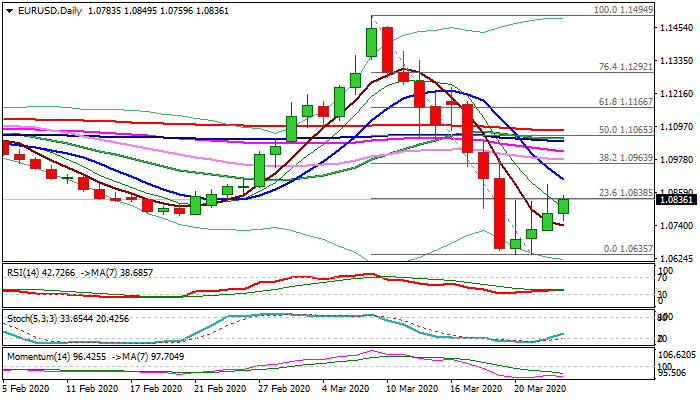

EUR/USD Outlook: Recovery needs close above pivotal Fibo barrier to signal reversal

EUR/USD

The Euro stands at the front foot on Wednesday and probes again above pivotal Fibo barrier at 1.0838 (23.6% of 1.1494/1.0635 fall) following Tuesday's failure to clearly break above, despite spike to 1.0887. The sentiment has improved on action of global central banks to cushion strong negative impact from corona virus pandemic, with latest Fed's $2 trillion aid package, being the highlight. Traders however remain cautious, as recovery action in past three days faced strong upside rejections (presented by three bullish daily candles with long upper shadows) that weighs on current recovery. Also, momentum on daily chart is pointing down and converging from north-heading RSI and stochastic, while daily MA's remain in full bearish setup. Close above 1.0838 is seen as minimum requirement for initial reversal signal, which would look for confirmation on break of falling 10DMA (1.0906) and Fibo 38.2% (1.0963). Caution on repeated failure to close above 1.0838 Fibo barrier as this could be initial signal that bulls are running out of steam.

Res: 1.0849; 1.0878; 1.0906; 1.0963

Sup: 1.0800; 1.0759; 1.0740; 1.0724

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.