EUR/USD Outlook: The Euro regained traction after mixed US data; awaiting Fed for more signals

EUR/USD

The Euro jumped at the beginning of the US session on Wednesday, after mixed US inflation data (Nov CPI m/m 0.3% vs 0.2% f/c but offset benign core CPI which came in line with expectations at 0.2%) deflated dollar.

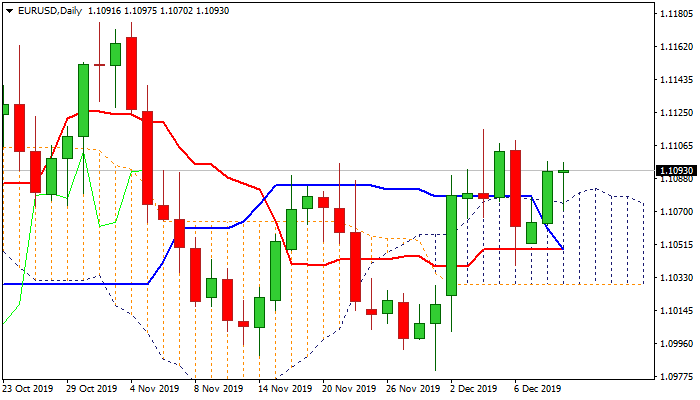

Today's dip to 1.1070 (European session low) was contained by the top of thick daily cloud, broken on Tuesday's strong rally and reverted to solid support.

Fresh advance retested Tuesday's high (1.1097) and pressures pivotal barriers at 1.1103 (Fibo 61.8% of 1.1179/1.0981) and 1.1115 (last week's high), violation of which would expose targets at 1.1132 (Fibo 76.4%) and 1.1153 (200DMA).

Bullish bias is expected above daily cloud that keeps near-term focus at the upside, after strong bullish signal was generated on Tuesday's break and close above the cloud.

Rising bullish momentum and daily MA's in bullish setup and formed multiple bull-crosses, support scenario.

All eyes are on Fed rate decision, due later today, with central bank widely expected to keep rates unchanged, but markets will pay attention to the statement, to get more clues about central bank's steps in 2020.

According to the current conditions, the Fed is going to stay on hold during the most of 2020, the year of the US presidential election, but may signal further easing if economic conditions deteriorate.

The Euro traders also focus Thursday's ECB policy meeting, with the central bank expected to stand pat, but traders will focus on views and remarks of new ECB chief Christine Lagarde, as this will be her first policy meeting as the head of the central bank.

Res: 1.1097; 1.1103; 1.1115; 1.1132

Sup: 1.1074; 1.1067; 1.1052; 1.1039

Interested in EUR/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.