EUR/USD outlook: Euro extends pullback after failure at 1.20 barrier and eyes key fibo supports

EUR/USD

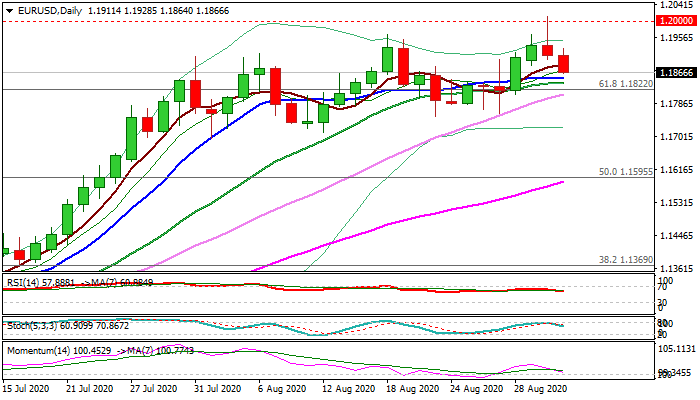

The Euro extends pullback from new 2020 high on Wednesday (so far down 0.31% since opening today), following strong rejection at psychological 1.20 barrier.

Bulls peaked at 1.2011 but breach was short-lived and subsequent pullback left bearish daily candle with long upper shadow that made initial bearish signal.

Traders booked some profits on massive longs that added pressure on the near-term action.

Sort of bull-trap pattern that is forming on daily chart (although 1.20 is not a technical barrier) could contribute to current scenario, signaled by daily indicators during past few days. Fading momentum and south-heading stochastic/RSI add to negative signals.

Fresh bears pressure initial supports at 1.1855/38 (10/20DMA's) which guard more significant double Fibo's at 1.1825/22 (61.8% of 1.1711/1.2011/broken 61.8% of 1.2555/1.0635), which should contain dip and sideline risk of deeper pullback.

Key supports are higher base at 1.1700 zone and Fibo 38.2% of 1.1168/1.2011 (1.1689), with break here to signal reversal and neutralize bulls.

Res: 1.1888; 1.1928; 1.1965; 1.2000

Sup: 1.1855; 1.1838; 1.1822; 1.1810

Interested in EUR/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.