EUR/USD Price Forecast: Bears maintain the pressure

EUR/USD Current price: 1.1522

- Market players await United States data for additional clues.

- Progress in trade talks continues to benefit the American currency.

- EUR/USD pressures daily lows in the 1.1520 area, aiming to extend its slump.

The EUR/USD pair fell to the 1.1520 region on Tuesday, pressuring the lows early in the American session, as the US Dollar (USD) retains its strong momentum across the FX board. The Greenback found its footing at the beginning of the week on the back of trade-deal announcements, particularly between the United States (US) and the European Union (EU), which seems more of a capitulation of the EU rather than a deal. The US also report continued talks with China, although a deal is not in the foreseeable future between the two rivals.

The USD also benefited from some profit taking ahead of multiple first-tier releases, including the Federal Reserve (Fed) monetary policy announcement on Wednesday. So far, US data has been quite encouraging, as the country released the June Goods Trade Balance, which posted a deficit of $85.9 billion according to preliminary estimates, better than the $98.4 billion loss expected. Preliminary Wholesale Inventories for the same month increased 0.2%, worse than the -0.1% anticipated. Coming up next is June JOLTS Job Openings and July CB Consumer Confidence.

EUR/USD short-term technical outlook

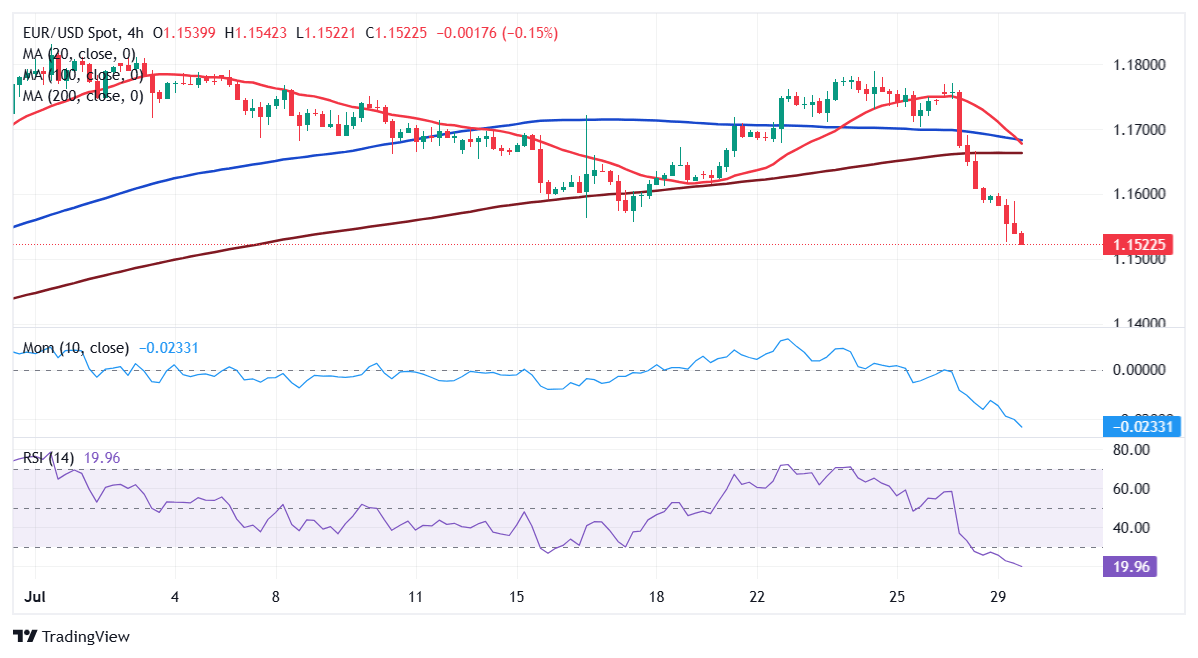

From a technical point of view, the EUR/USD pair is poised to extend its slump. It keeps falling below a mildly bearish 20 Simple Moving Average (SMA), which provides dynamic resistance at around 1.1690. The 100 SMA, in the meantime, maintains its bullish slope, albeit partially losing its upward strength at around 1.1340. Finally, technical indicators keep heading south well below their midlines, and at multi-week lows, in line with a bearish extension ahead.

The near-term picture shows EUR/USD is oversold and may bounce or consolidate before the next directional move. In the 4-hour chart, technical indicators turned flat at extreme levels, yet it keeps developing below all its moving averages, which skews the risk to the downside. A firmly bearish 20 SMA is crossing below the 100 SMA and aims to extend its slide below a directionless 200 SMA, usually a sign of prevalent selling interest.

Support levels: 1.1510 1.1470 1.1420

Resistance levels: 1.1555 1.1600 1.1640

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.