EUR/USD outlook: Eventual break of 1.23 barrier would expose targets at 1.25 zone

EUR/USD

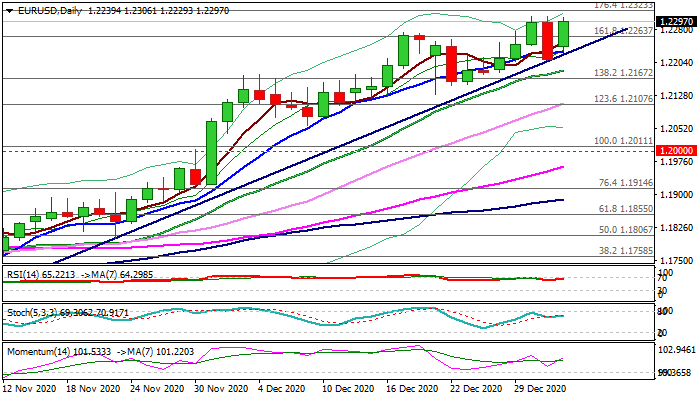

The Euro is probing again through 1.23 barrier on Monday after cracking the level twice last week, but without clear break.

Bulls regained traction at the first trading day of 2021, as the pair opened with a gap higher and rallied, neutralizing negative signal from 31 Dec’s bearish engulfing pattern.

Positive sentiment on hopes of vaccine success and subsequent stronger economic recovery, keep the Euro inflated.

Bullish daily studies add to positive signals as investors already eye next key barriers at 1.25 zone (1.2500 – psychological; 1.2517 – Fibo 38.2% of 1.6039/1.0340 and 1.2555 – 16 Feb 2018 peak).

Eventual close above 1.2300 would generate fresh signal for extension towards 1.2400/19 (round-figure / Fibo 200% projection of the rally from 1.1602) which mark the last obstacles on the way to 1.2500 zone targets.

Repeated failure to clear 1.23 barrier would signal extended consolidation, but would also make the downside more vulnerable.

Near-term action is expected to remain biased higher while holding above 10DMA / bull-trendline off 1.1602 low (1.2228) and keep dip-buying scenario favored.

Res: 1.2309; 1.2350; 1.2400; 1.2417.

Sup: 1.2272; 1.2229; 1.2208; 1.2184.

Interested in EUR/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.