EUR/USD Outlook: Bears retain control below 61.8% Fibo., ahead of German CPI

- EUR/USD comes under renewed selling pressure on Wednesday amid a stronger US Dollar.

- Bets for more Fed rate hikes and economic woes lift the USD closer to a two-month high.

- Traders now look to the flash German CPI for some impetus ahead of the US macro data.

The EUR/USD pair struggles to capitalize on the previous day's goodish rebound from its lowest level since March 20 and meets with a fresh supply during the Asian session on Wednesday. The US Dollar (USD) is back in demand and climbing closer to over a two-month high touched on Tuesday, which, in turn, is seen exerting downward pressure on the major. The prospects for additional interest rate hikes by the Federal Reserve (Fed) continue to act as a tailwind for the Greenback. The markets are pricing in a greater chance of another 25 bps lift-off at the next FOMC policy meeting in June, and the bets were lifted by the US PCE Price Index data on Friday, which showed that inflation remains sticky. Apart from this, a generally weaker risk tone offers additional support to the safe-haven buck.

The market sentiment remains fragile amid worries about slowing global economic growth. The fears were further fueled by the disappointing Chinese macro data released this Wednesday. The National Bureau of Statistics (NBS) reported that China's factory activity shrank faster than expected in May, and the official Manufacturing PMI fell to a five-month low of 48.8. In addition, service sector activity expanded slowly in four months, and the official non-manufacturing PMI fell to 54.5 in May from 56.4 previous. This and concerns about the worsening US-China ties overshadow the optimism over raising the US debt ceiling and tempering investors' appetite for riskier assets. The anti-risk flow, meanwhile, leads to some follow-through slide in the US Treasury bond yields and might cap the USD.

Bullish traders, meanwhile, seem unaffected by hawkish remarks by several European Central Bank (ECB) officials, backing the case for more rate hikes in the coming months. ECB Governing Council Gediminas Šimkus said on Tuesday that he expects a 25 basis points (bps) rate hike in June and July. Furthermore, ECB policymaker Mario Centeno said earlier this Wednesday that further adjustments are still necessary, albeit noted key interest rate is approaching its peak. This, in turn, warrants some caution for bears ahead of the flash German consumer inflation figures. Later during the early North American session, traders will take cues for the US economic docket, featuring the release of the Chicago PMI and JOLTS Job Openings data. This, along with speeches by influential FOMC members, the US bond yields and the broader risk sentiment, will drive the USD demand and provide some meaningful impetus to the EUR/USD pair.

Technical Outlook

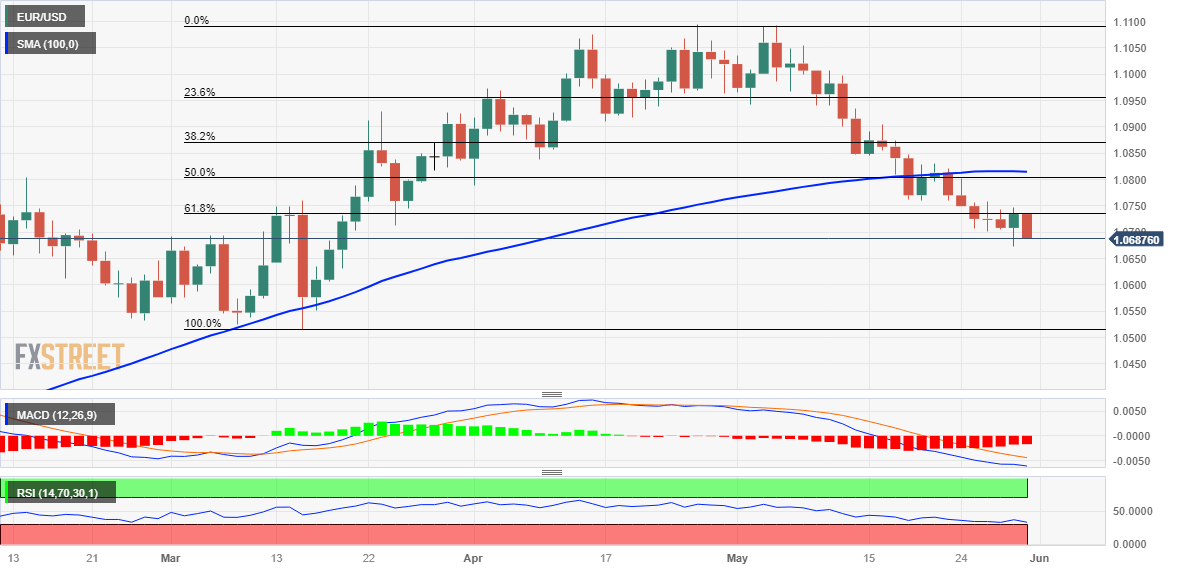

From a technical perspective, last week's breakdown below the 61.8% Fibonacci retracement level of the March-May rally was a fresh trigger for bearish traders. This and negative oscillators on the daily chart support prospects for a further near-term depreciating move. Some follow-through selling below the overnight swing low, around the 1.0675-1.0670 region, will reaffirm the outlook and drag the EUR/USD pair towards the 1.0600 round-figure mark. The downward trajectory could extend towards the 1.0570-1.0565 intermediate support before spot prices eventually drop to the March swing low, just ahead of the 1.0500 psychological mark.

On the flip side, 61.8% Fibo. level, around the 1.0735-1.0740 region, has emerged as an immediate barrier. A sustained strength beyond might trigger a short-covering move and lift the EUR/USD pair towards testing the 1.0800 confluence comprising the 100-day Simple Moving Average (SMA) and the 50% Fibo. level. The handle should now act as a pivotal point, which, if cleared decisively, will suggest that the recent pullback from over a one-year high has run its course and shifted the near-term bias in favour of bullish traders.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.