven approach.

Officials said inflation is largely on track with the 2% medium-term target. Core inflation is seen averaging 2.4% in 2025, easing to 1.9% in 2026 and 1.8% in 2027.

President Christine Lagarde described the ECB as being in a “good place”, with risks more evenly balanced. She reinforced, though, that rate decisions will remain entirely dependent on incoming data.

Trade tensions cool but tariffs remain

On the trade front, tensions between Washington and Beijing eased somewhat after both sides agreed to a 90-day extension of their truce. That said, tariffs are still high: the US continues to tax Chinese goods at 30%, while China applies a 10% tariff on US imports.

Meanwhile, Washington reached a deal with Brussels: the EU agreed to cut tariffs on US industrial goods and ease access for American farm and seafood exports. In return, the US imposed a 15% tariff on most EU imports. Auto tariffs remain on the table, pending EU regulatory discussions.

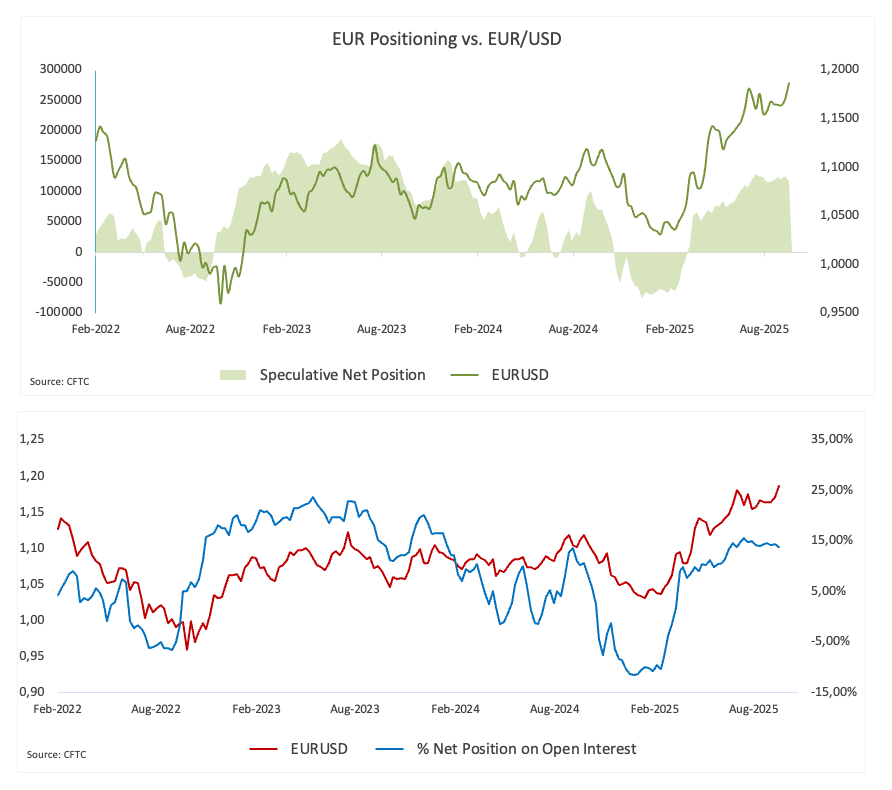

Speculators trim bullish bets

Speculative appetite for the Euro has cooled. Commodity Futures Trading Commission (CFTC) data for the week ending September 16 showed non-commercial net longs falling to five-week lows near 117.8K contracts. Additionally, institutional traders also pared back net shorts to around 167.4K contracts, all amid a drop in open interest to about 855.5K contracts, suggesting fading conviction on both sides.

Technical levels to watch

EUR/USD is showing signs of stabilisation after three straight days of losses.

On the topside, the key level is the 2025 ceiling at 1.1918 (September 17). A break higher would open the door to the psychological 1.2000 mark.

Support sits first at the 55-day Simple Moving Average (SMA) at 1.1672, followed by the weekly trough at 1.1574 (August 27) and the August low at 1.1391 (August 1).

Momentum signals appear constructive, although somewhat subdued: The Relative Strength Index (RSI) has slipped to around 56, pointing to a steady but softening buying impulse. Furthermore, the Average Directional Index (ADX), hovering near 17, highlights a trend that lacks muscle.

EUR/USD daily chart

-1758563029862-1758563029863.png&w=1536&q=95)

What’s next for EUR/USD?

Further gains in the pair can’t be ruled out in the relatively short-term horizon. However, that move may need a stronger catalyst to break higher with conviction: Such a move could come from a potential dovish pivot by the Fed, a rotation out of US assets in favour of European ones, tangible extra progress on trade, or signs that the ECB is comfortable holding rates steady for longer.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.