EUR/USD Outlook: Corrective pullback might still be seen as a buying opportunity

- EUR/USD edges lower during the Asian session on Monday, though it lacks follow-through selling.

- The USD recovers further from a one-year low and is a key factor exerting pressure.

- Expectations for an imminent Fed rate-hike pause act as a headwind for the USD and lend support.

The EUR/USD pair kicks off the new week on a softer note and moves away from its highest level since April 2022, around the 1.1075 area touched on Friday. The US Dollar (USD) builds on its recovery from a one-year high amid speculations that the Federal Reserve (Fed) might continue raising interest rates and acts as a headwind for the major. The markets are pricing in a greater chance of another 25 bps lift-off at the next FOMC meeting in May, and a rise in short-term inflation expectations lifted the bets. The University of Michigan's preliminary report showed that Consumer Sentiment Index increased from 62.0 to 63.5 in April, and one-year inflation expectations rose to 4.6% from 3.6% in March. This, in turn, remains supportive of elevated US Treasury bond yields and continues to underpin the Greenback.

Apart from this, impressive bank earnings further eased concerns about a banking crisis that unfolded in March. This, along with resilience in US core retail sales, suggested that the US economy is not so bad. Moreover, the gains in January and February put consumer spending firmly on track to accelerate in the first quarter. That said, weaker headline sales set consumer spending on a lower growth path heading into the second quarter and reaffirmed that the Fed's year-long interest rate hiking campaign is cooling domestic demand. The anticipated pause in the Fed's policy tightening cycle in June might keep the USD bulls from placing aggressive bets. This makes it prudent to wait for strong follow-through selling before confirming that the EUR/USD pair has formed a near-term top and positioning for deeper losses.

There isn't any relevant market-moving macro data due from the Eurozone on Monday, while the US economic docket features the release of the Empire State Manufacturing Index later during the early North American session. The US bond yields might influence the USD price dynamics and provide some impetus to the EUR/USD pair. Traders will further take cues from a scheduled speech by the European Central Bank (ECB) President Christine Lagarde, which will drive the shared currency and contribute to producing short-term opportunities around the major.

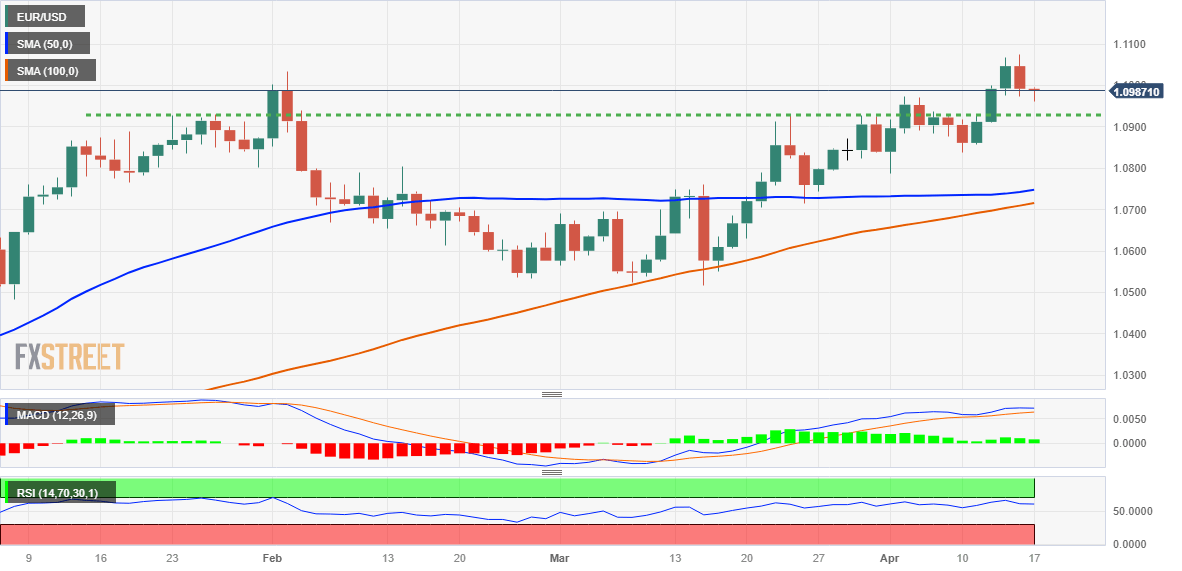

Technical Outlook

From a technical perspective, any meaningful slide below the Asian session low, around the 1.0960-1.0950 area, will likely find decent support near the 1.0920-1.0915 region. This is closely followed by the 1.0900 mark, below which the corrective slide could drag the EUR/USD pair towards the 1.0850 intermediate support. Spot prices could eventually slide below the 1.800 round figure and challenge the 50-day Simple Moving Average (SMA), currently around the 1.0745 zone.

On the flip side, momentum back above the 1.1000 psychological mark now seems to face some resistance near the 1.1040 area and the YTD peak, around the 1.1075 region. Some follow-through buying will be seen as a fresh trigger for bullish traders and push the EUR/USD pair beyond the 1.1100 mark towards testing the next relevant hurdle near the 1.1160-1.1170 horizontal zone.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.