EUR/USD: Momentum indicators are increasingly set up for a corrective move [Video]

![EUR/USD: Momentum indicators are increasingly set up for a corrective move [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/EURUSD/iStock-919003044_XtraLarge.jpg)

EUR/USD

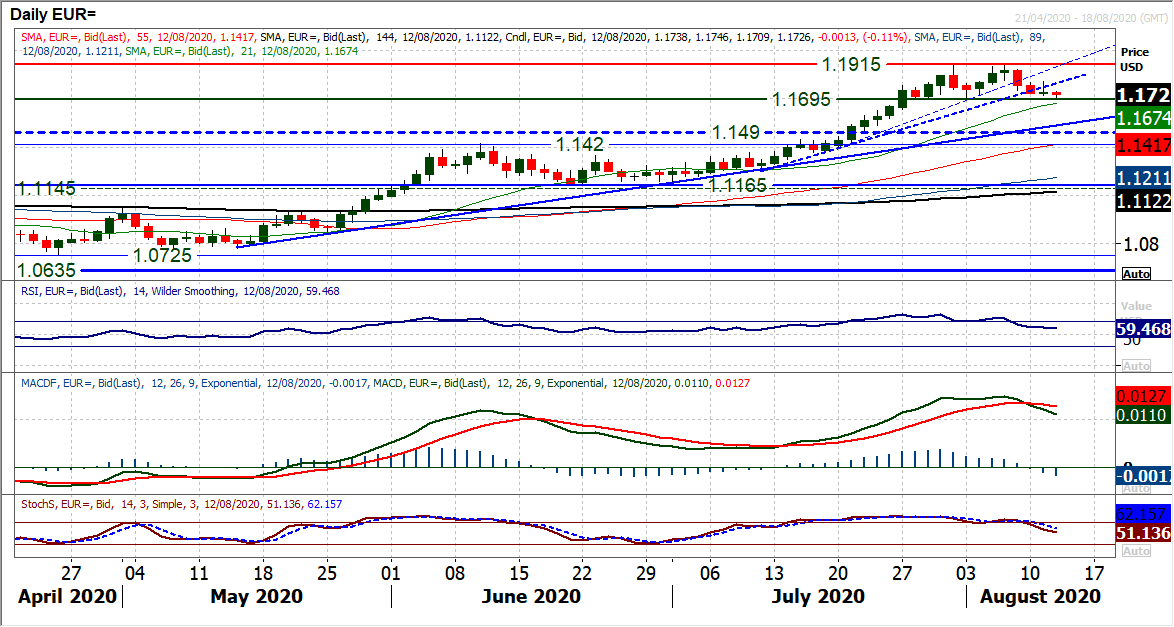

Yesterday’s session confirms that there has been a change in sentiment for the dollar. The European morning looked to be driving EUR/USD back higher, but a bull failure has left a growing negative bias within the trading range 1.1695/1.1915 which could end up now being a top pattern. Momentum indicators are increasingly set up for a corrective move, with near term bear cross sell signals on MACD and Stochastics, whilst RSI is now back under 60. A close under 1.1695 would complete the top and imply around -220 pips of corrective move, back towards the old key 1.1490/1.1500 breakout area. The near three month uptrend support comes in at 1.1530 today. The hourly chart reflects the growing negative bias now on EUR/USD, with the failure once more around 1.1800 which grows ever more prevalent as a pivot (currently resistance). Hourly momentum also suggests that intraday rebounds are a chance to sell for the test of 1.1695. Initial support beyond a breakdown comes in at 1.1580/1.1625. A decisive move above 1.1800 would improve the near term outlook within the 220 pip range again.

Author

Richard Perry

Independent Analyst