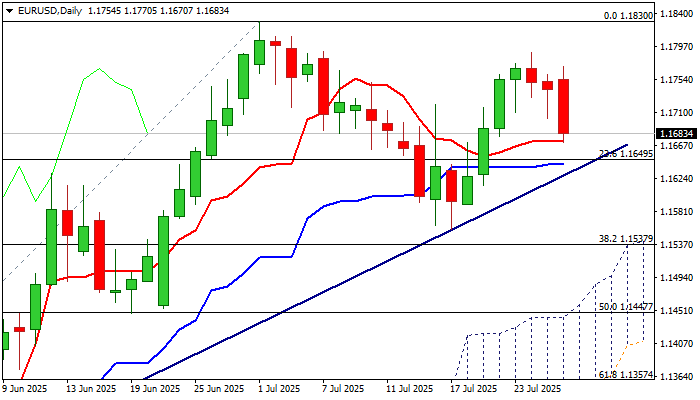

EUR/USD outlook: Tests strong support zone after a sharp drop

EUR/USD

EURUSD lost ground on Monday after a gap-higher opening and short-lived gains, losing nearly 0.7% in late-Asian / early European trading.

Positive impact from US-EU trade deal was so far very limited, probably that markets have already positively reacted on anticipation that agreement will be reached before the deadline and after digesting the news about the whole package, signed in Scotland, which may not be in favor of the EU bloc.

Technical picture on daily chart weakened as 14-d momentum crossed in the negative territory, after bears cracked initial support at 1.1672 (daily Tenkan-sen) and eye more significant supports at 1.1650/30 zone (Fibo 23.6% of 1.1065/1.1830 uptrend / daily Kijun-sen / trendline support.

Violation of these levels would further weaken near-term structure and unmask key supports at 1.1556/37 (July 17 higher low / Fibo 38.2%), loss of which to complete bearish failure swing pattern and generate reversal signal.

Conversely, ability to hold above the trendline (ideally) would generate initial signal about a healthy correction before larger bulls return to play.

Res: 1.1703; 1.1770; 1.1789; 1.1830.

Sup: 1.1650; 1.1630; 1.1589; 1.1556.

Interested in EUR/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.