EUR/USD – Offers a downside bias in three timeframes

Breaking down the timeframes

Background: The Euro is under pressure this morning after poor IFO results from Germany and President Lagarde’s speech

Let us look at the technical side

EURUSD daily – looks to have completed a short 5-wave pattern at the 2.24% extension of 1.2318 (Elioot Wave). This would dictate that we see a sustained move lower in three waves (AB=CD)

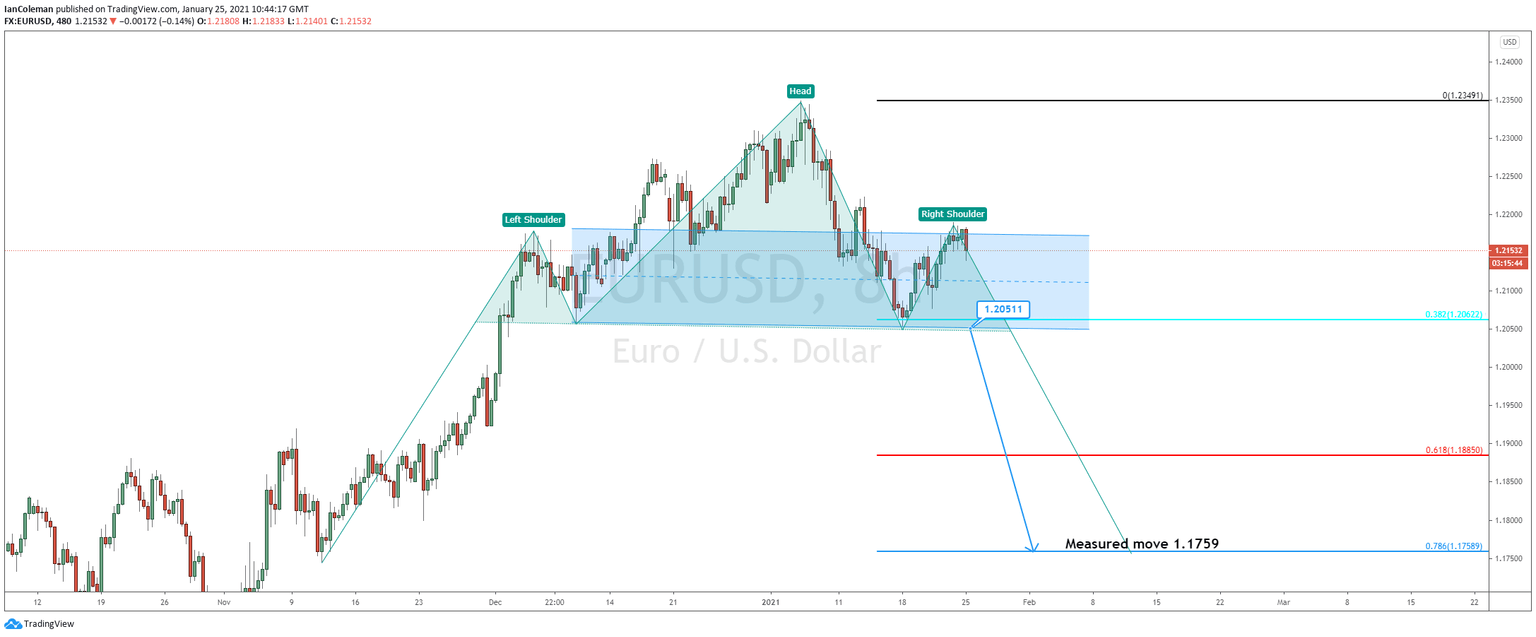

EURUSD eight hours – possible bearish Head and Shoulders pattern. A break of support at 1.2050 and the measured move target is at 1.1759. This lines up with the 78.6% pullback of the last rally. It would also complete a three-wave correction

EURUSD four hours- formed a bearish Gartley pattern at 1.2186. Rallies are likely to find sellers

Author

Ian Coleman

FXStreet

Ian started his financial career at the age of 18 working as a Junior Swiss Broker at Godsell Astley and Pearce (London). He quickly moved through the ranks and was Desk Manager at RP Martins at the age of 29.