EUR/USD Price Forecast: A minor support comes near 1.1470

- EUR/USD resumed its downtrend and approached the key 1.1600 support.

- The US Dollar gathered fresh steam on solid data ahead of Powell’s speech.

- The US flash PMIs surprised to the upside; Claims rose more than estimated.

The Euro (EUR) faced increased selling pressure on Thursday, with EUR/USD edging down toward the 1.1600 contention zone. The marked retracement came as the US Dollar (USD) rose sharply to multi-day highs, underpinned by firm data from the US business activity in August.

With little on the geopolitical front and no big news regarding trade, investors are now looking ahead to the Fed Chair Jerome Powell’s speech at Jackson Hole on Friday.

Trade truce: A pause, not peace

Markets took some comfort from a temporary cooling of global trade tensions. Washington and Beijing agreed on a 90-day extension to their deal, just before fresh tariffs were set to kick in. President Trump signed an executive order delaying hikes until November 10, while China pledged reciprocal measures. Still, existing tariffs remain steep: 30% on Chinese exports to the US and 10% on US goods heading the other way.

Meanwhile, the US and EU locked in their own compromise on Thursday: The deal slaps a 15% US tariff on most European imports, everything from cars and semiconductors to lumber and pharmaceuticals. In fact, in a joint statement, both sides laid out their promises. Brussels pledged to scrap tariffs on all US industrial goods and open the door wider for American seafood and farm products. For its part, Washington said it would cut the 27.5% tariffs currently weighing on European cars and car parts, but only once the EU passes the legislation needed to deliver its side of the bargain.

Central banks: Cautious and data-driven

The Federal Reserve (Fed) held rates steady at its last meeting, with Powell treading carefully between steady guidance and more dovish signals from Governors Christopher Waller and Michelle Bowman.

Minutes from that meeting showed that those two policymakers were alone calling for lower rates, failing to gain support from others. Officials noted tariffs were clearly raising costs for some goods, but the broader impact on inflation and growth remained uncertain. Looking ahead, they flagged the possibility of “tough choices” if inflation proves sticky while labour market conditions weaken.

At the European Central Bank (ECB), President Christine Lagarde said eurozone growth remains “solid, if a little better.” Even so, markets now see the ECB holding off on its first rate cut until spring 2026.

Positioning: Long bets trimmed back

Speculative demand for the Euro has eased. Commodity Futures Trading Commission (CFTC) data through August 12 showed net long positions slipping to a six-week low of about 115.4K contracts, while commercial traders pushed net shorts above 167K, the highest in two weeks. Further data saw open interest increase to roughly 825K after falling for two weeks.

Technicals: Momentum fading

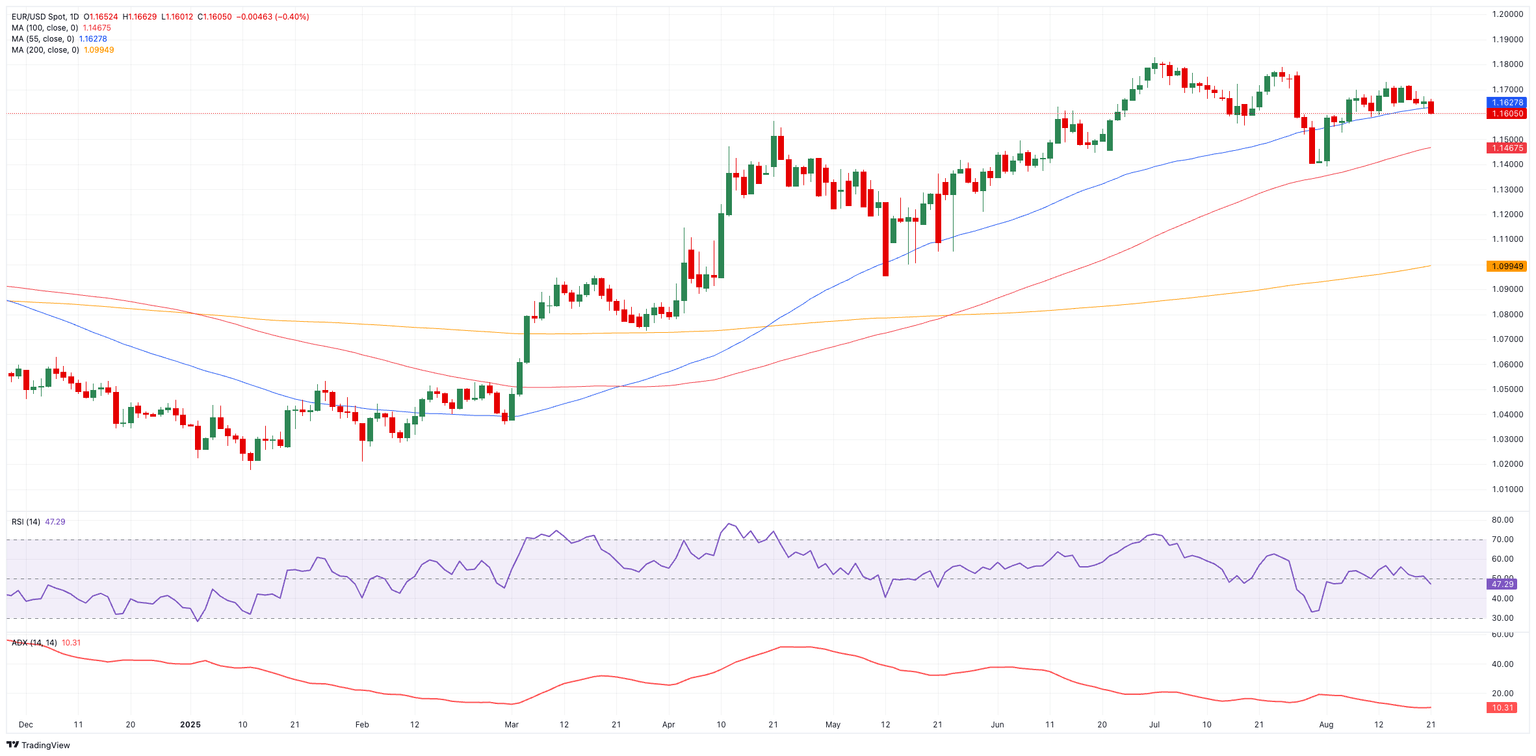

Upside hurdles sit at the weekly high of 1.1788 (July 24), the year-to-date (YTD) ceiling at 1.1830 (July 1), and the September 2021 peak at 1.1909 (September 3), just shy of the key 1.2000 level.

Transitory support, on the flip side, is seen at the 100-day Simple Moving Average (SMA) at 1.1473, followed by the August base at 1.1391 (August 1) and the weekly floor at 1.1210 (May 29).

Momentum signals aren’t convincing: the Relative Strength Index (RSI) slipped back below 48, suggesting downside potential ahead, but the Average Directional Index (ADX) at around 11 points to a weak, directionless trend.

EUR/USD daily chart

Outlook: Still stuck in consolidation

For now, EUR/USD looks range-bound. A clearer move may depend on the Fed’s tone later this week or a sharper turn in trade headlines. Until then, the direction of the pair is likely to remain dominated by the US Dollar.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.