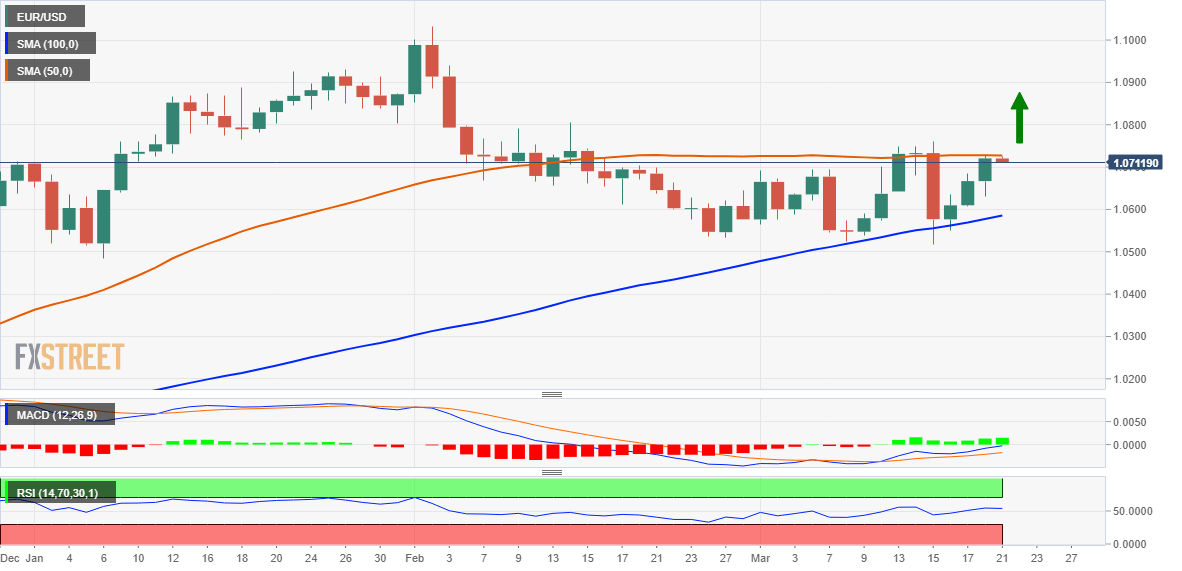

EUR/USD Outlook: Bulls need to make it through 50 DMA barrier before placing fresh bets

- EUR/USD snaps a three-day winning streak amid a modest USD recovery from the monthly low.

- A further recovery in the US bond yields turns out to be a key factor lending support to the buck.

- Bets for a less hawkish Fed should act as a headwind for the US bond yields and the Greenback.

The EUR/USD pair attracts fresh sellers near the 50-day Simple Moving Average (SMA) during the Asian session on Tuesday and for now, seems to have snapped a three-day winning streak. The US Dollar (USD) edges higher and recovers a part of the previous day's losses to its lowest level since February 14, which, in turn, acts as a headwind for the major. A further recovery in the US Treasury bond yields - led by easing fears of a widespread contagion risk following the news that UBS will rescue Credit Suisse in a $3.24 billion deal - is seen as a key factor lending some support to the Greenback. Investors, however, seem convinced that the Federal Reserve will soften its hawkish rhetoric to prevent any further economic pressure from high-interest rates. This should keep a lid on any meaningful upside for the US bond yields and the USD, at least for the time being.

In fact, the markets have been pricing in a greater chance of a smaller 25 bps lift-off in March and the possibility that the Fed will cut rates during the second half of the year. The speculations were fueled by the collapse of two mid-size US banks - Silicon Valley Bank and Signature Bank - that had led to the recent sharp decline in the US bond yields. It is worth mentioning that the rate-sensitive 2-year US government bond last week recorded its biggest three-day slump since Black Monday in October 1987. Hence, the market focus will remain glued to the outcome of the highly-anticipated two-day FOMC monetary policy meeting, starting this Tuesday. In the meantime, the overnight hawkish remarks by the European Central Bank (ECB) President Christine Lagarde should continue to underpin the shared currency and lend support to the EUR/USD pair.

Lagarde told European Parliament's Committee on Economic and Monetary Affairs on Monday that financial market turmoil may do some of the ECB's work if it dampens demand and inflation. Lagarde, however, reaffirmed that market turbulence won't stand in the way of the ECB's fight against inflation and that the inflation outlook alone would warrant more rate hikes. This, in turn, warrants some caution before placing aggressive bearish bets around the EUR/USD pair and positioning for any further downfall. Market participants now look forward to the release of the German ZEW Economic Sentiment and Largarde's scheduled speech, which might influence the Euro and provide some impetus. Traders will further take cues from the US Existing Home Sales data to grab short-term opportunities heading into the key central bank event risk.

Technical Outlook

From a technical perspective, bulls might still wait for a sustained strength above the 50-day SMA before placing fresh bets. Some follow-through buying beyond the monthly peak, around the 1.0750 region, will confirm a fresh breakout and pave the way for strong gains. The EUR/USD pair might then aim to reclaim the 1.0800 round figure. The momentum could get extended further towards the 1.0860-1.0865 static barrier en route to the 1.0900 mark and the next relevant hurdle near the 1.0925-1.0930 region.

On the flip side, weakness back below the 1.0700 mark might continue to attract some buyers and remain limited near the overnight swing low, around the 1.0630 area. The latter should act as a pivotal point, which if broken decisively might prompt some technical selling and drag the EUR/USD pair below the 1.0600 mark, towards testing the 100-day SMA, currently around the 1.0575 region. This is followed by last week's swing low, around the 1.0515 zone, below which spot prices could accelerate the fall towards the 1.0460-1.0455 intermediate support before eventually dropping to the 1.0400 mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.