EUR/USD outlook: Limited recovery suggests that larger bears hold grip

EUR/USD

EURUSD fell on Tuesday morning, erasing about a half of Monday’s 1.3% rally, sparked by decision of President Trump to keep tariffs on hold, against initial plan to impose them from the day one.

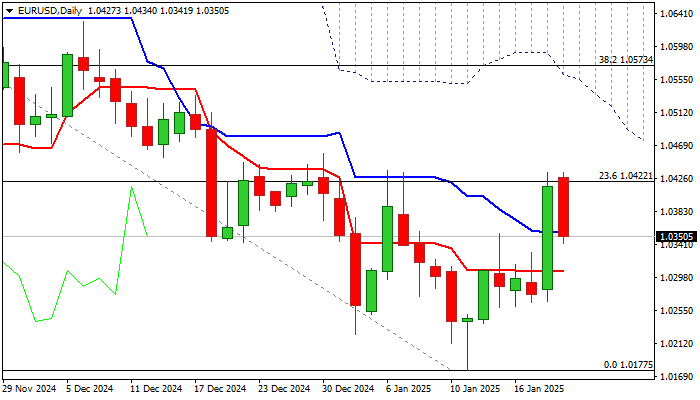

A breather in the larger downtrend seems to be short lived so far, as correction was minor and capped by solid barrier provided by Fibo 23.6% of 1.1214/1.0177 (1.0422) where recent recovery attempts were repeatedly capped.

Overall technical picture is predominantly bearish and signal that larger bears are likely to regain full control after current consolidation phase, as falling daily cloud (spanned between 1.0555 and 1.0690) continues to weigh on price action

Formation of 100/200DMA death cross adds to negative signals, along with south-heading RSI, which slid under neutrality territory.

Near term bias is expected to remain with bears while the action stays capped under Fibo barrier (1.0422).

Fundamental situation is not bright for Euro as bloc’s economy is struggling to get into recovery track, persisting political tremors continue to undermine and arrival of Donald Trump posses the biggest challenge for the Eurozone.

Threat of tariffs on all EU exports to the US, due to US trade deficit with EU, which Trump wants to erase, is serious problem for EU which tries to find the way strengthen ties with US and avoid the worst scenario, while fighting with high energy prices and contributions to the war in Ukraine.

Extended consolidation should be likely near-term scenario, with price action to remain within current range (stronger upticks to stall under the base of falling daily cloud), before larger downtrend off 2024 peak (1.1214) resumes.

Res: 1.0422; 1.0478; 1.0534; 1.0555.

Sup: 1.0305; 1.0260; 1.0224; 1.0200.

Interested in EUR/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.